Question

Slippers Inc. produces and sells shoes in chain stores. Company sells 10 kinds of cheap shoes with similar costs and selling prices. Each store has

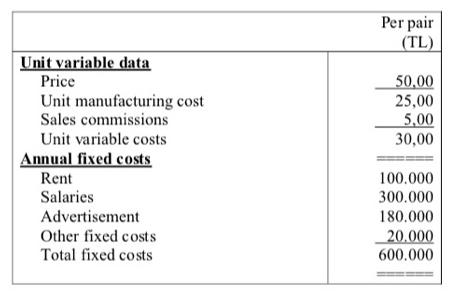

Slippers Inc. produces and sells shoes in chain stores. Company sells 10 kinds of cheap shoes with similar costs and selling prices. Each store has a manager working for a salary. Each salesperson is paid salary plus a sales Premium. Company pays extra 1 TL premium to sales person and 1 TL to manager for each pair of shoes sold beyond BEP. Company is to decide whether to open up or not a new store. Budgeted revenue and costs are given below.

Required:

a) Compute operating profit (loss) assuming 35,000 pairs of shoes are sold.

b) Compute target sales in units and TL to earn TL 180,000 operating profit.

c) Assume Company pays extra 1 TL premium to sales person for each pair sold over 40.000 pairs. Compute operating profit if 50,000 pairs of shoes are sold.

Per pair (TL) Unit variable data Price 50,00 25,00 Unit manufacturing cost Sales commissions Unit variable costs 5,00 30,00 Annual fixed costs Rent 100.000 Salaries 300.000 Advertisement 180.000 Other fixed costs Total fixed costs 20.000 600.000

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Computation of profitloss on sale of 35000 pairs of shoes Particulars Amount Amount Sales value350...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started