Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Small Business Dilemma Assessment of Prevailing Spot and Forward Rates by the Sports Exports Company As the sports exports company exports football to the United

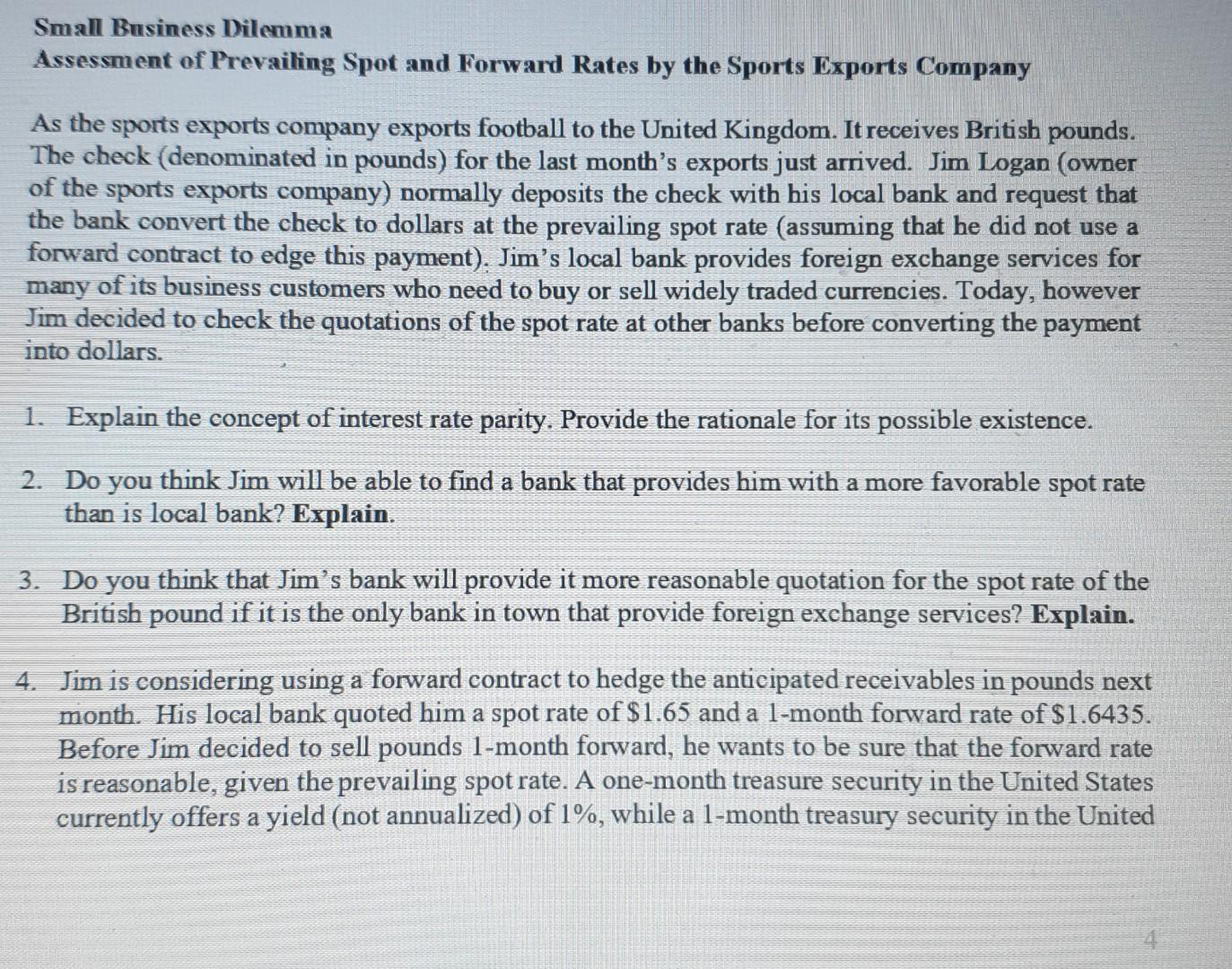

Small Business Dilemma Assessment of Prevailing Spot and Forward Rates by the Sports Exports Company As the sports exports company exports football to the United Kingdom. It receives British pounds. The check (denominated in pounds) for the last month's exports just arrived. Jim Logan (owner of the sports exports company) normally deposits the check with his local bank and request that the bank convert the check to dollars at the prevailing spot rate (assuming that he did not use a forward contract to edge this payment). Jim's local bank provides foreign exchange services for many of its business customers who need to buy or sell widely traded currencies. Today, however Jim decided to check the quotations of the spot rate at other banks before converting the payment into dollars. 1. Explain the concept of interest rate parity. Provide the rationale for its possible existence. 2. Do you think Jim will be able to find a bank that provides him with a more favorable spot rate than is local bank? Explain. 3. Do you think that Jim's bank will provide it more reasonable quotation for the spot rate of the British pound if it is the only bank in town that provide foreign exchange services? Explain. 4. Jim is considering using a forward contract to hedge the anticipated receivables in pounds next month. His local bank quoted him a spot rate of $1.65 and a 1-month forward rate of $1.6435. Before Jim decided to sell pounds 1-month forward, he wants to be sure that the forward rate is reasonable, given the prevailing spot rate. A one-month treasure security in the United States currently offers a yield (not annualized) of 1%, while a 1-month treasury security in the United Small Business Dilemma Assessment of Prevailing Spot and Forward Rates by the Sports Exports Company As the sports exports company exports football to the United Kingdom. It receives British pounds. The check (denominated in pounds) for the last month's exports just arrived. Jim Logan (owner of the sports exports company) normally deposits the check with his local bank and request that the bank convert the check to dollars at the prevailing spot rate (assuming that he did not use a forward contract to edge this payment). Jim's local bank provides foreign exchange services for many of its business customers who need to buy or sell widely traded currencies. Today, however Jim decided to check the quotations of the spot rate at other banks before converting the payment into dollars. 1. Explain the concept of interest rate parity. Provide the rationale for its possible existence. 2. Do you think Jim will be able to find a bank that provides him with a more favorable spot rate than is local bank? Explain. 3. Do you think that Jim's bank will provide it more reasonable quotation for the spot rate of the British pound if it is the only bank in town that provide foreign exchange services? Explain. 4. Jim is considering using a forward contract to hedge the anticipated receivables in pounds next month. His local bank quoted him a spot rate of $1.65 and a 1-month forward rate of $1.6435. Before Jim decided to sell pounds 1-month forward, he wants to be sure that the forward rate is reasonable, given the prevailing spot rate. A one-month treasure security in the United States currently offers a yield (not annualized) of 1%, while a 1-month treasury security in the United

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started