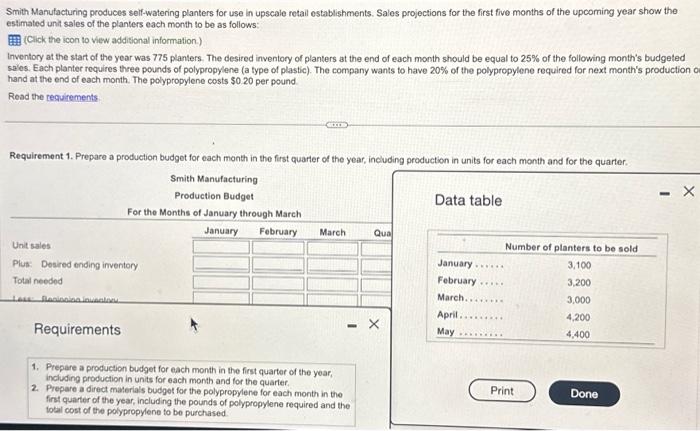

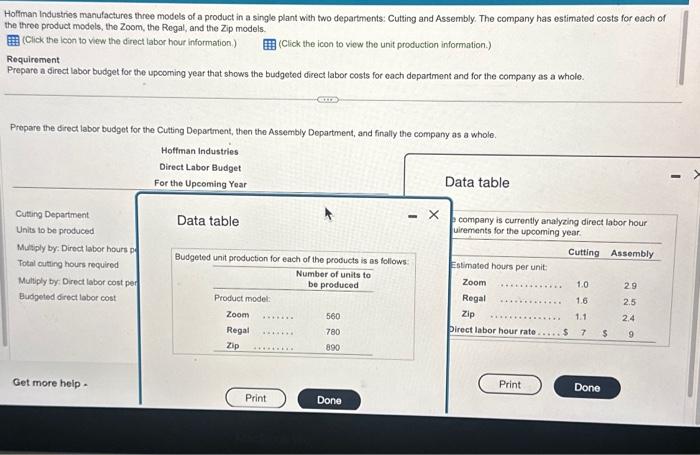

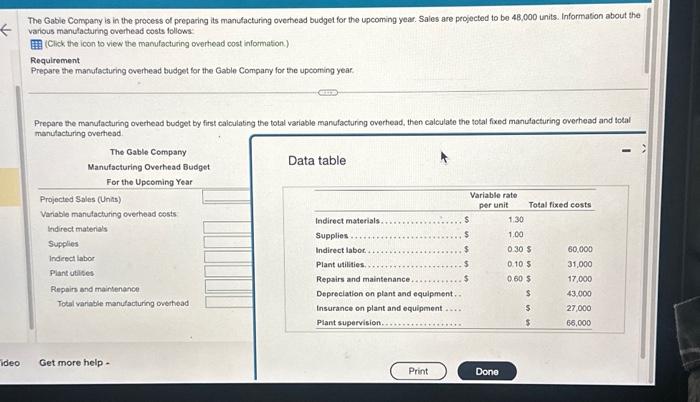

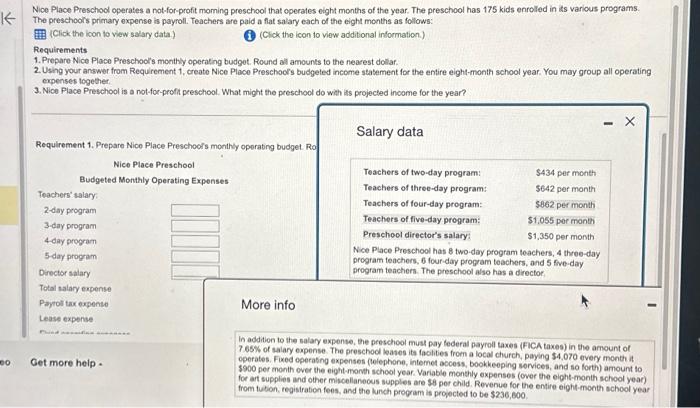

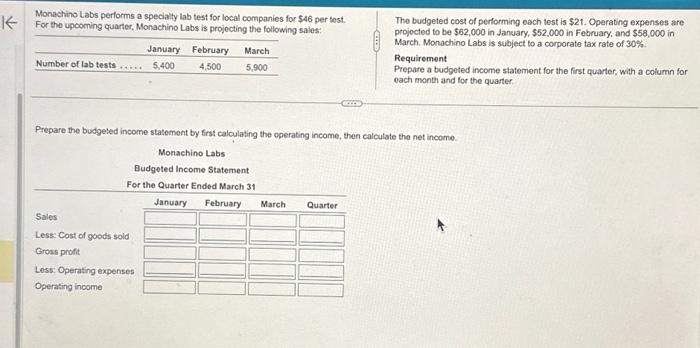

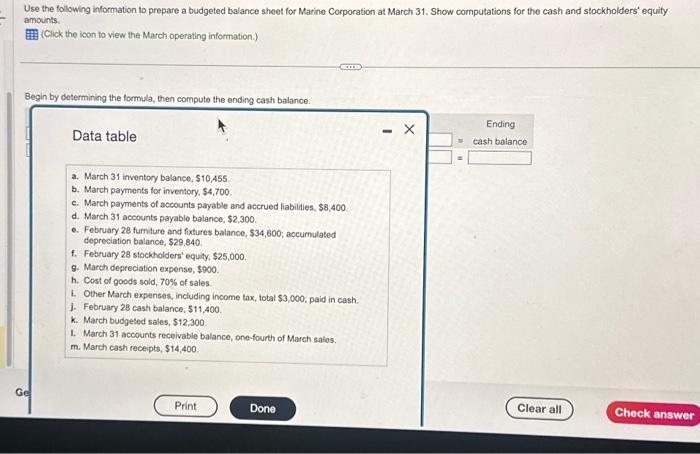

Smith Manufacturing produces self-watering planters for use in upscale retail establishments. Sales projections for the first five months of the upcoming year show the estimated unit sales of the planters each month to be as follows: (Click the icon to view additional information.) Inventory at the start of the year was 775 planters. The desired inventory of planters at the end of each month should be equal to 25% of the following month's budgeted sales. Each planter requires three pounds of polypropylene (a type of plastic). The company wants to have 20% of the polypropylene required for next month's production o hand at the end of each month. The polypropylene costs $0.20 per pound. Road the teguirements. Requirement 1. Prepare a production budget for each month in the first quarter of the year, including production in units for each month and for the quarter. Data table Requirements 1. Prepare a production budget for each month in the first quarter of the year, including production in units for each month and for the quarter. 2. Prepare a direct materials budget for the polypropylene for each month in the finst quarter of the year, including the pounds of polypropylene required and the total cost of the polypropylene to be purchased. Hoffman Industries manufactures three models of a product in a single plant with two departments: Cutting and Assembly. The company has estimated costs for each of the three product models, the Zoom, the Regal, and the Zip models. (Click the loon to view the direct labor hour information). (Click the icon to view the unit production information.) Roquirement Prepare a direct labor budget for the upcoming year that shows the budgeted direct labor costs for each department and for the company as a whole. Propare the direct labor budget for the Cutting Department, then the Assembly Department, and finally the company as a whole. The Gable Company is in the process of preparing its manufacturing overhead budget for the upcoming year. Sales are peojected to be 48,000 units. Information about the various manutacturing overhead costs follows: (Click the icon to view the mamufacturing overhead cost information.) Requirement Prepare the manufacturing cverhead budget for the Gable Company for the upcoming year. Prepare the manufacturing overhead budget by first calculabing the total variable manufactuning overhead, then calculate the total fixed manutacturing overhead and total manutacturing overhead. Data table Nice Place Preschool operates a not-for-profit moming preschool that operates eight months of the year. The preschool has 175 kids enrolled in its various programs. The preschoors primary expense is payroti. Teachers are pald a flat salary each of the elight months as follows: (Click the icon lo view salary data.) (i) (Click the icon to view additional information.) Requirements 1. Prepare Nice Place Preschool's monthy operating budget. Round all amounts to the nearest dollaf. 