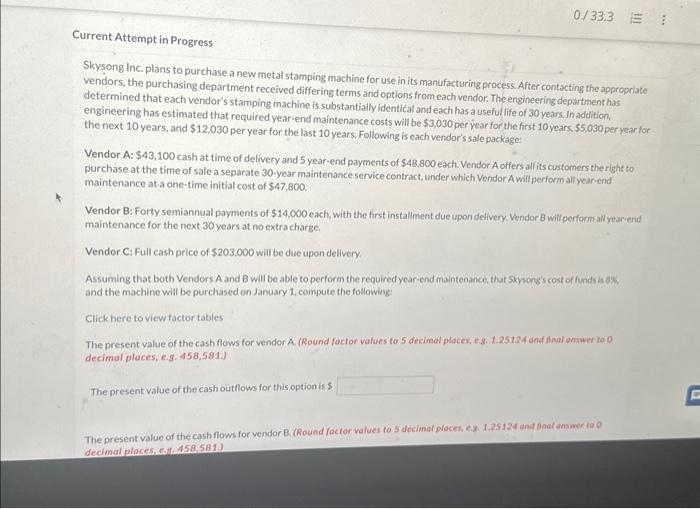

Skysong inc. plans to purchase a new metal stamping machine for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor. The engineering department has determined that each vendor's stamping machine is substantiatly identical and each has a useful life of 30 years. In addition, engineering has estimated that required year-end maintenance costs will be $3,030 per year for the first 10 years. $5,030 per year for the next 10 years, and $12,030 per year for the last 10 years. Following is cach vendor's sale package: Vendor A:$43,100 cash at time of delivery and 5 year-end payments of $48,800 each. Vendor A offers all its customers theright to purchase at the time of sale a separate 30 -year maintenance service contract, under which Vendor A will perform all year-end maintenance at-a one-time initial cost of $47,800. Vendor B: Forty semiannual payments of $14,000 each, with the first installment due upon delivery. Vendor B will perform all yearyend maintenance for the next 30 years at no extracharge. Vendor C: Full cash price of $203,000 will be due upon delivery. Assuming that both Vendors A and B will be able to perform the required year-end maintenance, that Skyong's cost of funds is ax. and the machine will be purchased on January 1, compute the following: Click here to view factor tables The present value of the cash fows for vendor A. (Round foctor values to 5 decimal places, es. 1.25124 and final onswer to 0 decimal places, e.g. 458.581. . The present value of the cashoutfows for this option is $ The present value of the cash flows for vendor B. (Round foctor values to 5 decinal ploces, ex. 1.25124 and Anat anwer to o The present value of the cash flows for vendor A. (Round factor values to 5 decimal places, es: 1.25124 and final answer to 0 decimal places, e., 3.458,581.) The present value of the cash outflows for this option is 5 The presient value of the cash flows for vendor B, (Round foctor values to 5 decimol ploces, e.s: 1.25124 and final aniwer to O decimal places, e.8. 458.581. .) The present value of the cash outhows for this option is The prosent value of the cash flows for vendor C. (Round foctor values to 5 decimal places, es, 1.25124 und final answer to o decimal ploces, e.s, 458,581.) The present value of the cashouthows for this option is $ From which wendor should the stamping machine be purchased? The press should be purchasedron