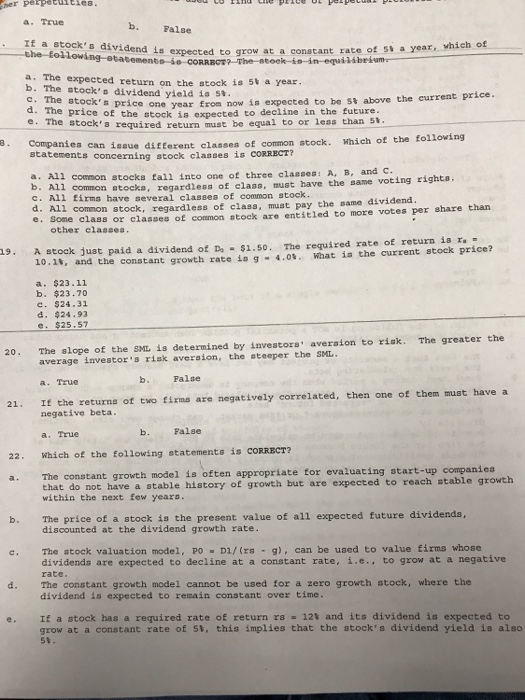

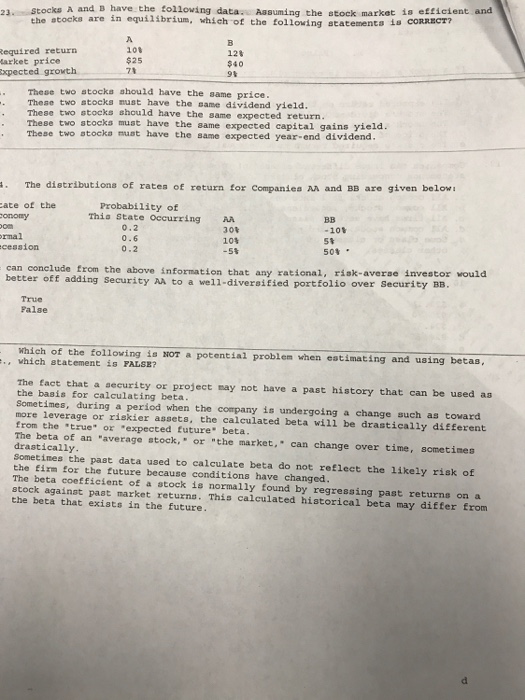

smer Perpetuities False If a stock dividend is expected constant rate of 5 a year, which of to grow at a nte se in a. The expected return on the stock is 5t a year b. dividend yield 53. above the current price. c. The stock's price one year from now is expected to be st d. The price of the stock expected to decline in the future e. The stock's required return must be equal or less than 5t. e. Companies can issue different classes of common stock. Which of the following statements concerning stock classes is CORRECT? a. All common stocks fall into one of three classes: A, B, and rights. b. All common stocks, regardless of class, must have the same voting c. All firms have several classes of common stock. the same dividend. than d. All common stock, regardless of class, must per share lass or classes of common stock are entitled to more votes other classea A stock just paid a dividend of Da $1.50 The required rate of return is re 10.1 and the constant growth io g 4.01 What is the current stock price? rate 19 $23.11 b. $23.70 $24.31 d, $24.93 e. $25.57 The slope of the sML is determined by investors. aversion to risk. The greater the 20 average s risk the steeper the sML. False 21. If the returns of two firms are negatively then one of them must have a correlated, negative beta. False following statements is CORRECT? which of the 22 The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years. The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. c. The stock valuation model po D1/ (rs g), can be used to value firms whose dividends are expected to decline at a constant rate, i e.. to grow at a negative rate The constant growth model cannot be used for a zero growth stock, where the dividend is expected to remain constant over time. If a stock has a required rate of return rs 121 and its dividend is expected to this implies that the atock's dividend yield is also grow at a constant rate of 51