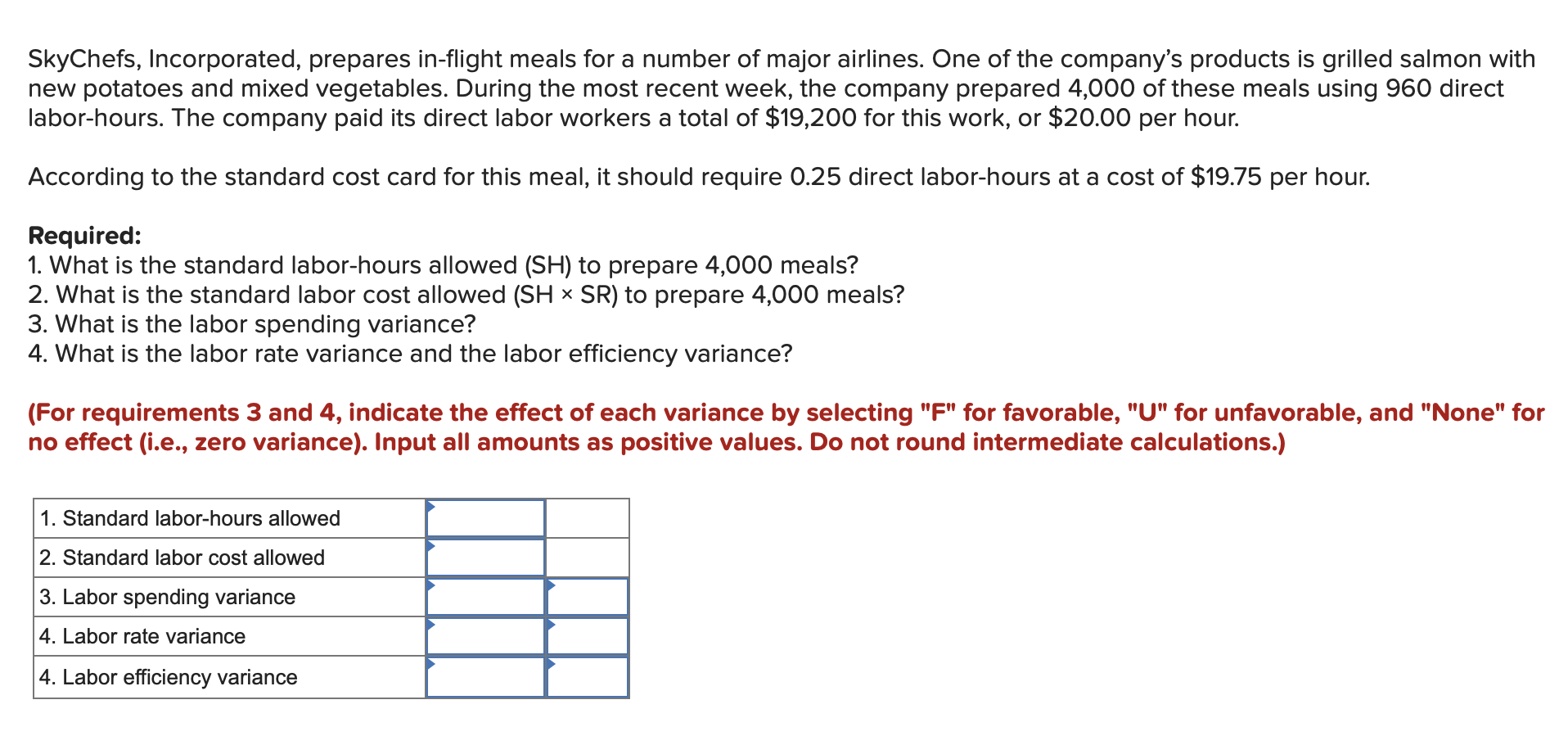

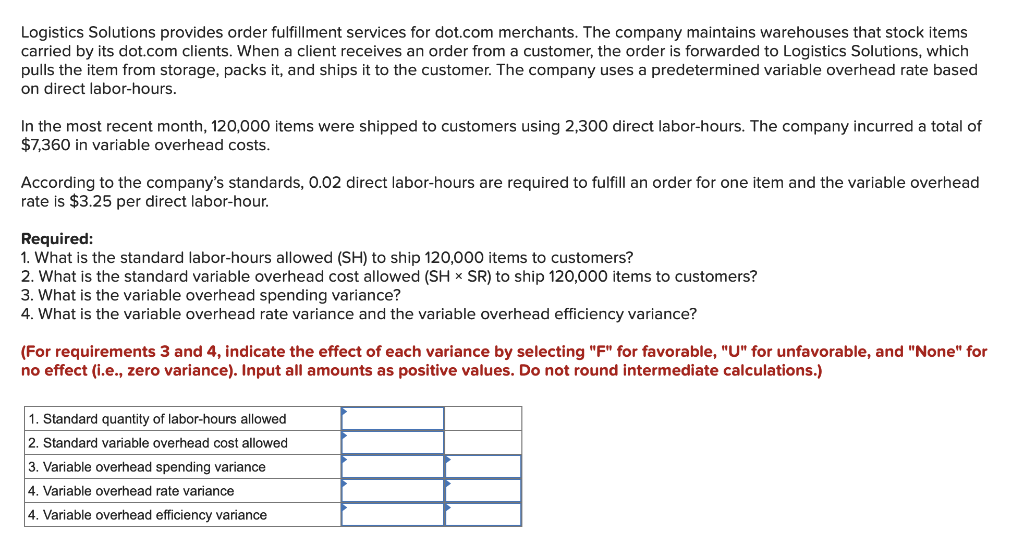

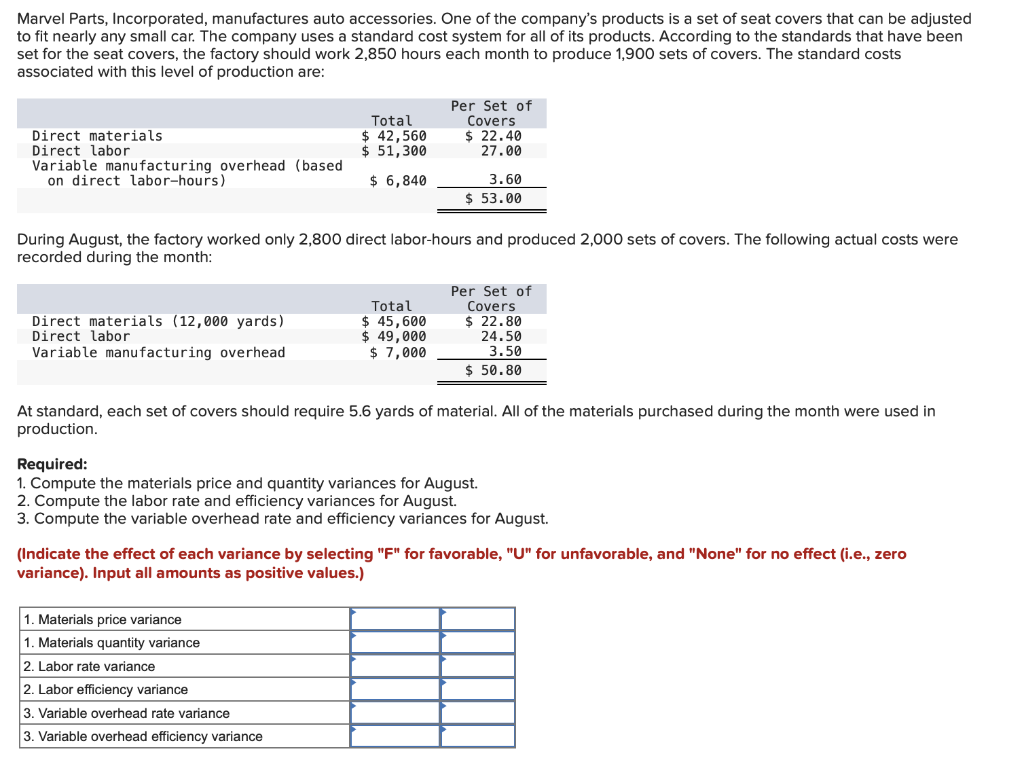

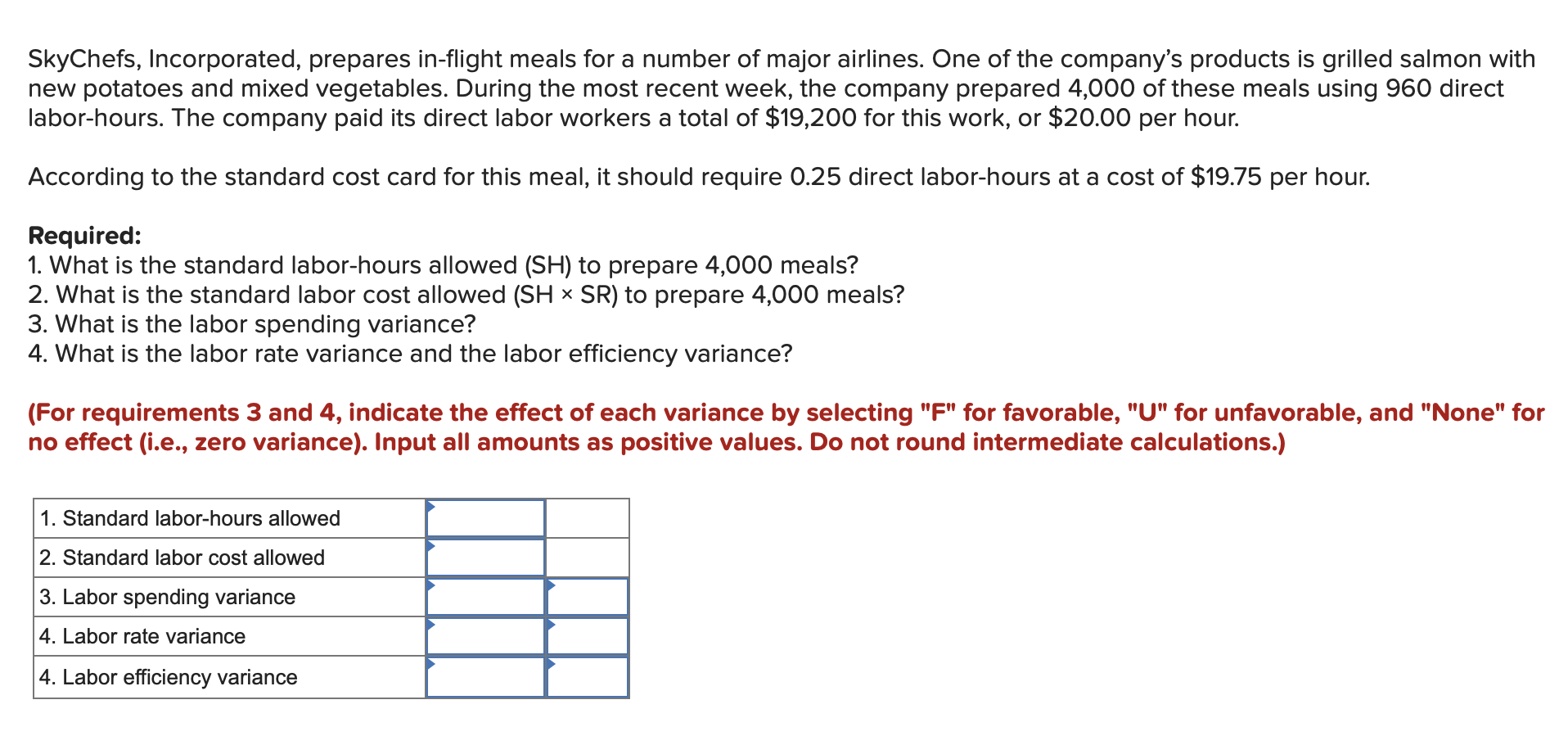

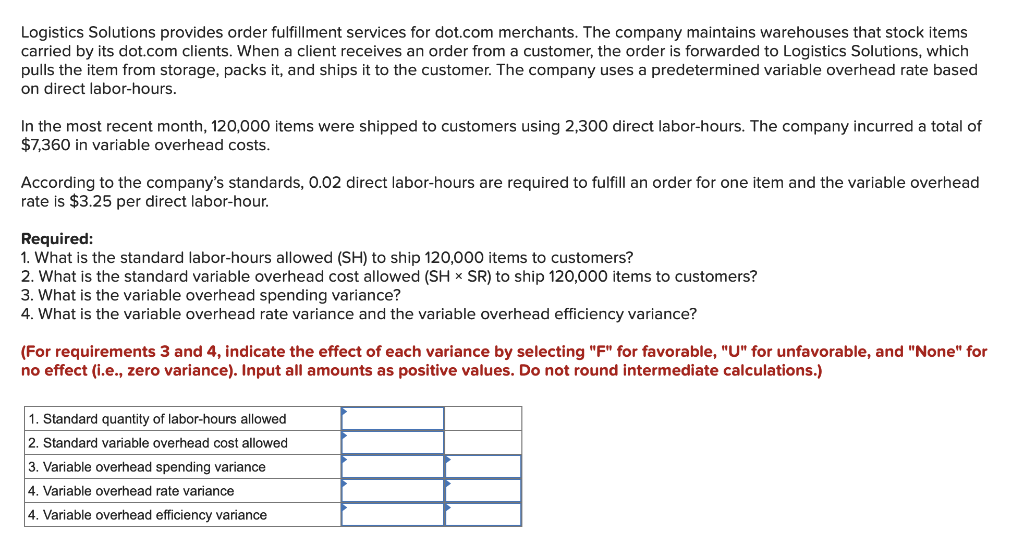

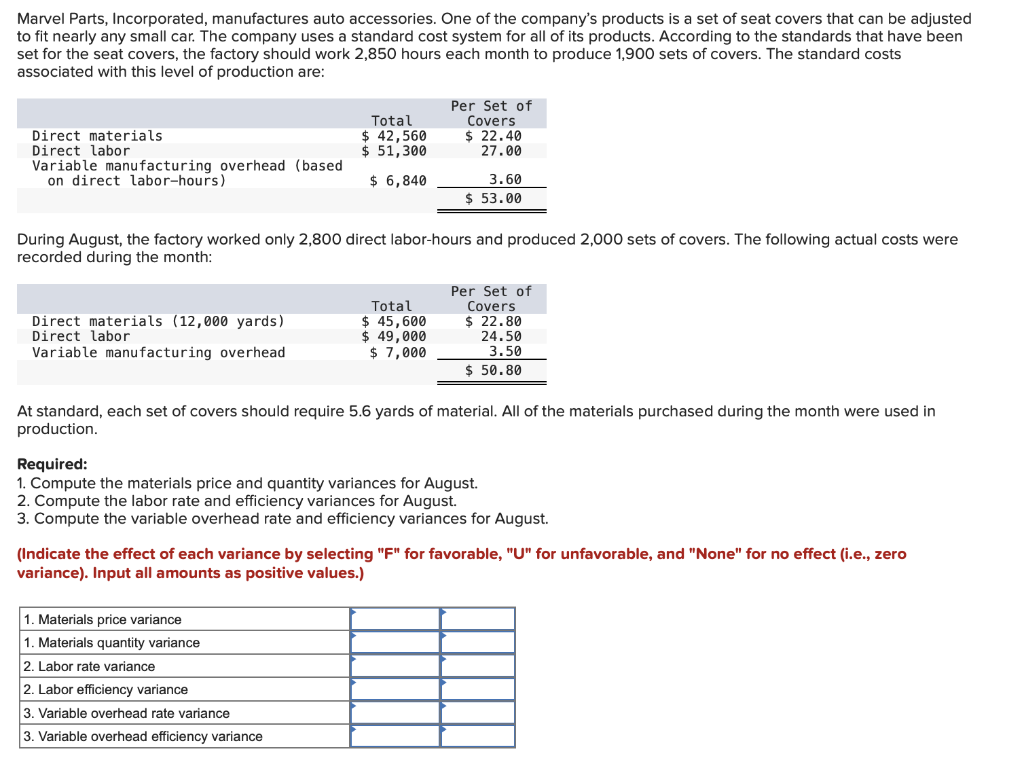

SkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company's products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,000 of these meals using 960 direct labor-hours. The company paid its direct labor workers a total of $19,200 for this work, or $20.00 per hour. According to the standard cost card for this meal, it should require 0.25 direct labor-hours at a cost of $19.75 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 4,000 meals? 