Question

SLO-2 . Explain the process of cost allocation. SLO-3. Identify the components of a products cost. SLO-4 . Explain how material, labor, and overhead costs

SLO-2. Explain the process of cost allocation.

SLO-3. Identify the components of a products cost.

SLO-4. Explain how material, labor, and overhead costs are added to a product at each stage of the production process.

SLO-5. Understand the relation between cost, volume and profit, and how to use CVP-analysis to evaluate data and decisions.

SLO-6. Describe the three basic types of product costing systems (job, process and operations) and calculate product costs using these systems.

Please explain as the per the above income statement table. please answer ASAP. thank you

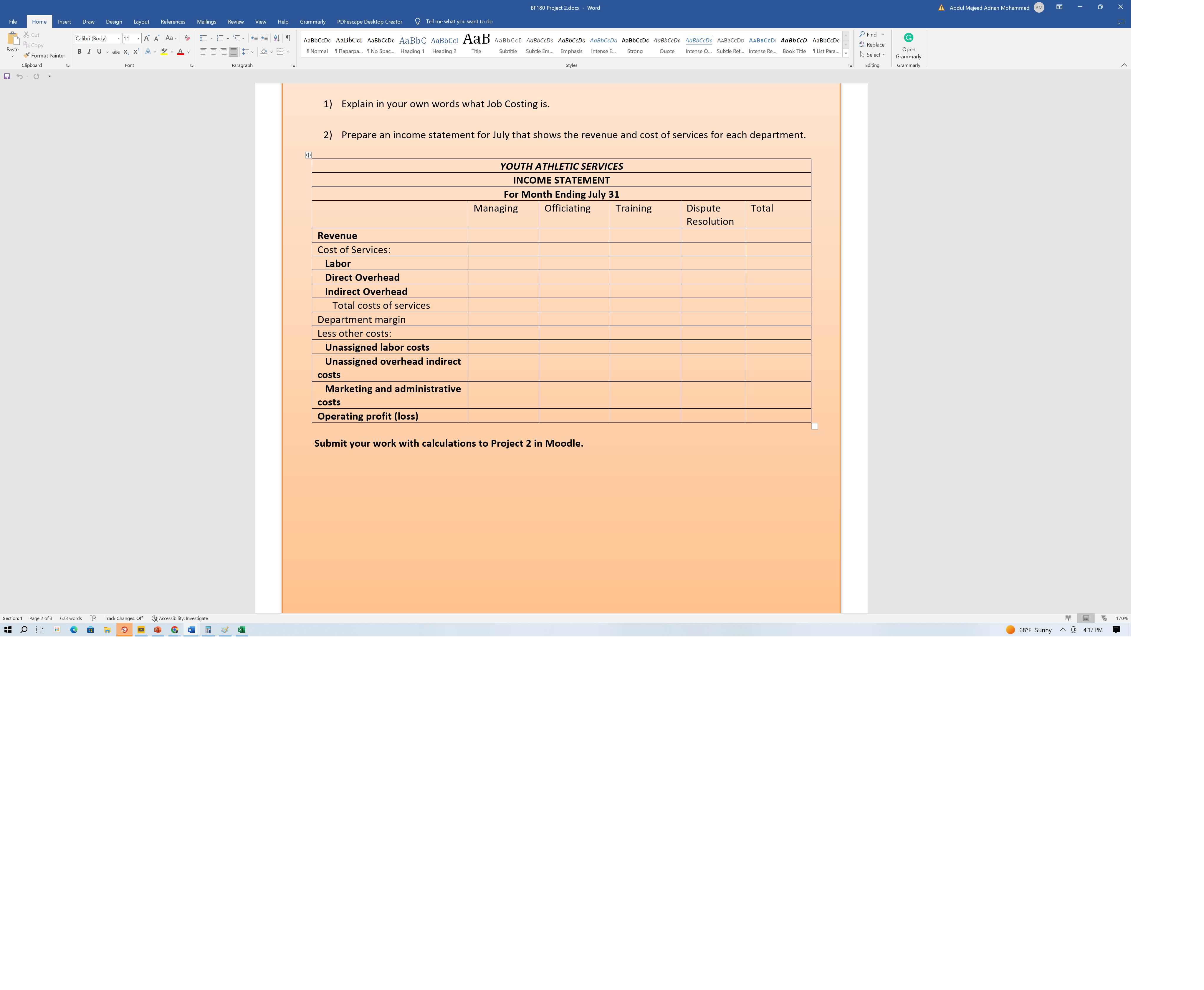

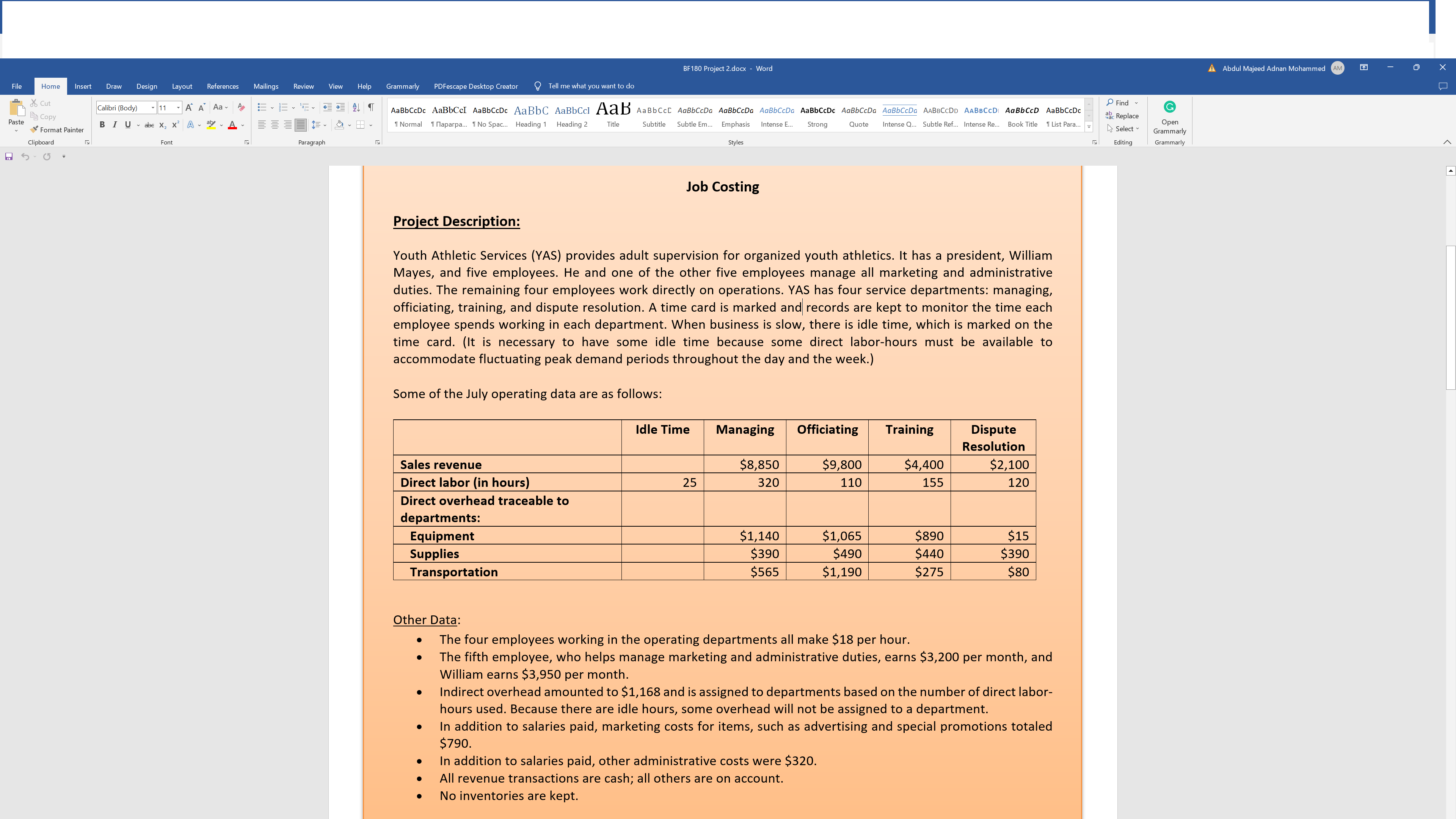

1) Explain in your own words what Job Costing is. 2) Prepare an income statement for July that shows the revenue and cost of services for each department. Submit your work with calculations to Project 2 in Moodle. Project Description: Youth Athletic Services (YAS) provides adult supervision for organized youth athletics. It has a president, William Mayes, and five employees. He and one of the other five employees manage all marketing and administrative duties. The remaining four employees work directly on operations. YAS has four service departments: managing, officiating, training, and dispute resolution. A time card is marked and records are kept to monitor the time each employee spends working in each department. When business is slow, there is idle time, which is marked on the time card. (It is necessary to have some idle time because some direct labor-hours must be available to accommodate fluctuating peak demand periods throughout the day and the week.) Some of the July operating data are as follows: Other Data: - The four employees working in the operating departments all make $18 per hour. - The fifth employee, who helps manage marketing and administrative duties, earns $3,200 per month, and William earns $3,950 per month. - Indirect overhead amounted to $1,168 and is assigned to departments based on the number of direct laborhours used. Because there are idle hours, some overhead will not be assigned to a department. - In addition to salaries paid, marketing costs for items, such as advertising and special promotions totaled $790. - In addition to salaries paid, other administrative costs were $320. - All revenue transactions are cash; all others are on account. - No inventories are keptStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started