Answered step by step

Verified Expert Solution

Question

1 Approved Answer

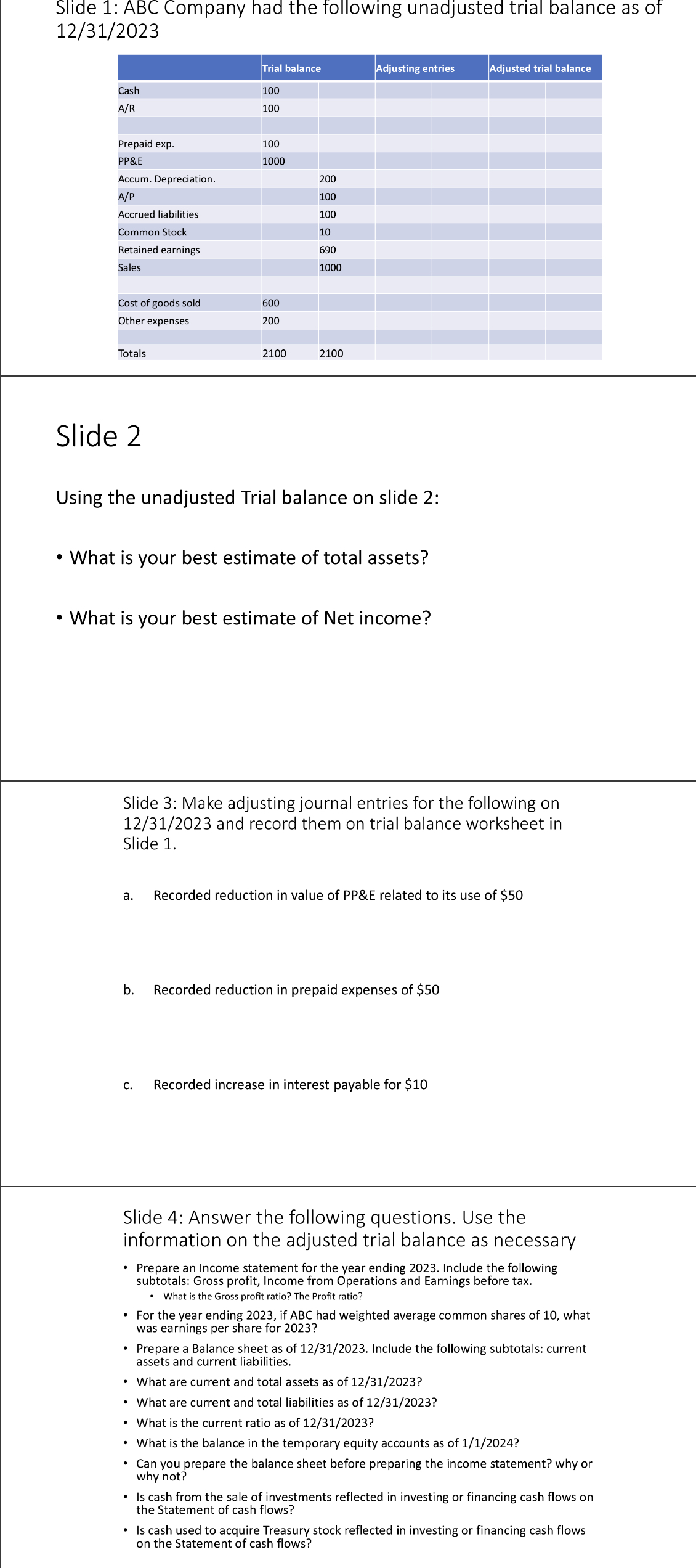

Slide 1: ABC Company had the following unadjusted trial balance as of 12/31/2023 Slide 2 Using the unadjusted Trial balance on slide 2: -What is

