Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to

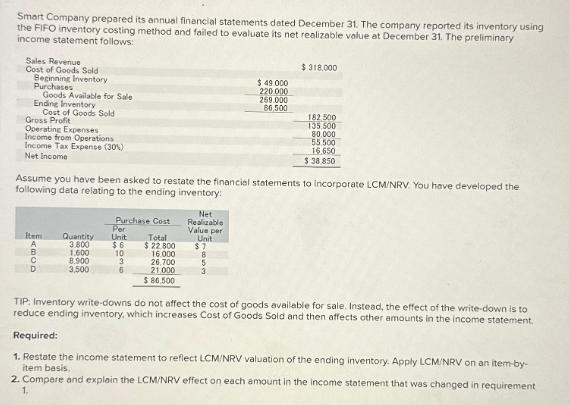

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary income statement follows: Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit $318,000 $ 49 000 220 000 259.000 86,500 182.500 135.500 Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 80,000 55.500 16.650 $ 38.850 Assume you have been asked to restate the financial statements to incorporate LCM/NRV You have developed the following data relating to the ending inventory: Net Purchase Cost Realizable Per Item Quantity Unit Value per Total Unit A 3.800 $6 $22.800 $7 B 1,600 10 16,000 8.900 3 26,700 5 D 3,500 6 21,000 $ 86,500 TIP: Inventory write-downs do not affect the cost of goods available for sale. Instead, the effect of the write-down is to reduce ending inventory, which increases Cost of Goods Sold and then affects other amounts in the income statement. Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by- item basis. 2. Compare and explain the LCM/NRV effect on each amount in the income statement that was changed in requirement 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started