Answered step by step

Verified Expert Solution

Question

1 Approved Answer

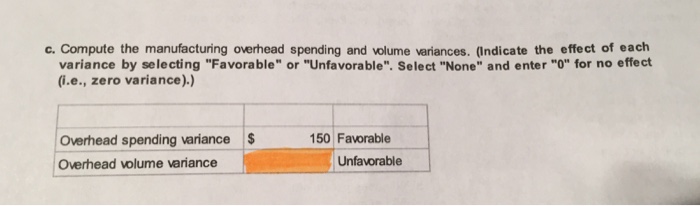

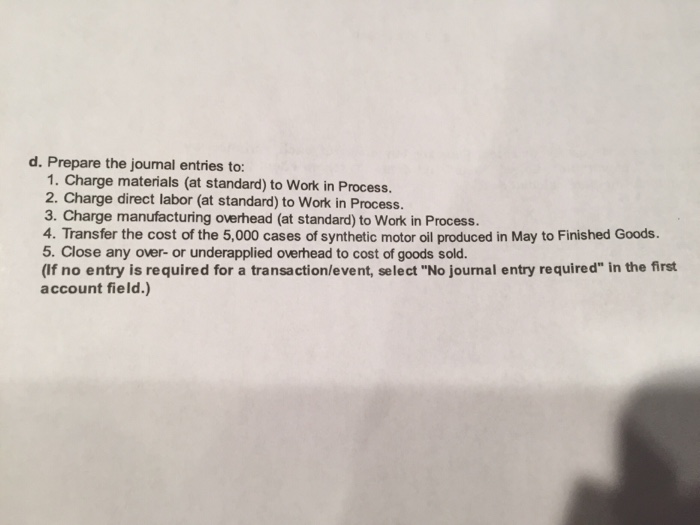

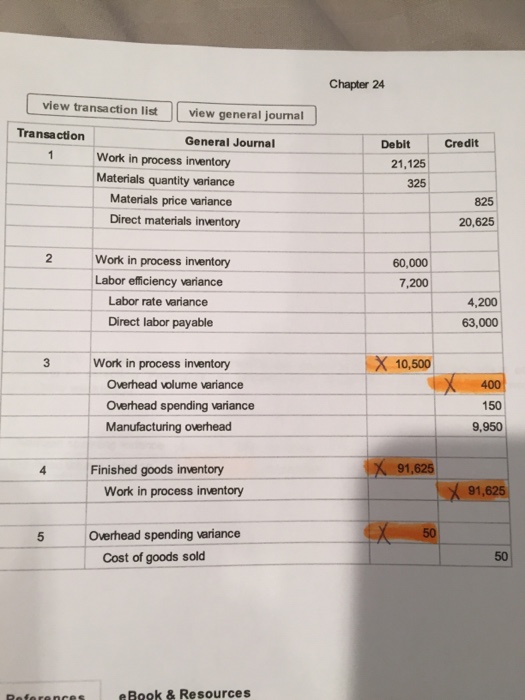

Slick corporation is a small producer of synthetic motor oil. During May, the company produced 5,000 cases of lubricant. Each case contains 12 quarts of

