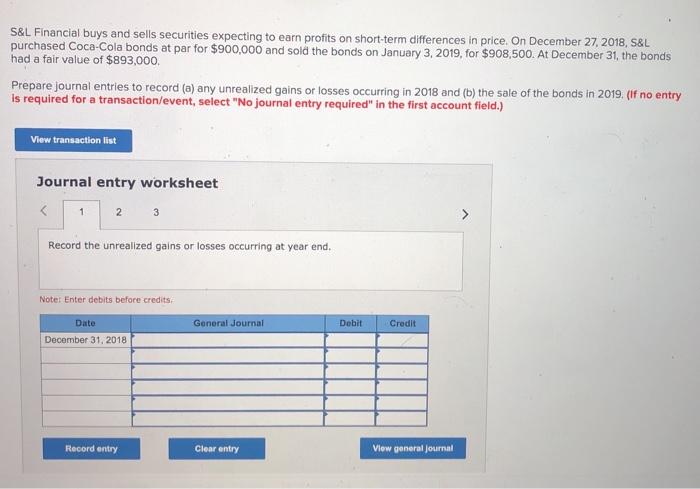

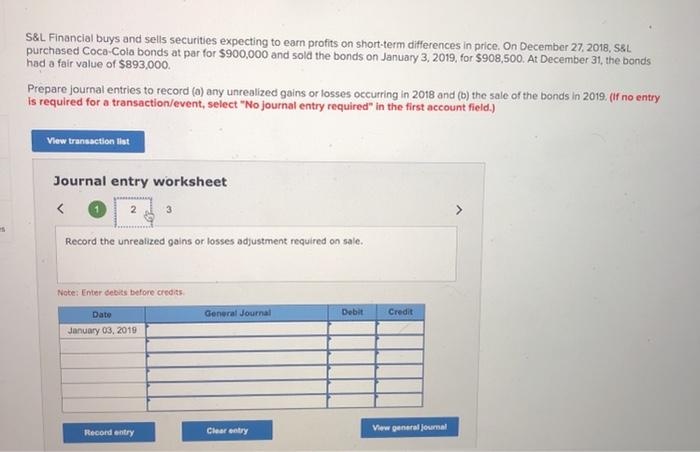

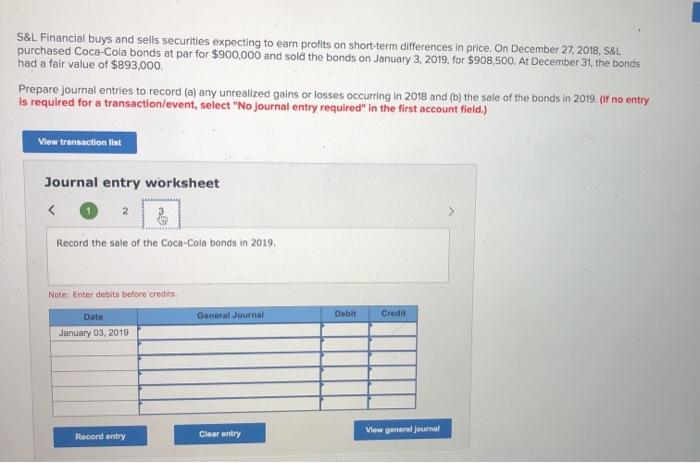

S&L Financial buys and sells securities expecting to earn profits on short-term differences in price. On December 27, 2018, S&L purchased Coca-Cola bonds at par for $900,000 and sold the bonds on January 3, 2019, for $908,500. At December 31, the bonds had a fair value of $893,000 Prepare journal entries to record (a) any unrealized gains or losses occurring in 2018 and (b) the sale of the bonds in 2019. (If no entry Is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 3 1 2 Record the unrealized gains or losses occurring at year end. Note: Enter debits before credits General Journal Debit Credit Date December 31, 2018 Record entry Clear entry View general Journal S&L Financial buys and sells securities expecting to earn profits on short-term differences in price, On December 27, 2018, S&L purchased Coca-Cola bonds at par for $900,000 and sold the bonds on January 3, 2019, for $908,500. At December 31, the bonds had a fair value of $893,000. Prepare journal entries to record (o) any unrealized gains or losses occurring in 2018 and (b) the sale of the bonds in 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction let Journal entry worksheet > Record the unrealized gains or losses adjustment required on sale. Note: Enter debts before credits General Journal Debit Credit Date January 03, 2010 Record entry Clear entry View general Journal S&L Financial buys and sells securities expecting to earn profits on short-term differences in price. On December 27, 2018, S&L purchased Coca-Cola bonds at par for $900,000 and sold the bonds on January 3, 2019, for $908,500. At December 31, the bonds had a fair value of $893,000 Prepare journal entries to record (a) any unrealized gains or losses occurring in 2018 and (b) the sale of the bonds in 2019. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 > Record the sale of the Coca-Cola bonds in 2019, Note: Enter debits before credits General Journal Dobit Credit Dato January 03, 2019 Record entry Clear entry View general Journal