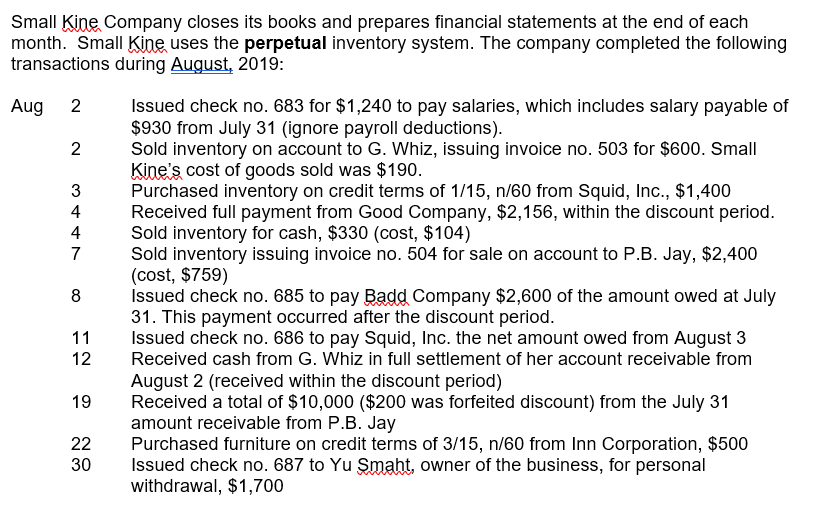

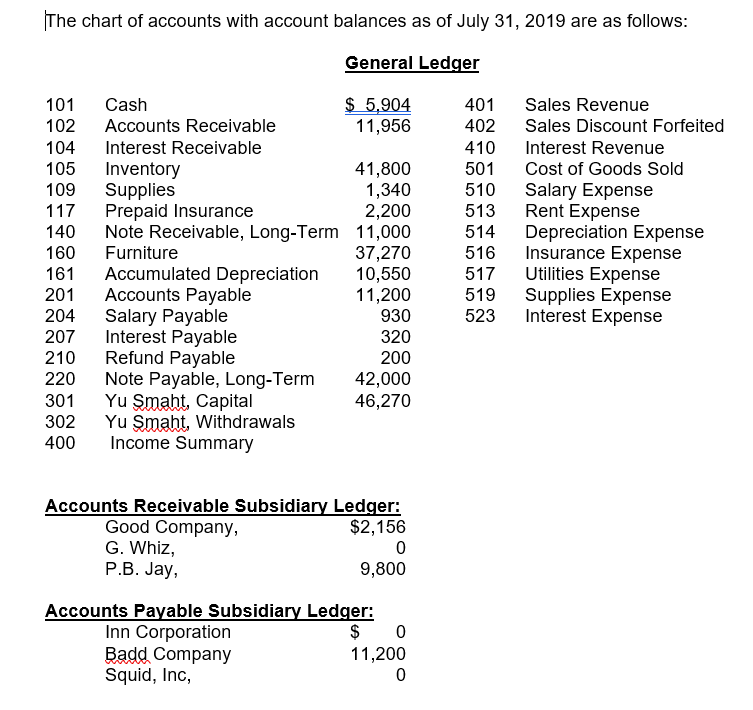

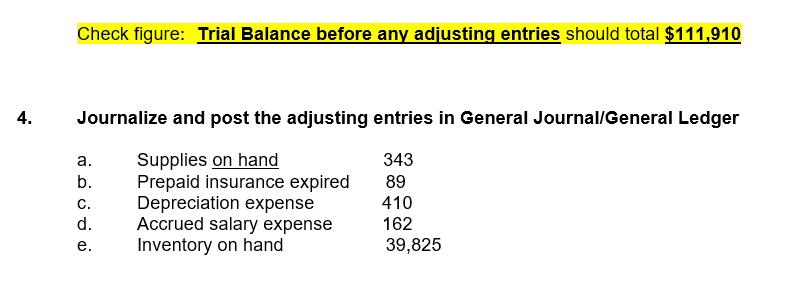

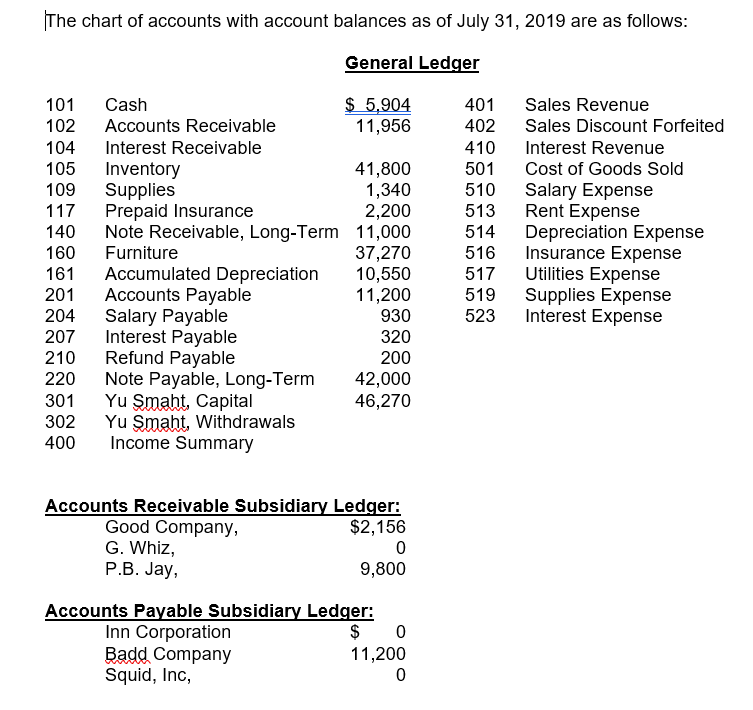

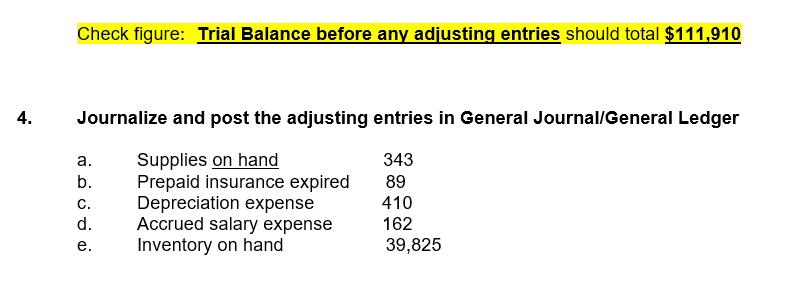

Small Kine Company closes its books and prepares financial statements at the end of each month. Small Kine uses the perpetual inventory system. The company completed the following transactions during August, 2019: Aug 2 Issued check no. 683 for $1,240 to pay salaries, which includes salary payable of $930 from July 31 (ignore payroll deductions). Sold inventory on account to G. Whiz, issuing invoice no. 503 for $600. Small Kine's cost of goods sold was $190. Purchased inventory on credit terms of 1/15, n/60 from Squid, Inc., $1,400 Received full payment from Good Company, $2,156, within the discount period. Sold inventory for cash, $330 (cost, $104) Sold inventory issuing invoice no. 504 for sale on account to P.B. Jay, $2,400 (cost, $759) Issued check no. 685 to pay Badd Company $2,600 of the amount owed at July 31. This payment occurred after the discount period. Issued check no. 686 to pay Squid, Inc. the net amount owed from August 3 Received cash from G. Whiz in full settlement of her account receivable from August 2 (received within the discount period) Received a total of $10,000 ($200 was forfeited discount) from the July 31 amount receivable from P.B. Jay