Slide 1: ABC Company had the following unadjusted trial balance as of 12/31/2023 Slide 2 Using the unadjusted Trial balance on slide 2: -What is your best estimate of total assets? -What is your best estimate of Net income? Slide 3: Make adjusting journal entries for the following on 12/31/2023 and record them on trial balance worksheet in Slide 1. a. Recorded reduction in value of PP\&E related to its use of $50 b. Recorded reduction in prepaid expenses of $50 c. Recorded increase in interest payable for $10 Slide 4: Answer the following questions. Use the information on the adjusted trial balance as necessary - Prepare an Income statement for the year ending 2023. Include the following subtotals: Gross profit, Income from Operations and Earnings before tax. - What is the Gross profit ratio? The Profit ratio? - For the year ending 2023 , if ABC had weighted average common shares of 10 , what was earnings per share for 2023 ? - Prepare a Balance sheet as of 12/31/2023. Include the following subtotals: current assets and current liabilities. - What are current and total assets as of 12/31/2023 ? - What are current and total liabilities as of 12/31/2023 ? - What is the current ratio as of 12/31/2023 ? - What is the balance in the temporary equity accounts as of 1/1/2024 ? - Can you prepare the balance sheet before preparing the income statement? why or why not? - Is cash from the sale of investments reflected in investing or financing cash flows on the Statement of cash flows? - Is cash used to acquire Treasury stock reflected in investing or financing cash flows on the Statement of cash flows? Slide 1: ABC Company had the following unadjusted trial balance as of 12/31/2023 Slide 2 Using the unadjusted Trial balance on slide 2: -What is your best estimate of total assets? -What is your best estimate of Net income? Slide 3: Make adjusting journal entries for the following on 12/31/2023 and record them on trial balance worksheet in Slide 1. a. Recorded reduction in value of PP\&E related to its use of $50 b. Recorded reduction in prepaid expenses of $50 c. Recorded increase in interest payable for $10 Slide 4: Answer the following questions. Use the information on the adjusted trial balance as necessary - Prepare an Income statement for the year ending 2023. Include the following subtotals: Gross profit, Income from Operations and Earnings before tax. - What is the Gross profit ratio? The Profit ratio? - For the year ending 2023 , if ABC had weighted average common shares of 10 , what was earnings per share for 2023 ? - Prepare a Balance sheet as of 12/31/2023. Include the following subtotals: current assets and current liabilities. - What are current and total assets as of 12/31/2023 ? - What are current and total liabilities as of 12/31/2023 ? - What is the current ratio as of 12/31/2023 ? - What is the balance in the temporary equity accounts as of 1/1/2024 ? - Can you prepare the balance sheet before preparing the income statement? why or why not? - Is cash from the sale of investments reflected in investing or financing cash flows on the Statement of cash flows? - Is cash used to acquire Treasury stock reflected in investing or financing cash flows on the Statement of cash flows

Slide 1: ABC Company had the following unadjusted trial balance as of 12/31/2023 Slide 2 Using the unadjusted Trial balance on slide 2: -What is your best estimate of total assets? -What is your best estimate of Net income? Slide 3: Make adjusting journal entries for the following on 12/31/2023 and record them on trial balance worksheet in Slide 1. a. Recorded reduction in value of PP\&E related to its use of $50 b. Recorded reduction in prepaid expenses of $50 c. Recorded increase in interest payable for $10 Slide 4: Answer the following questions. Use the information on the adjusted trial balance as necessary - Prepare an Income statement for the year ending 2023. Include the following subtotals: Gross profit, Income from Operations and Earnings before tax. - What is the Gross profit ratio? The Profit ratio? - For the year ending 2023 , if ABC had weighted average common shares of 10 , what was earnings per share for 2023 ? - Prepare a Balance sheet as of 12/31/2023. Include the following subtotals: current assets and current liabilities. - What are current and total assets as of 12/31/2023 ? - What are current and total liabilities as of 12/31/2023 ? - What is the current ratio as of 12/31/2023 ? - What is the balance in the temporary equity accounts as of 1/1/2024 ? - Can you prepare the balance sheet before preparing the income statement? why or why not? - Is cash from the sale of investments reflected in investing or financing cash flows on the Statement of cash flows? - Is cash used to acquire Treasury stock reflected in investing or financing cash flows on the Statement of cash flows? Slide 1: ABC Company had the following unadjusted trial balance as of 12/31/2023 Slide 2 Using the unadjusted Trial balance on slide 2: -What is your best estimate of total assets? -What is your best estimate of Net income? Slide 3: Make adjusting journal entries for the following on 12/31/2023 and record them on trial balance worksheet in Slide 1. a. Recorded reduction in value of PP\&E related to its use of $50 b. Recorded reduction in prepaid expenses of $50 c. Recorded increase in interest payable for $10 Slide 4: Answer the following questions. Use the information on the adjusted trial balance as necessary - Prepare an Income statement for the year ending 2023. Include the following subtotals: Gross profit, Income from Operations and Earnings before tax. - What is the Gross profit ratio? The Profit ratio? - For the year ending 2023 , if ABC had weighted average common shares of 10 , what was earnings per share for 2023 ? - Prepare a Balance sheet as of 12/31/2023. Include the following subtotals: current assets and current liabilities. - What are current and total assets as of 12/31/2023 ? - What are current and total liabilities as of 12/31/2023 ? - What is the current ratio as of 12/31/2023 ? - What is the balance in the temporary equity accounts as of 1/1/2024 ? - Can you prepare the balance sheet before preparing the income statement? why or why not? - Is cash from the sale of investments reflected in investing or financing cash flows on the Statement of cash flows? - Is cash used to acquire Treasury stock reflected in investing or financing cash flows on the Statement of cash flows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started