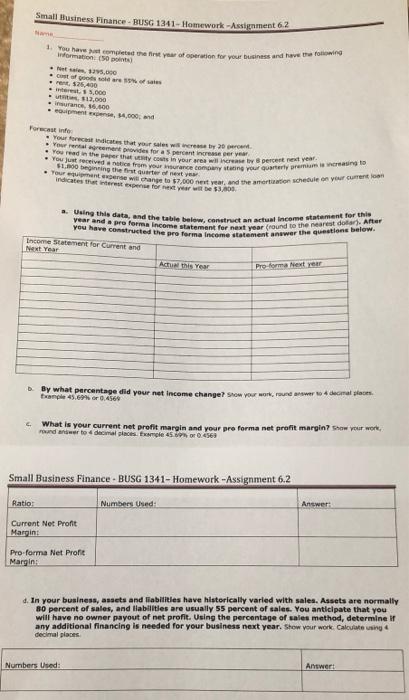

Small Bustness Finance - BUSG 1341 - Homework Assignment 62 formation (50) u have come the first year at operation for your business and have the following N. Goods were 525.400 SOOD 17.000 Insurance, 6.000 Font,34,000, Your forecast indicates that your web grant You realment provides for a percent in server You read the party cous pourrowse by percent reader You from your order and your quarterly premium raung to $1.000 being the first rest Tourse will change to $7,000 next year, and the motion schedule on your current indicates that performer year wie 53/100 Using this data, and the table below construct an actual income statement for the You have constructed the proforma Income statement answer the questions below year and pro forma income statement for next year round to the nearest do After Encome statement for Current and Next Year Actus this year Proforma Next year . By what percentage did your net income change? Show your work, round wer decimal faces tampe 45.69 0.4568 Foundato decamatams 4563 What is your current net profit margin and your preforma net profit margin? Show your work Small Business Finance - BUSG 1341- Homework - Assignment 6.2 Ratio Numbers Used: Answer: Current Net Profit Margin: Pro forma Net Profit Margin: d. In your business, assets and liabilities have historically varied with sales. Assets are normally 80 percent of sales, and liabilities are usually 55 percent of sales. You anticipate that you will have no owner payout of net profit. Using the percentage of sales method, determine if any additional financing is needed for your business next year. Show your work. Calcule using decimal places Numbers Used: Answer: Small Bustness Finance - BUSG 1341 - Homework Assignment 62 formation (50) u have come the first year at operation for your business and have the following N. Goods were 525.400 SOOD 17.000 Insurance, 6.000 Font,34,000, Your forecast indicates that your web grant You realment provides for a percent in server You read the party cous pourrowse by percent reader You from your order and your quarterly premium raung to $1.000 being the first rest Tourse will change to $7,000 next year, and the motion schedule on your current indicates that performer year wie 53/100 Using this data, and the table below construct an actual income statement for the You have constructed the proforma Income statement answer the questions below year and pro forma income statement for next year round to the nearest do After Encome statement for Current and Next Year Actus this year Proforma Next year . By what percentage did your net income change? Show your work, round wer decimal faces tampe 45.69 0.4568 Foundato decamatams 4563 What is your current net profit margin and your preforma net profit margin? Show your work Small Business Finance - BUSG 1341- Homework - Assignment 6.2 Ratio Numbers Used: Answer: Current Net Profit Margin: Pro forma Net Profit Margin: d. In your business, assets and liabilities have historically varied with sales. Assets are normally 80 percent of sales, and liabilities are usually 55 percent of sales. You anticipate that you will have no owner payout of net profit. Using the percentage of sales method, determine if any additional financing is needed for your business next year. Show your work. Calcule using decimal places Numbers Used