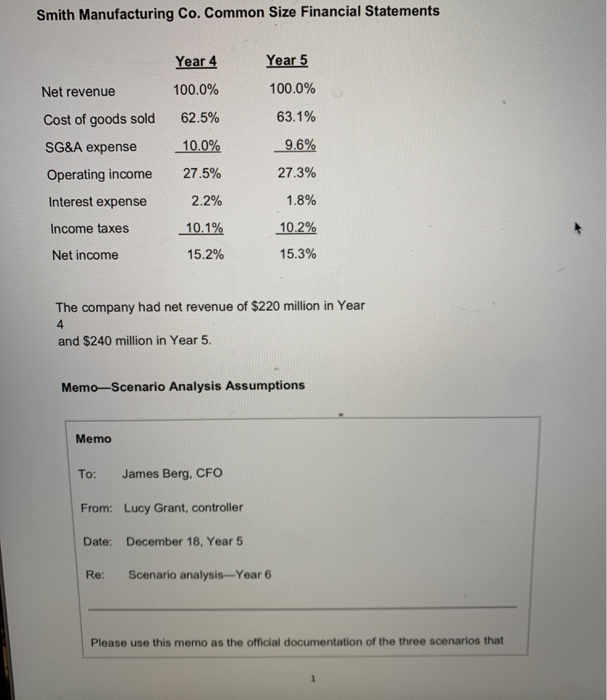

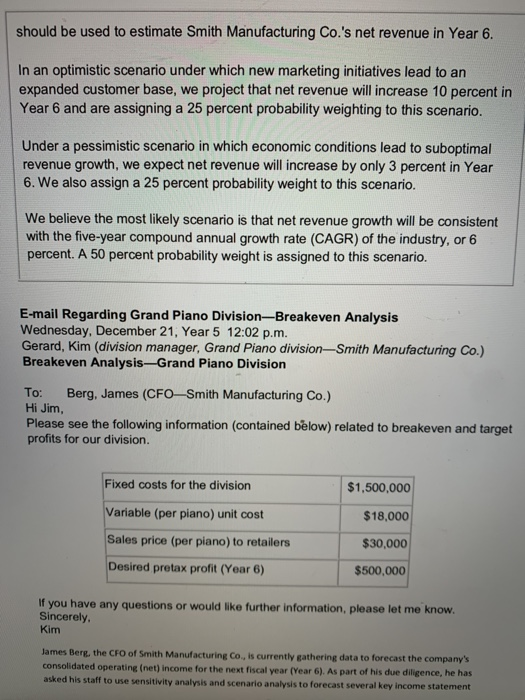

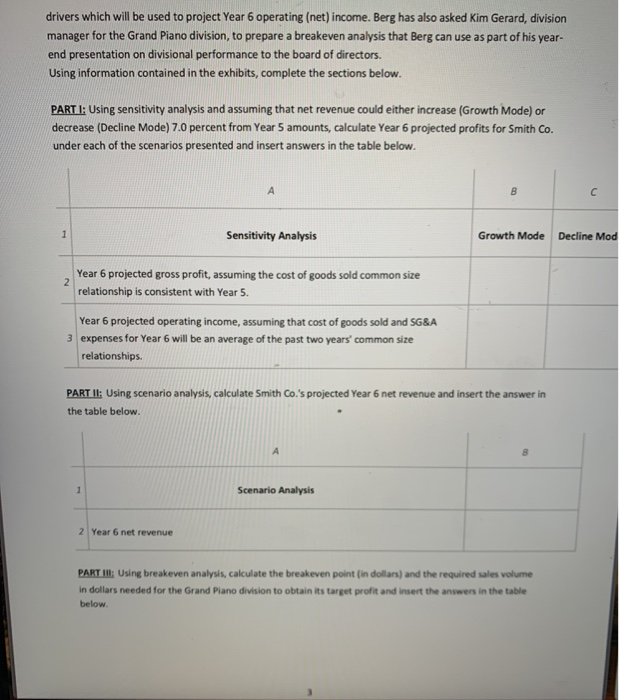

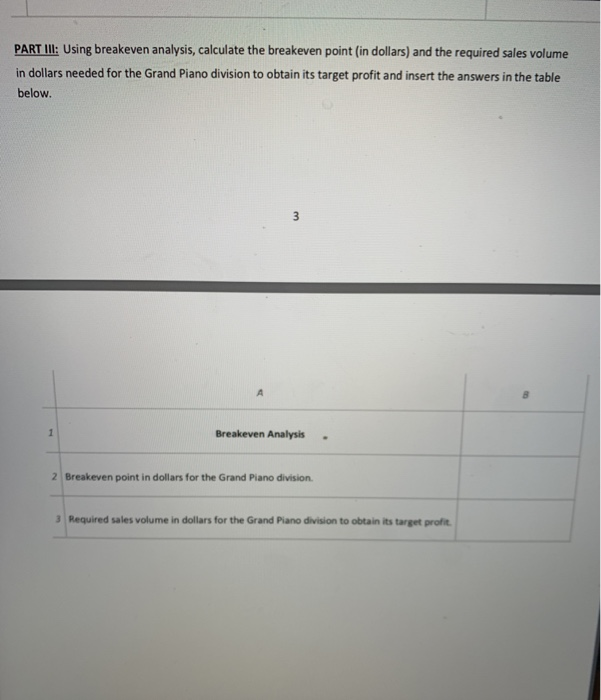

Smith Manufacturing Co. Common Size Financial Statements Net revenue Cost of goods sold SG&A expense Operating income Interest expense Year 4 100.0% 62.5% 10.0% 27.5% 2.2% 10.1% 15.2% Year 5 100.0% 63.1% 9.6% 27.3% 1.8% Income taxes 10.2% 15.3% Net income The company had net revenue of $220 million in Year and $240 million in Year 5. Memo-Scenario Analysis Assumptions Memo To: James Berg, CFO From: Lucy Grant, controller Date: December 18, Year 5 Re: Scenario analysis--Year 6 Please use this memo as the official documentation of the three scenarios that should be used to estimate Smith Manufacturing Co.'s net revenue in Year 6. In an optimistic scenario under which new marketing initiatives lead to an expanded customer base, we project that net revenue will increase 10 percent in Year 6 and are assigning a 25 percent probability weighting to this scenario. Under a pessimistic scenario in which economic conditions lead to suboptimal revenue growth, we expect net revenue will increase by only 3 percent in Year 6. We also assign a 25 percent probability weight to this scenario. We believe the most likely scenario is that net revenue growth will be consistent with the five-year compound annual growth rate (CAGR) of the industry, or 6 percent. A 50 percent probability weight is assigned to this scenario. E-mail Regarding Grand Plano Division-Breakeven Analysis Wednesday, December 21, Year 5 12:02 p.m. Gerard, Kim (division manager, Grand Piano division-Smith Manufacturing Co.) Breakeven Analysis-Grand Piano Division To: Berg, James (CFO-Smith Manufacturing Co.) Hi Jim, Please see the following information (contained below) related to breakeven and target profits for our division. Fixed costs for the division $1,500,000 $18,000 Variable (per piano) unit cost Sales price (per piano) to retailers $30,000 Desired pretax profit (Year 6) $500,000 If you have any questions or would like further information, please