Question

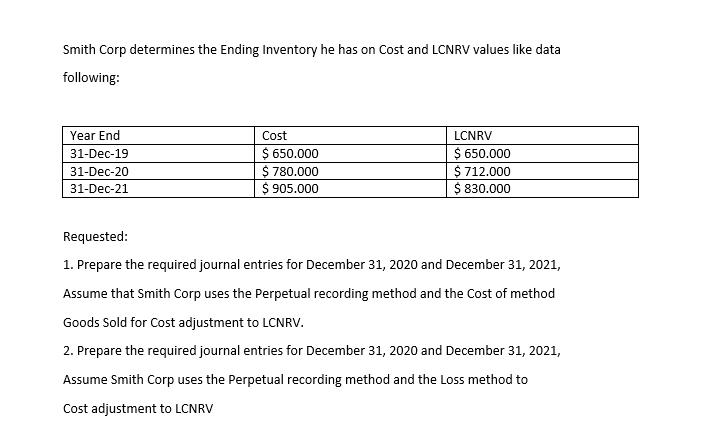

Smith Corp determines the Ending Inventory he has on Cost and LCNRV values like data following: Year End 31-Dec-19 31-Dec-20 31-Dec-21 Cost $ 650.000

Smith Corp determines the Ending Inventory he has on Cost and LCNRV values like data following: Year End 31-Dec-19 31-Dec-20 31-Dec-21 Cost $ 650.000 $ 780.000 $ 905.000 LCNRV $ 650.000 $ 712.000 $ 830.000 Requested: 1. Prepare the required journal entries for December 31, 2020 and December 31, 2021, Assume that Smith Corp uses the Perpetual recording method and the Cost of method Goods Sold for Cost adjustment to LCNRV. 2. Prepare the required journal entries for December 31, 2020 and December 31, 2021, Assume Smith Corp uses the Perpetual recording method and the Loss method to Cost adjustment to LCNRV

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1Using the Cost Method for Adjusting Inventory to LCNRV December 31 2020 Debit Inventory LCNRV Adjus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

12th Edition

978-0073526706, 9780073526706

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App