Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Slide 19.15 Example General Electric Company's stock is currently trading at US$10.32. Put options are available at a cost of US$0.07 per share at strike

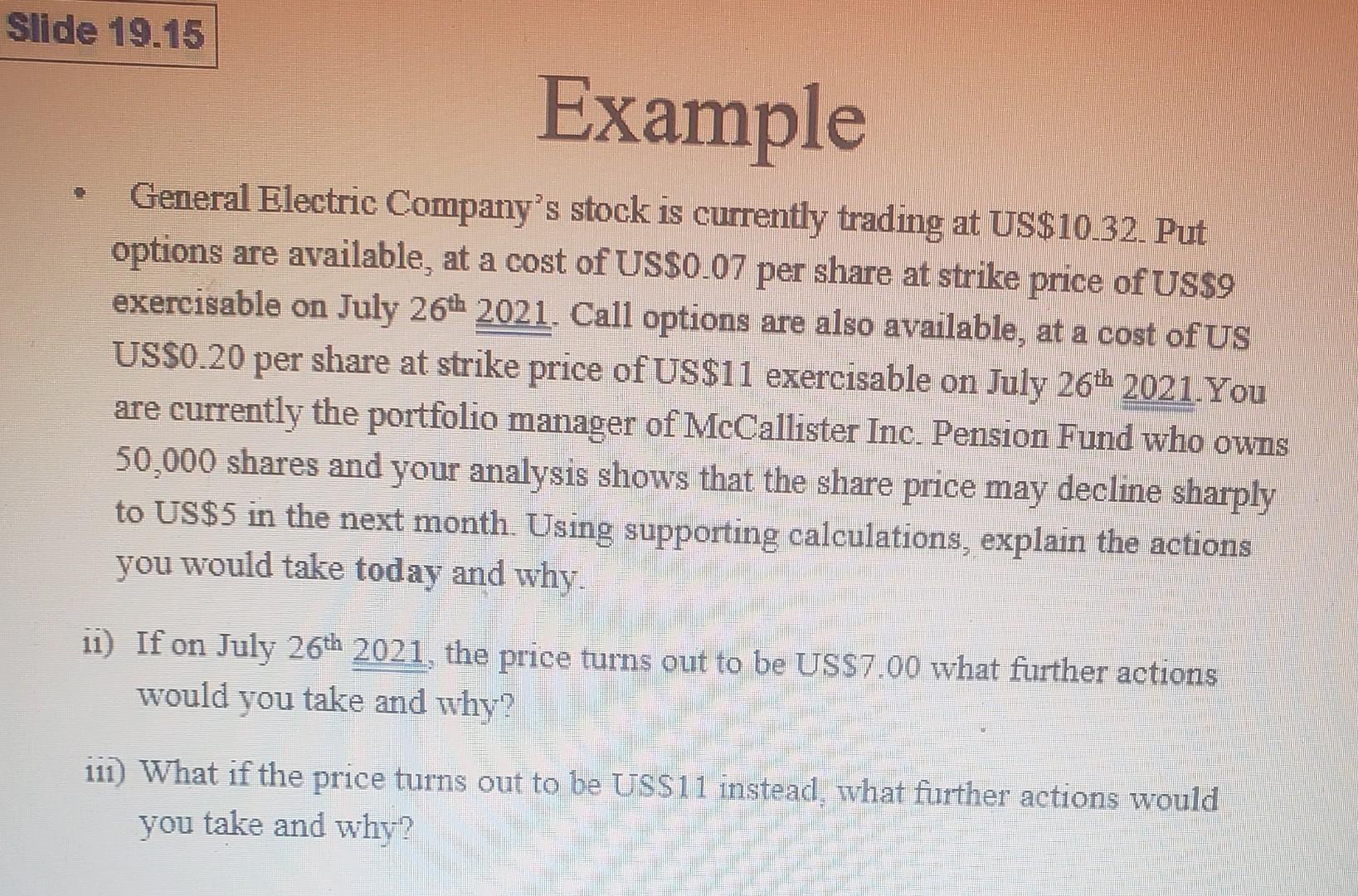

Slide 19.15 Example General Electric Company's stock is currently trading at US$10.32. Put options are available at a cost of US$0.07 per share at strike price of US$9 exercisable on July 26th 2021. Call options are also available, at a cost of US USSO.20 per share at strike price of US$11 exercisable on July 26th 2021. You are currently the portfolio manager of McCallister Inc. Pension Fund who owns 50,000 shares and your analysis shows that the share price may decline sharply to US$5 in the next month. Using supporting calculations, explain the actions you would take today and why. 11) If on July 26th 2021, the price turns out to be US$7.00 what further actions would you take and why? 111) What if the price turns out to be USS11 instead, what further actions would you take and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started