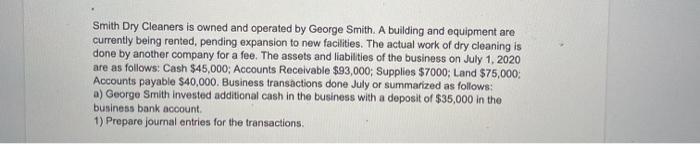

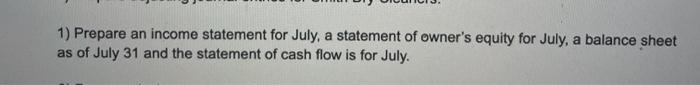

Smith Dry Cleaners is owned and operated by George Smith. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and liabilities of the business on July 1, 2020 are as follows: Cash $45,000; Accounts Receivable $93,000; Supplies $7000; Land $75,000 Accounts payable $40,000. Business transactions done July or summarized as follows: a) George Smith invested additional cash in the business with a deposit of $35,000 in the business bank account 1) Prepare journal entries for the transactions 2) Prepare adjusting journal entries for Smith Dry Cleaners. 3) Prepare a post-closing trial balance. 1) Prepare an income statement for July, a statement of owner's equity for July, a balance sheet as of July 31 and the statement of cash flow is for July. New SA LE AMMIN E TMS v4seAGYVUcf-2 dmloi9gdW8IB_po9FV7P4CEho2qw/edit Lo 151 LE CA Maps News Translate Blackboard Learn Add-ons Help Last edit was 2 hours ago Arial 12 BIVA + OD 3 lili IEE 1 3 5 Smith Dry Cleaners is owned and operated by George Smith. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and liabilities of the business on July 1, 2020 are as follows: Cash $45,000; Accounts Receivable $93,000; Supplies $7000; Land $75,000; Accounts payable $40,000. Business transactions done July or summarized as follows: a) George Smith invested additional cash in the business with a deposit of $35,000 in the business bank account. 1) Prepare journal entries for the transactions. 2) Prepare adjusting journal entries for Smith Dry Cleaners. 1) Prepare an income statenient for July, a statement of owner's equity for July, a balance sheet as of July 31 and the statement of cash flow is for July 2) Prepare closing entries for Smith Dry Cleaners. 3) Prepare a post-closing trial balance. 2 13 4 5 6 a) George Smith invested additional cash in the business with a deposit of $35,000 in the business bank account. 1) Prepare iournal entries for the transactions Smith Dry Cleaners is owned and operated by George Smith. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and liabilities of the business on July 1, 2020 are as follows: Cash $45,000; Accounts Receivable $93,000; Supplies $7000; Land $75,000 Accounts payable $40,000. Business transactions done July or summarized as follows: a) George Smith invested additional cash in the business with a deposit of $35,000 in the business bank account 1) Prepare journal entries for the transactions 2) Prepare adjusting journal entries for Smith Dry Cleaners. 3) Prepare a post-closing trial balance. 1) Prepare an income statement for July, a statement of owner's equity for July, a balance sheet as of July 31 and the statement of cash flow is for July. New SA LE AMMIN E TMS v4seAGYVUcf-2 dmloi9gdW8IB_po9FV7P4CEho2qw/edit Lo 151 LE CA Maps News Translate Blackboard Learn Add-ons Help Last edit was 2 hours ago Arial 12 BIVA + OD 3 lili IEE 1 3 5 Smith Dry Cleaners is owned and operated by George Smith. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and liabilities of the business on July 1, 2020 are as follows: Cash $45,000; Accounts Receivable $93,000; Supplies $7000; Land $75,000; Accounts payable $40,000. Business transactions done July or summarized as follows: a) George Smith invested additional cash in the business with a deposit of $35,000 in the business bank account. 1) Prepare journal entries for the transactions. 2) Prepare adjusting journal entries for Smith Dry Cleaners. 1) Prepare an income statenient for July, a statement of owner's equity for July, a balance sheet as of July 31 and the statement of cash flow is for July 2) Prepare closing entries for Smith Dry Cleaners. 3) Prepare a post-closing trial balance. 2 13 4 5 6 a) George Smith invested additional cash in the business with a deposit of $35,000 in the business bank account. 1) Prepare iournal entries for the transactions