Smart claims that the corporation is getting even more business opportunities by expanding both the Europe and the Mainland market. But some financial analysts question its innovation and profitability ability.

You are required to:

- Discuss the possible difficulties in analyzing the financial performance of Smart by Hong Kong financial analysts.

(15 marks)

- Comment on the profitability of Smart with regard to the extracted data. You may make assumptions in giving your comments. Please clearly state any assumptions you have made.

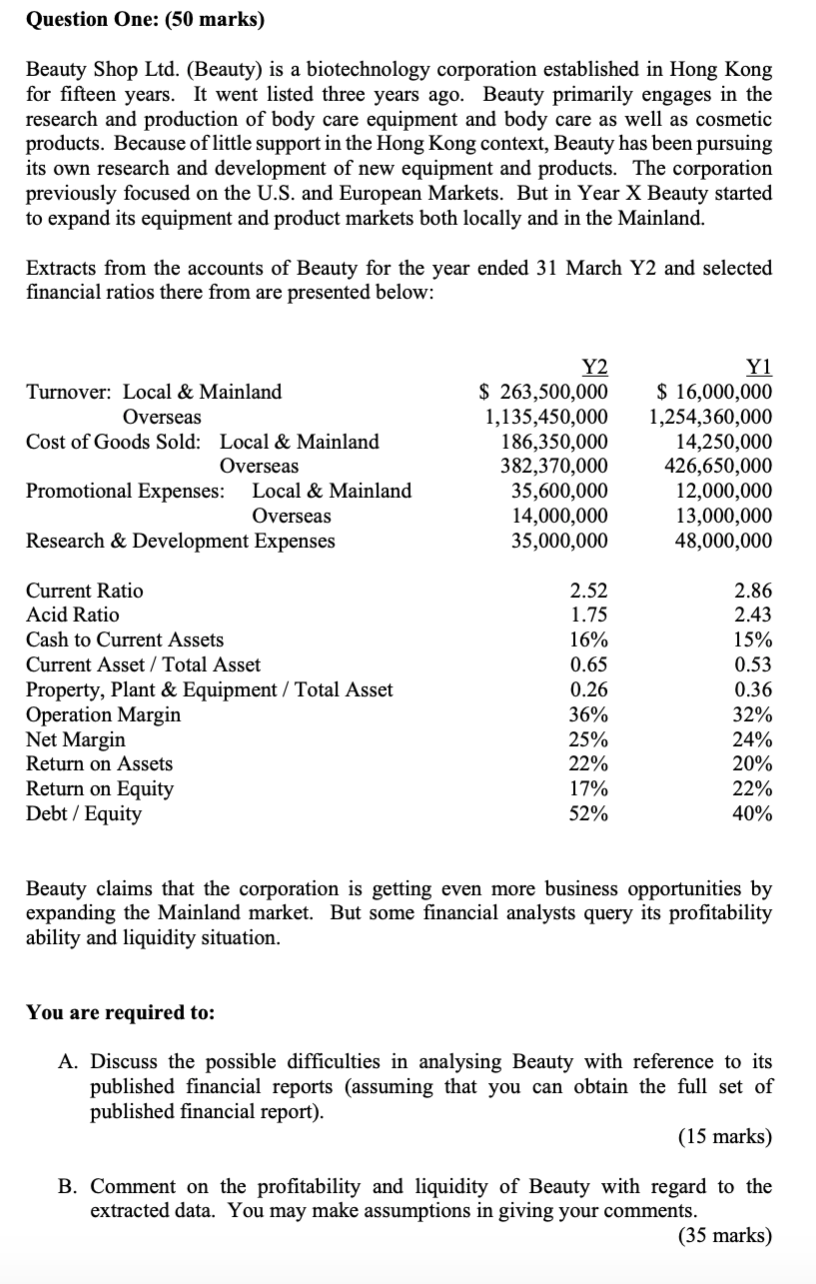

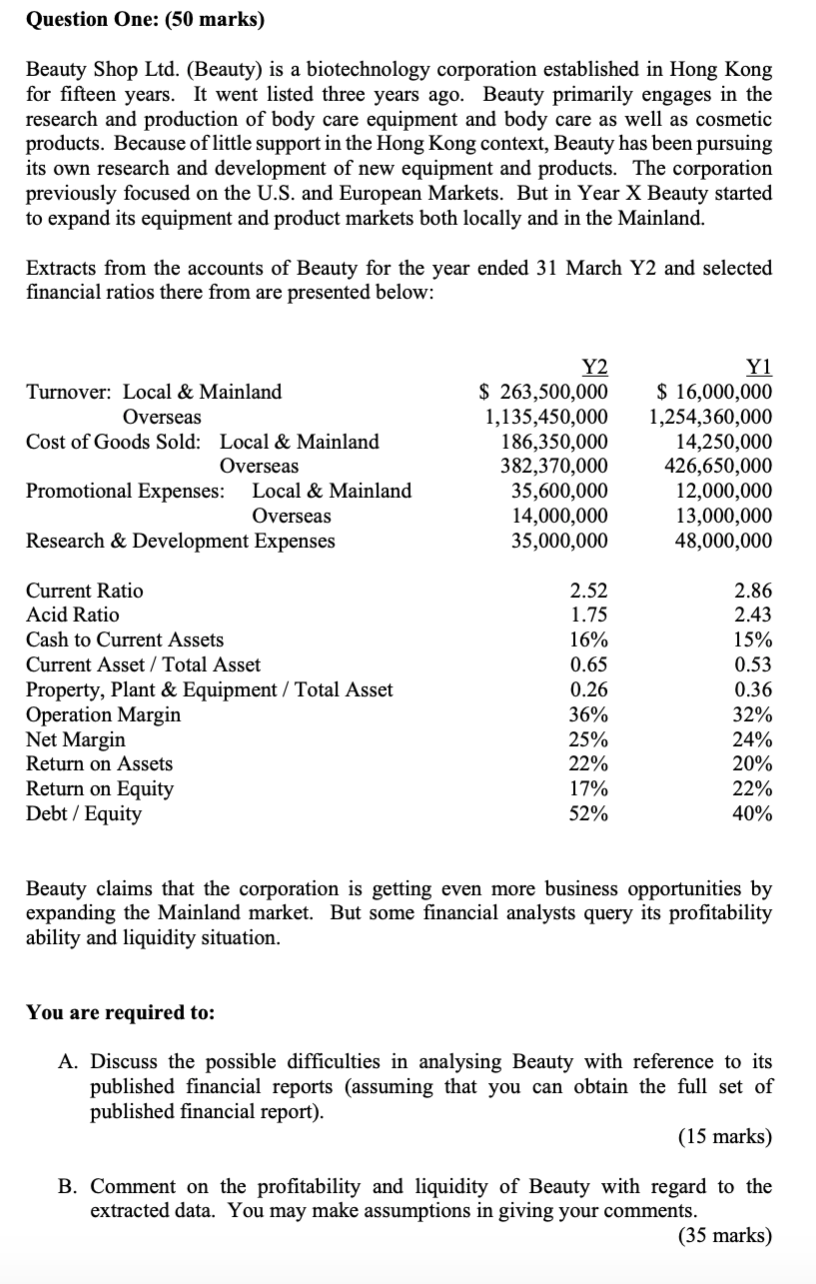

Question One: (50 marks) Beauty Shop Ltd. (Beauty) is a biotechnology corporation established in Hong Kong for fifteen years. It went listed three years ago. Beauty primarily engages in the research and production of body care equipment and body care as well as cosmetic products. Because of little support in the Hong Kong context, Beauty has been pursuing its own research and development of new equipment and products. The corporation previously focused on the U.S. and European Markets. But in Year X Beauty started to expand its equipment and product markets both locally and in the Mainland. Extracts from the accounts of Beauty for the year ended 31 March Y2 and selected financial ratios there from are presented below: Turnover: Local & Mainland Overseas Cost of Goods Sold: Local & Mainland Overseas Promotional Expenses: Local & Mainland Overseas Research & Development Expenses Y2 $ 263,500,000 1,135,450,000 186,350,000 382,370,000 35,600,000 14,000,000 35,000,000 Y1 $ 16,000,000 1,254,360,000 14,250,000 426,650,000 12,000,000 13,000,000 48,000,000 Current Ratio Acid Ratio Cash to Current Assets Current Asset/Total Asset Property, Plant & Equipment / Total Asset Operation Margin Net Margin Return on Assets Return on Equity Debt / Equity 2.52 1.75 16% 0.65 0.26 36% 25% 22% 17% 52% 2.86 2.43 15% 0.53 0.36 32% 24% 20% 22% 40% Beauty claims that the corporation is getting even more business opportunities by expanding the Mainland market. But some financial analysts query its profitability ability and liquidity situation. You are required to: A. Discuss the possible difficulties