let me know. Sincerely, Kim James Berthe CFO of Smith Manufacturing Co., is currently gathering data to forecast the company's consolidated operating (net) income for the next fiscal year (Year 6). As part of his due diligence, he has asked his staff to use sensitivity analysis and scenario analysis to forecast several key income statement drivers which will be used to project Year 6 operating (net) income. Berg has also asked Kim Gerard, division manager for the Grand Piano division, to prepare a breakeven analysis that Berg can use as part of his year- end presentation on divisional performance to the board of directors. Using information contained in the exhibits, complete the sections below. PARTI: Using sensitivity analysis and assuming that net revenue could either increase (Growth Mode) or decrease (Decline Mode) 7.0 percent from Year 5 amounts, calculate Year 6 projected profits for Smith Co. under each of the scenarios presented and insert answers in the table below. Sensitivity Analysis Growth Mode Decline Mod Year 6 projected gross profit, assuming the cost of goods sold common size relationship is consistent with Year 5. Year 6 projected operating income, assuming that cost of goods sold and SG&A expenses for Year 6 will be an average of the past two years' common size relationships. PART II: Using scenario analysis, calculate Smith Co.'s projected Year 6 net revenue and insert the answer in the table below. Scenario Analysis 2 Year 6 net revenue PART III: Using breakeven analysis, calculate the breakeven point in dollars) and the required sales volume in dollars needed for the Grand Piano division to obtain its target profit and insert the answers in the table below. PART III: Using breakeven analysis, calculate the breakeven point in dollars) and the required sales volume in dollars needed for the Grand Piano division to obtain its target profit and insert the answers in the table below. Breakeven Analysis 2 Breakeven point in dollars for the Grand Piano division Required sales volume in dollars for the Grand Piano division to obtain its target profit