Skippy Scooters manufactures motor scooters. The company has automated productic so it allocates manufacturing overhead based on machine hours. Skippy expects to in- cur

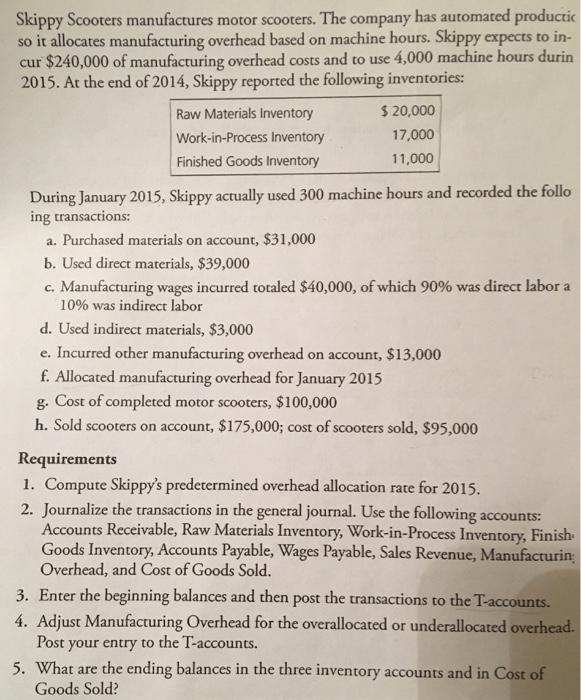

Skippy Scooters manufactures motor scooters. The company has automated productic so it allocates manufacturing overhead based on machine hours. Skippy expects to in- cur $240,000 of manufacturing overhead costs and to use 4,000 machine hours durin 2015. At the end of 2014, Skippy reported the following inventories: Raw Materials Inventory Work-in-Process Inventory Finished Goods Inventory $ 20,000 17,000 11,000 During January 2015, Skippy actually used 300 machine hours and recorded the follo ing transactions: a. Purchased materials on account, $31,000 b. Used direct materials, $39,000 c. Manufacturing wages incurred totaled $40,000, of which 90% was direct labor a 10% was indirect labor d. Used indirect materials, $3,000 e. Incurred other manufacturing overhead on account, $13,000 f. Allocated manufacturing overhead for January 2015 g. Cost of completed motor scooters, $100,000 h. Sold scooters on account, $175,000; cost of scooters sold, $95,000 Requirements 1. Compute Skippy's predetermined overhead allocation rate for 2015. 2. Journalize the transactions in the general journal. Use the following accounts: Accounts Receivable, Raw Materials Inventory, Work-in-Process Inventory, Finish Goods Inventory, Accounts Payable, Wages Payable, Sales Revenue, Manufacturin Overhead, and Cost of Goods Sold. 3. Enter the beginning balances and then post the transactions to the T-accounts. 4. Adjust Manufacturing Overhead for the overallocated or underallocated overhead. Post your entry to the T-accounts. 5. What are the ending balances in the three inventory accounts and in Cost of Goods Sold?

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 overhead allocation rate for 2015 240000 4000 60 per Machine Hour 2 JOURNAL Date Particul...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started