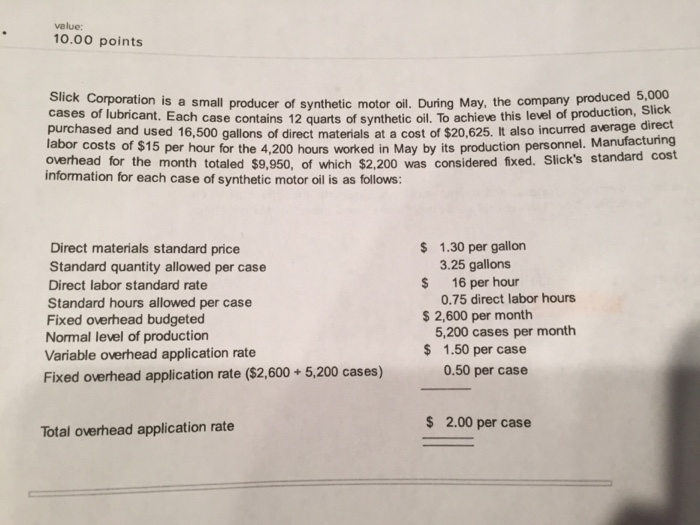

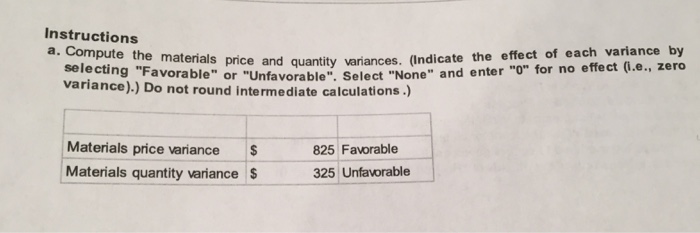

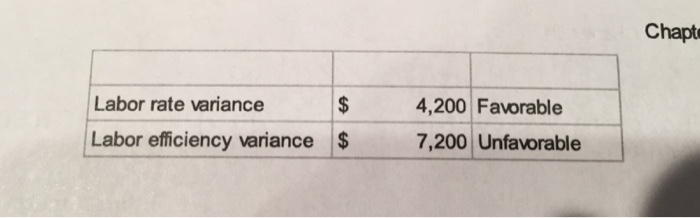

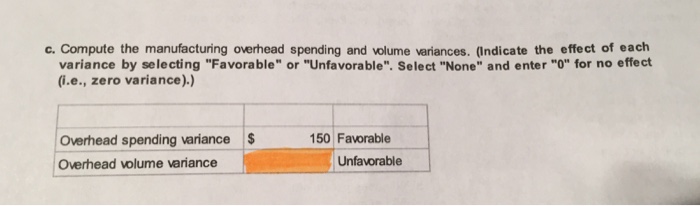

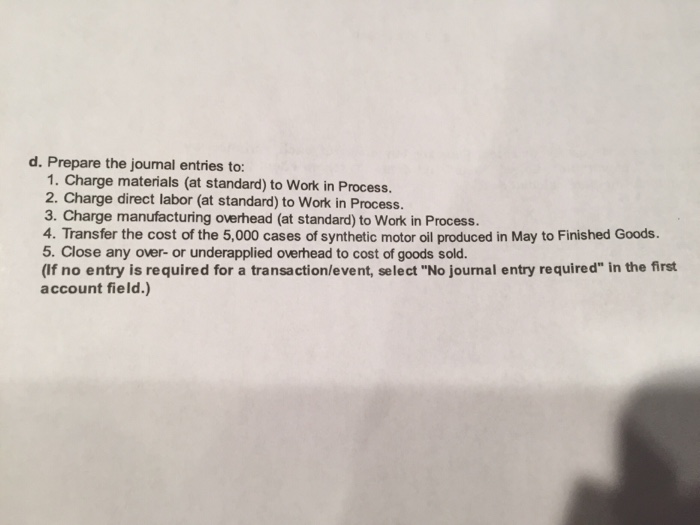

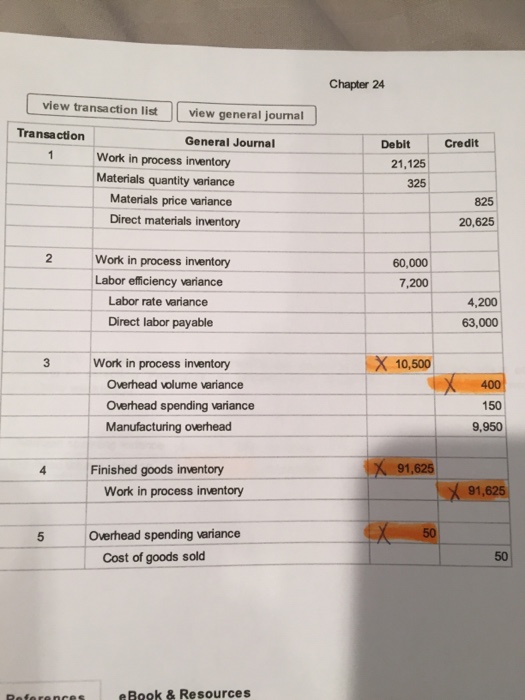

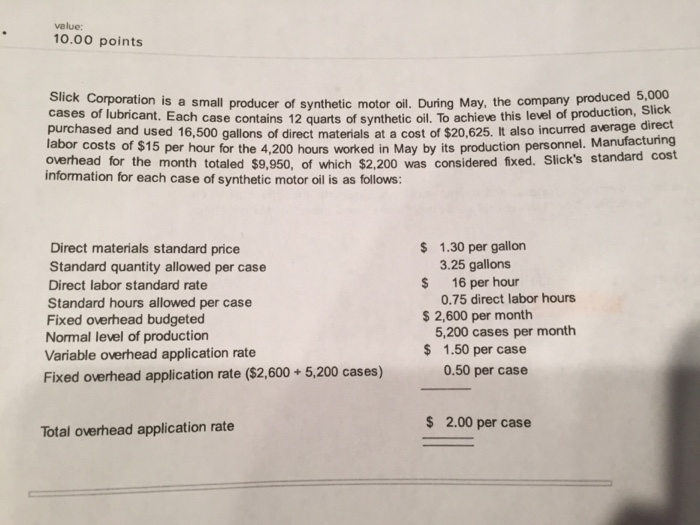

Slick corporation is a small producer of synthetic motor oil. During May, the company produced 5,000 cases of lubricant. Each case contains 12 quarts of synthetic oil. To achieve this level of production, slick purchased and used 16,500 gallons of direct materials at a cost of $20,625. It also incurred average direct labor costs of $15 per hour for the 4,200 hours worked in May by its production personnel. Manufacturing overhead for the month totaled $9,950, of which $2,200 was considered fixed. Slick's standard cost information for each case of synthetic motor oil is as follows:

velue: 10.00 points the company produced 5,000 uction, Slick cases of lubricant. Each case contains 12 quarts of synthetic oil. To achieve this level of production,sk Slick Corporation is a small producer of synthetic motor oil, During May, e direct purchased and used 16,500 gallons of direct materials at a cost of $20,625. It also incurred average direct labor costs of $15 per hour for the 4,200 hours worked in May by its production personnel. Manufactung overhead for the month totaled $9,950, of which $2,200 was considered fixed. Slick's standard cos information for each case of synthetic motor oil is as follows: $ 1.30 per gallon 3.25 gallons $ 16 per hour Direct materials standard price Standard quantity allowed per case Direct labor standard rate Standard hours allowed per case Fixed overhead budgeted Normal level of production Variable overhead application rate Fixed overhead application rate ($2,600+5,200 cases) 0.75 direct labor hours $ 2,600 per month 5,200 cases per month 1.50 per case 0.50 per case $ $ 2.00 per case Total overhead application rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started