Answered step by step

Verified Expert Solution

Question

1 Approved Answer

& Slim (F&S) is a health club that offers members various gym services. equired: 1. Assume F&S offers a deal whereby enrolling in a new

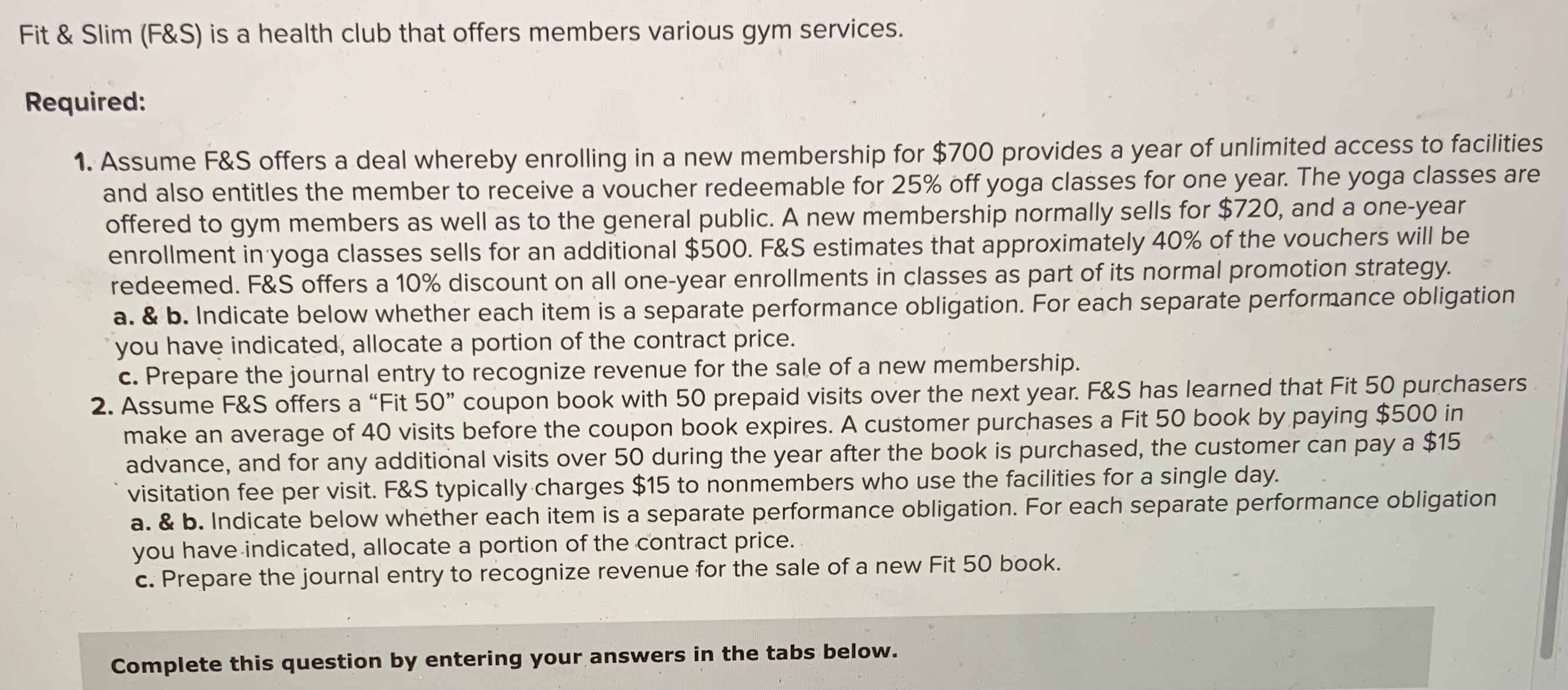

\\& Slim (F\\&S) is a health club that offers members various gym services. equired: 1. Assume F\\&S offers a deal whereby enrolling in a new membership for \\( \\$ 700 \\) provides a year of unlimited access to facilities and also entitles the member to receive a voucher redeemable for \25 off yoga classes for one year. The yoga classes are offered to gym members as well as to the general public. A new membership normally sells for \\( \\$ 720 \\), and a one-year enrollment in yoga classes sells for an additional \\( \\$ 500 \\). F\\&S estimates that approximately \40 of the vouchers will be redeemed. F\\&S offers a 10\\% discount on all one-year enrollments in classes as part of its normal promotion strategy. a. \\& b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new membership. 2. Assume F\\&S offers a \"Fit 50\" coupon book with 50 prepaid visits over the next year. F\\&S has learned that Fit 50 purchasers make an average of 40 visits before the coupon book expires. A customer purchases a Fit 50 book by paying \\( \\$ 500 \\) in advance, and for any additional visits over 50 during the year after the book is purchased, the customer can pay a \\$15 visitation fee per visit. F\\&S typically charges \\( \\$ 15 \\) to nonmembers who use the facilities for a single day. a. \\& b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new Fit 50 book. Complete this question by entering your answers in the tabs below

\\& Slim (F\\&S) is a health club that offers members various gym services. equired: 1. Assume F\\&S offers a deal whereby enrolling in a new membership for \\( \\$ 700 \\) provides a year of unlimited access to facilities and also entitles the member to receive a voucher redeemable for \25 off yoga classes for one year. The yoga classes are offered to gym members as well as to the general public. A new membership normally sells for \\( \\$ 720 \\), and a one-year enrollment in yoga classes sells for an additional \\( \\$ 500 \\). F\\&S estimates that approximately \40 of the vouchers will be redeemed. F\\&S offers a 10\\% discount on all one-year enrollments in classes as part of its normal promotion strategy. a. \\& b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new membership. 2. Assume F\\&S offers a \"Fit 50\" coupon book with 50 prepaid visits over the next year. F\\&S has learned that Fit 50 purchasers make an average of 40 visits before the coupon book expires. A customer purchases a Fit 50 book by paying \\( \\$ 500 \\) in advance, and for any additional visits over 50 during the year after the book is purchased, the customer can pay a \\$15 visitation fee per visit. F\\&S typically charges \\( \\$ 15 \\) to nonmembers who use the facilities for a single day. a. \\& b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new Fit 50 book. Complete this question by entering your answers in the tabs below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started