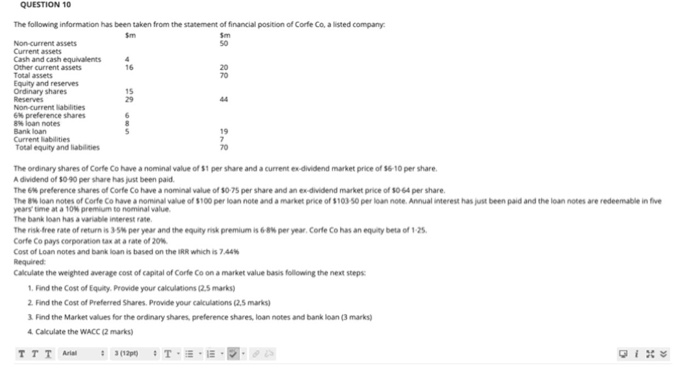

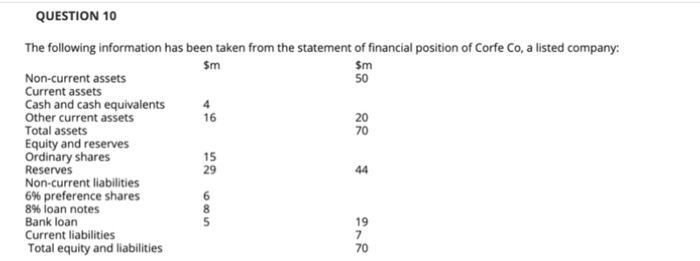

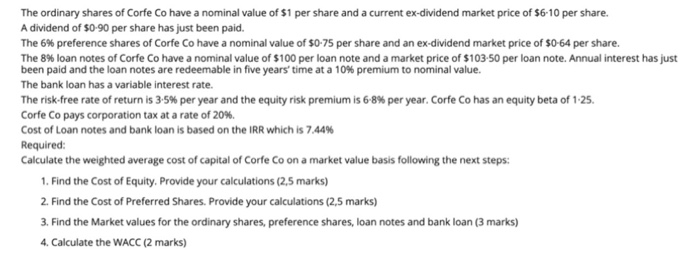

Sm 50 QUESTION 10 The following information has been taken from the statement of financial position of Corfe Co, a listed company Non-current assets Current assets Cash and cash equivalents Other current assets 16 20 70 Equity and reserves 15 44 70 6h preference shares 8loan notes 19 Current liabilities Total equity and liabilities The ordinary shares of Corte Co have a nominal value of 51 per share and a current ex dividend market price of 36 10 per share. A dividend of 80 90 per sharehas just been paid. The preference shares of Corfe Co have a nominal value of 50-75 per share and an ex dividend market price of 50 64 per share. The en loan notes of Corte Co have a nominal value of $100 per loan note and a market price of 5103 50 per loan note. Annual interest has just been paid and the loan notes are redeemable in five The bank loan has a variable interest rate The risk-free rate of return is super year and the equity risk premium is 68% per year. Corte Co has an equity beta of 125. Corfe Co pays corporation tax at a rate of 20% Cost of Loan notes and bank loan is based on the IRR which is 7.44% Required Calculate the weighted average cost of capital of Corte Co on a market value basis following the next steps: 1. Find the Cost of Equity. Provide your calculations (2.5 marks) 2. Find the cost of Preferred Shares. Provide your calculations (2.5 marks) 3. Find the Market values for the ordinary shares, preference shares, loan notes and bank loan (3 marks) 4. Calculate the WACC (2 marks : (126 QUESTION 10 The following information has been taken from the statement of financial position of Corfe Co, a listed company: Sm Sm 50 16 20 70 Non-current assets Current assets Cash and cash equivalents Other current assets Total assets Equity and reserves Ordinary shares Reserves Non-current liabilities 6% preference shares 8% loan notes Bank loan Current liabilities Total equity and liabilities 44 15 29 6 8 5 19 7 70 The ordinary shares of Corfe Co have a nominal value of $1 per share and a current ex-dividend market price of $6-10 per share. A dividend of $0-90 per share has just been paid. The 6% preference shares of Corfe Co have a nominal value of $0-75 per share and an ex-dividend market price of $0-64 per share. The 8% loan notes of Corfe Co have a nominal value of $100 per loan note and a market price of $103-50 per loan note. Annual interest has just been paid and the loan notes are redeemable in five years' time at a 10% premium to nominal value. The bank loan has a variable interest rate. The risk-free rate of return is 3-5% per year and the equity risk premium is 6-8% per year. Corfe Co has an equity beta of 1-25. Corfe Co pays corporation tax at a rate of 20%. Cost of Loan notes and bank loan is based on the IRR which is 7.44% Required: Calculate the weighted average cost of capital of Corfe Co on a market value basis following the next steps: 1. Find the cost of Equity. Provide your calculations (2,5 marks) 2. Find the Cost of Preferred Shares. Provide your calculations (2,5 marks) 3. Find the Market values for the ordinary shares, preference shares, loan notes and bank loan (3 marks) 4. Calculate the WACC (2 marks)