in analysing Beauty with reference to its published financial reports (assuming that you can obtain the full set of published financial report). (15 marks) B. Comment on the profitability and liquidity of Beauty with regard to the extracted data. You may make assumptions in giving your comments. (35 marks) Question One: (50 marks) Beauty Shop Ltd. (Beauty) is a biotechnology corporation established in Hong Kong for fifteen years. It went listed three years ago. Beauty primarily engages in the research and production of body care equipment and body care as well as cosmetic products. Because of little support in the Hong Kong context, Beauty has been pursuing its own research and development of new equipment and products. The corporation previously focused on the U.S. and European Markets. But in Year X Beauty started to expand its equipment and product markets both locally and in the Mainland. Extracts from the accounts of Beauty for the year ended 31 March Y2 and selected financial ratios there from are presented below: Turnover: Local & Mainland Overseas Cost of Goods Sold: Local & Mainland Overseas Promotional Expenses: Local & Mainland Overseas Research & Development Expenses Y2 $ 263,500,000 1,135,450,000 186,350,000 382,370,000 35,600,000 14,000,000 35,000,000 Y1 $ 16,000,000 1,254,360,000 14,250,000 426,650,000 12,000,000 13,000,000 48,000,000 Current Ratio Acid Ratio Cash to Current Assets Current Asset/Total Asset Property, Plant & Equipment / Total Asset Operation Margin Net Margin Return on Assets Return on Equity Debt / Equity 2.52 1.75 16% 0.65 0.26 36% 25% 22% 17% 52% 2.86 2.43 15% 0.53 0.36 32% 24% 20% 22% 40% Beauty claims that the corporation is getting even more business opportunities by expanding the Mainland market. But some financial analysts query its profitability ability and liquidity situation. You are required to: A. Discuss the possible difficulties in analysing Beauty with reference to its published financial reports (assuming that you can obtain the full set of published financial report). (15 marks) B. Comment on the profitability and liquidity of Beauty with regard to the extracted data. You may make assumptions in giving your comments. (35 marks)