Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Small business entrepreneur Elizabeth 0 'Brien decides to start up her own business to provide cooking classes to the local community. Taste Buds Kitchen not

Small business entrepreneur Elizabeth 'Brien decides to start up her own business to provide cooking classes to the local community. Taste Buds Kitchen not only provides cooking classes but also provides sells prepackaged ingredients called "Taste Buds at Home" that customers can purchase to recreate gourmet meals at home. In November Elizabeth incorporates her business Taste Buds Kitchen, Inc. The following events occur in November and December, the first two months of operations:

November

November

November

November

November

Elizabeth cashes in her US Savings Bond and receives $ which she deposits in her personal bank account.

Elizabeth purchases $ of common stock in Taste Buds Kitchen.

Taste Buds Kitchen pays $ to purchase baking supplies, such as flour, sugar, butter, and chocolate chips Account: Supplies

Elizabeth starts to gather some equipment to take with her when teaching the cooking classes. She has an excellent topoftheline food processor and mixer that originally cost her $ Elizabeth decides to start using it only in her business. She estimates that the equipment is currently worth $ and she transfers the equipment into the business in exchange for additional common stock.

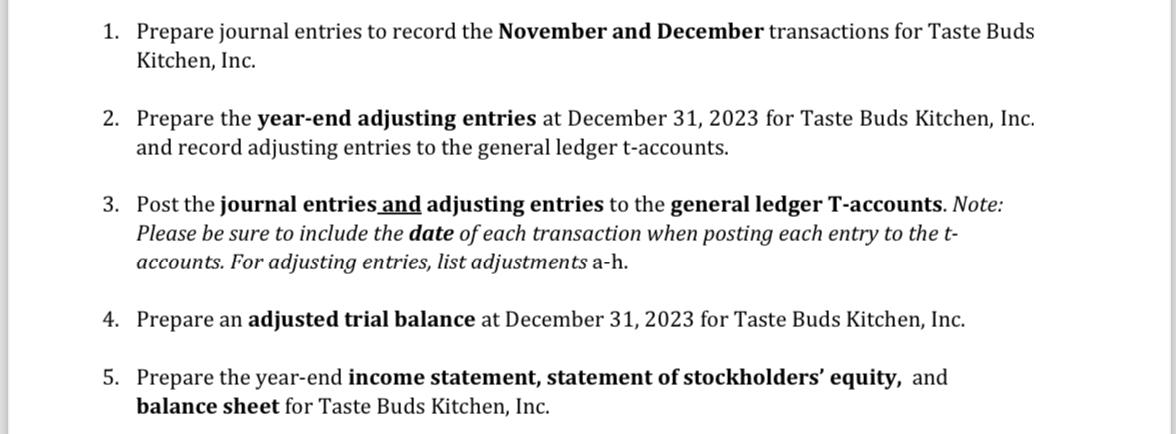

Prepare journal entries to record the November and December transactions for Taste Buds Kitchen, Inc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started