Answered step by step

Verified Expert Solution

Question

1 Approved Answer

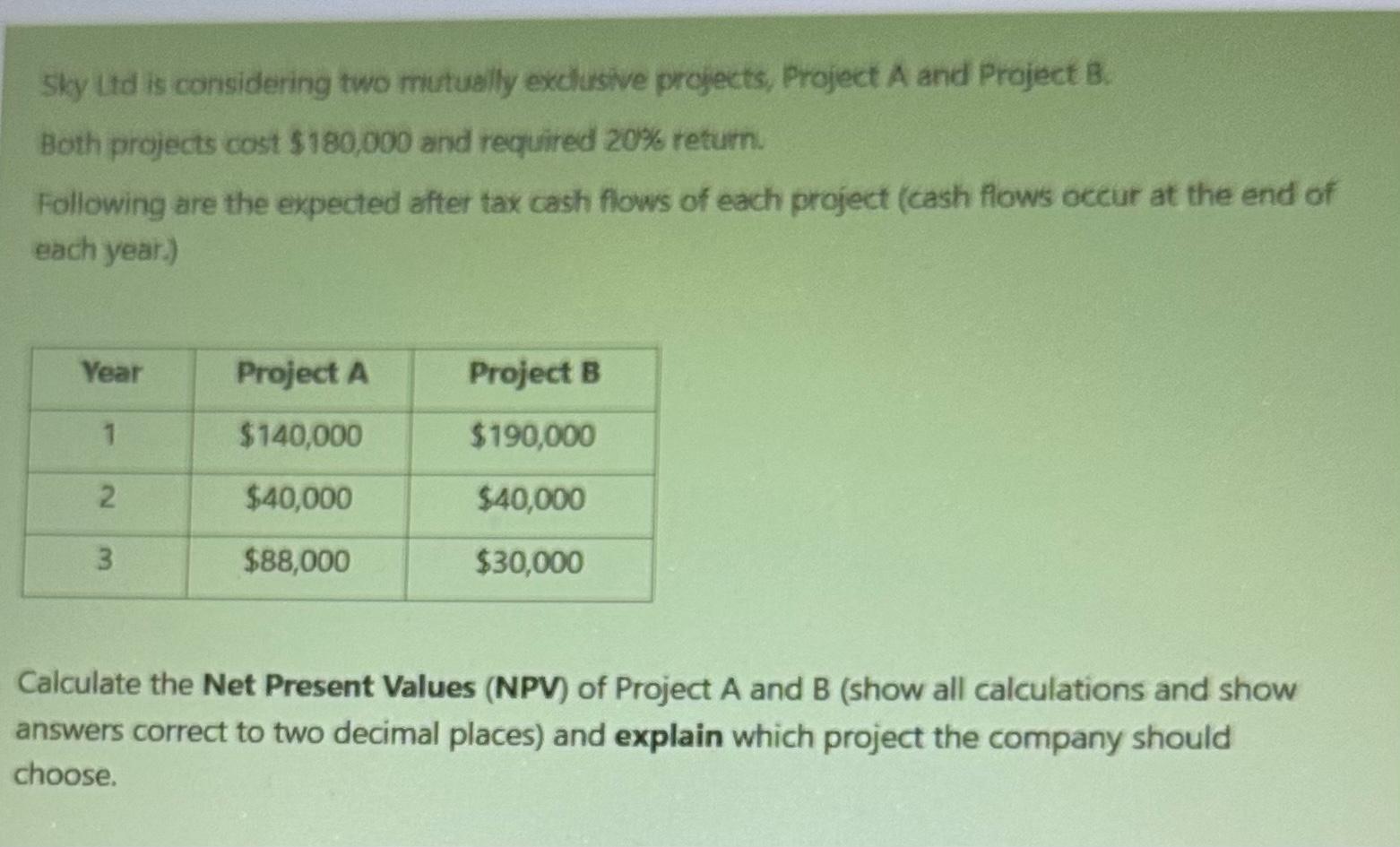

Sky Ltd is considering two mutually exclusive projects, Project A and Project B. Both projects cost $180,000 and required 20% return. Following are the

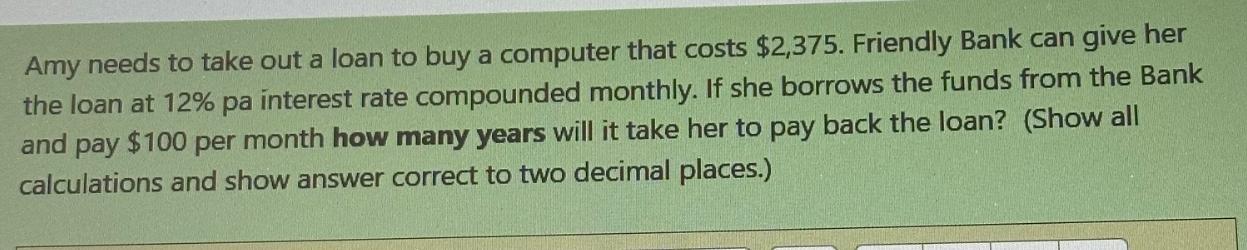

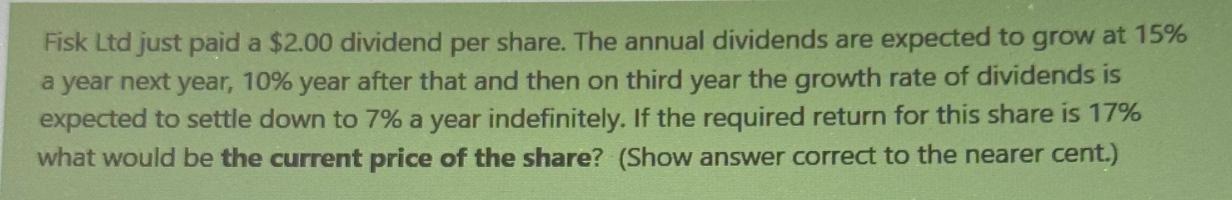

Sky Ltd is considering two mutually exclusive projects, Project A and Project B. Both projects cost $180,000 and required 20% return. Following are the expected after tax cash flows of each project (cash flows occur at the end of each year.) Year 1 2 3 Project A $140,000 $40,000 $88,000 Project B $190,000 $40,000 $30,000 Calculate the Net Present Values (NPV) of Project A and B (show all calculations and show answers correct to two decimal places) and explain which project the company should choose. Amy needs to take out a loan to buy a computer that costs $2,375. Friendly Bank can give her the loan at 12% pa interest rate compounded monthly. If she borrows the funds from the Bank and pay $100 per month how many years will it take her to pay back the loan? (Show all calculations and show answer correct to two decimal places.) Fisk Ltd just paid a $2.00 dividend per share. The annual dividends are expected to grow at 15% a year next year, 10% year after that and then on third year the growth rate of dividends is expected to settle down to 7% a year indefinitely. If the required return for this share is 17% what would be the current price of the share? (Show answer correct to the nearer cent.)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of each project we need to discount the expected cash flows to their present value using the given discount rate of 20 and subtract the initial investment cost G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started