2. What is the standard labor cost allowed (SH * SR) to prepare 4,000 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 1. Standard labor-hours allowed 2. Standard labor cost allowed 3. Labor spending variance 4. Labor rate variance 4. Labor efficiency variance Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 120,000 items were shipped to customers using 2,300 direct labor-hours. The company incurred a total of $7,360 in variable overhead costs. According to the company's standards, 0.02 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $3.25 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 120,000 items to customers? 2. What is the standard variable overhead cost allowed (SH SR) to ship 120,000 items to customers? 3. What is the variable overhead spending variance? 4. What is the variable overhead rate variance and the variable overhead efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 1. Standard quantity of labor-hours allowed 2. Standard variable overhead cost allowed 3. Variable overhead spending variance 4. Variable overhead rate variance 4. Variable overhead efficiency variance Marvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company uses a standard cost system for all of its products. According to the standards that have been set for the seat covers, the factory should work 2,850 hours each month to produce 1,900 sets of covers. The standard costs associated with this level of production are: Direct materials Direct labor Variable manufacturing overhead (based on direct labor-hours) Total $ 42,560 $ 51,300 Per Set of Covers $ 22.40 27.00 $ 6,840 3.60 $ 53.00 During August, the factory worked only 2,800 direct labor-hours and produced 2,000 sets of covers. The following actual costs were recorded during the month: Direct materials (12,000 yards) Direct labor Variable manufacturing overhead Total $ 45,600 $ 49,000 $ 7,000 Per Set of Covers $ 22.80 24.50 3.50 $ 50.80 At standard, each set of covers should require 5.6 yards of material. All of the materials purchased during the month were used in production. Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficiency variances for August. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) 1. Materials price variance 1. Materials quantity variance 2. Labor rate variance 2. Labor efficiency variance 3. Variable overhead rate variance 3. Variable overhead efficiency variance