2. Using your answer from Requirement 1, creato Nice Placo Preschocrs budgeted income statement for the entire eight-month school year. You may group all operating expenses logether. 3. Nice Place Preschool is a not-for-proft preschool. What might the preschool do with lits projected income for the year? Requirement 1. Prepare Nico Place Preschoofs monthy operating budget Ro Salary data Nice Place Preschool Budgeted Monthly Operating Expenses Teachers' walary: 2-day program 3-day program 4-day pregam 5-day program Drector salary Total salary expense Paprol tax expente More info Lease expense Get more help . In addition to the salary expense, the preschool must pay federal payroll taxes (FiCA taxes) in the amount of 7.65% of salary expense. The preschool loases its fachities from a local church, paying $4,070 every month it operates. Fixed operating expenses (felephone, internet access, bookkeoping sorvices, and so forth) amount to $900 per month over the eight-month school year. Variable monthly expenses (over the eight-month school year) for art supplies and other miscellaneous supples are $8 per child. Revenue for the entire eight-month school year from tution, registration fees, and the lunch program is projected to be $236,600. Monachino Labs performs a specialty lab test for local companies for $46 per test. For the upooming quarter, Monachino Labs is projocting the following sales: Tho budgeted cost of performing each test is \$21. Operating expenses are projocted to be $62,000 in January, $52,000 in February, and $58,000 in March. Monachino Labs is subject to a corporate tax rate of 30%. Requirement Prepare a budgeted income statement for the first quarter, with a column for each month and for the quarter. Prepare the budgeted income statement by first calculating the operating income, then calculate the net income. Use the following information to prepare a budgeted balance sheet for Marine Corporation at March 31. Show computations for the cash and stockholders' equity amounts. (Click the icon to view the March operating information.) Begin by determining the formula, then compute the ending cash balance. Data table Ending a. March 31 inventory balance, $10,455. b. March payments for inventory, $4,700. c. March payments of accounts payable and accrued liabilities, $8,400 d. March 31 accounts payable balance, $2,300. e. February 28 furniture and fixtures balanco, $34,600; accumulated depreciation balance, $29,840. f. February 28 stockholders' equity, $25,000. 9. March depreciation expense, $900. h. Cost of goods sold, 70% of sales. 1. Other March expenses, including income tax, total \$3,000; paid in cash. J. February 28 cash balance, $11,400. k. March budgeted sales, $12,300. 1. March 31 accounts receivable balance, one-fourth of March salos. m. March cash receipts, $14,400