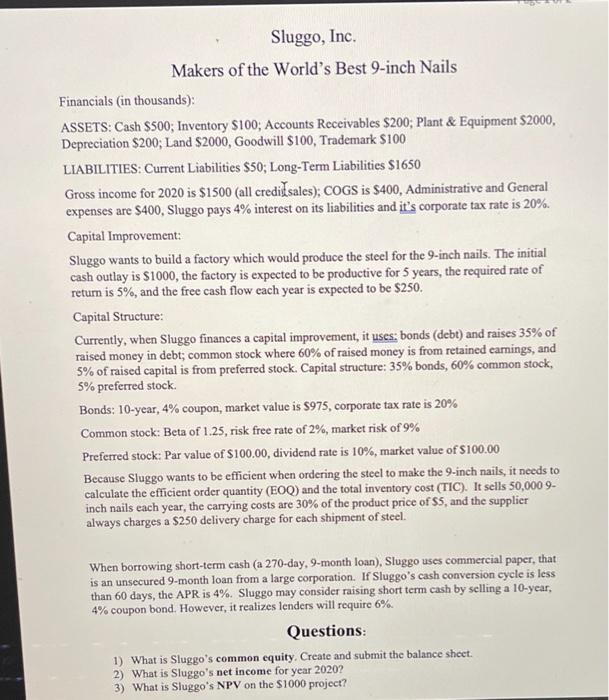

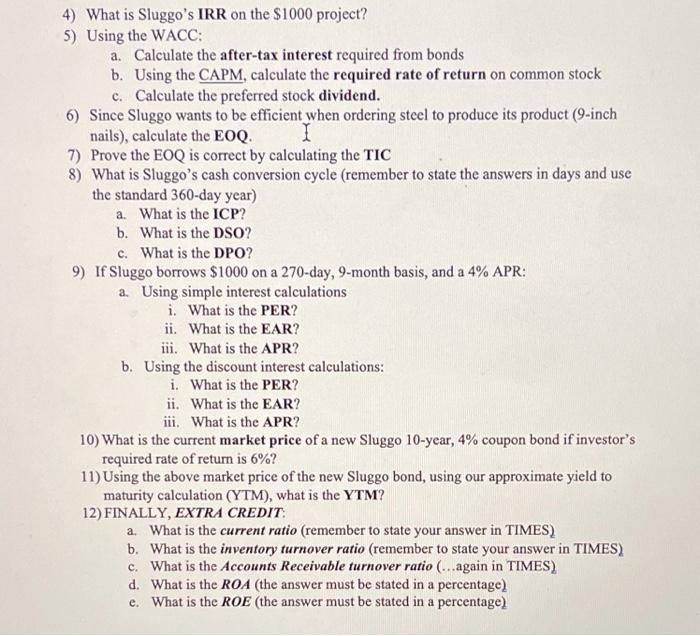

Sluggo, Inc. Makers of the World's Best 9-inch Nails Financials (in thousands): ASSETS: Cash $500; Inventory S100; Accounts Receivables $200; Plant & Equipment S2000, Depreciation $200; Land $2000, Goodwill $100, Trademark $100 LIABILITIES: Current Liabilities $50; Long-Term Liabilities $1650 Gross income for 2020 is $1500 (all credit sales); COGS is $400, Administrative and General expenses are $400, Sluggo pays 4% interest on its liabilities and it's corporate tax rate is 20%. Capital Improvement: Sluggo wants to build a factory which would produce the steel for the 9-inch nails. The initial cash outlay is $1000, the factory is expected to be productive for 5 years, the required rate of return is 5%, and the free cash flow each year is expected to be $250. Capital Structure: Currently, when Sluggo finances a capital improvement, it uses: bonds (debt) and raises 35% of raised money in debt; common stock where 60% of raised money is from retained carings, and 5% of raised capital is from preferred stock. Capital structure: 35% bonds, 60% common stock, 5% preferred stock Bonds: 10-year, 4% coupon, market value is $975, corporate tax rate is 20% Common stock: Beta of 1.25, risk free rate of 2%, market risk of 9% Preferred stock: Par value of $100.00, dividend rate is 10%, market value of $100.00 Because Sluggo wants to be efficient when ordering the steel to make the 9-inch nails, it needs to calculate the efficient order quantity (EOQ) and the total inventory cost (TIC). It sells 50,000 9- inch nails each year, the carrying costs are 30% of the product price of $5, and the supplier always charges a $250 delivery charge for each shipment of steel. When borrowing short-term cash (a 270-day, 9-month loan), Sluggo uses commercial paper, that is an unsecured 9-month loan from a large corporation. If Sluggo's cash conversion cycle is less than 60 days, the APR is 4%. Sluggo may consider raising short term cash by selling a 10-year, 4% coupon bond. However, it realizes lenders will require 6%. Questions: 1) What is Sluggo's common equity. Create and submit the balance sheet. 2) What is Sluggo's net income for year 2020? 3) What is Sluggo's NPV on the $1000 project? 4) What is Sluggo's IRR on the $1000 project? 5) Using the WACC: a. Calculate the after-tax interest required from bonds b. Using the CAPM, calculate the required rate of return on common stock c. Calculate the preferred stock dividend. 6) Since Sluggo wants to be efficient when ordering steel to produce its product (9-inch nails), calculate the EOQ. I 7) Prove the EOQ is correct by calculating the TIC 8) What is Sluggo's cash conversion cycle (remember to state the answers in days and use the standard 360-day year) a. What is the ICP? b. What is the DSO? c. What is the DPO? 9) If Sluggo borrows $1000 on a 270-day, 9-month basis, and a 4% APR: a. Using simple interest calculations i. What is the PER? ii. What is the EAR? iii. What is the APR? b. Using the discount interest calculations: i. What is the PER? ii. What is the EAR? iii. What is the APR? 10) What is the current market price of a new Sluggo 10-year, 4% coupon bond if investor's required rate of return is 6%? 11) Using the above market price of the new Sluggo bond, using our approximate yield to maturity calculation (YTM), what is the YTM? 12) FINALLY, EXTRA CREDIT: a. What is the current ratio (remember to state your answer in TIMES) b. What is the inventory turnover ratio (remember to state your answer in TIMES) C. What is the Accounts Receivable turnover ratio (...again in TIMES) d. What is the ROA (the answer must be stated in a percentage) e. What is the ROE (the answer must be stated in a percentage)