Purchased furniture on credit terms of 3/15, n/60 from Inn Corporation, $500 Issued check no. 687 to Yu Smaht, owner of the business, for personal withdrawal, $1,700 The chart of accounts with account balances as of July 31, 2019 are as follows: General Ledger $ 5,904 11,956 101 102 104 105 109 117 140 160 161 201 204 207 210 220 301 302 400 Cash Accounts Receivable Interest Receivable Inventory Supplies Prepaid Insurance Note Receivable, Long-Term Furniture Accumulated Depreciation Accounts Payable Salary Payable Interest Payable Refund Payable Note Payable, Long-Term Yu Smaht, Capital Yu Smaht, Withdrawals Income Summary 41,800 1,340 2,200 11,000 37,270 10,550 11,200 930 320 200 42,000 46,270 401 402 410 501 510 513 514 516 517 519 523 Sales Revenue Sales Discount Forfeited Interest Revenue Cost of Goods Sold Salary Expense Rent Expense Depreciation Expense Insurance Expense Utilities Expense Supplies Expense Interest Expense Accounts Receivable Subsidiary Ledger: Good Company, $2,156 G. Whiz, P.B. Jay, 9,800 Accounts Payable Subsidiary Ledger: Inn Corporation $ 0 Badd Company 11,200 Squid, Inc, Check figure: Trial Balance before any adjusting entries should total $111,910 Journalize and post the adjusting entries in General Journal/General Ledger cooooo Supplies on hand Prepaid insurance expired Depreciation expense Accrued salary expense Inventory on hand 343 89 410 162 39,825