Answered step by step

Verified Expert Solution

Question

1 Approved Answer

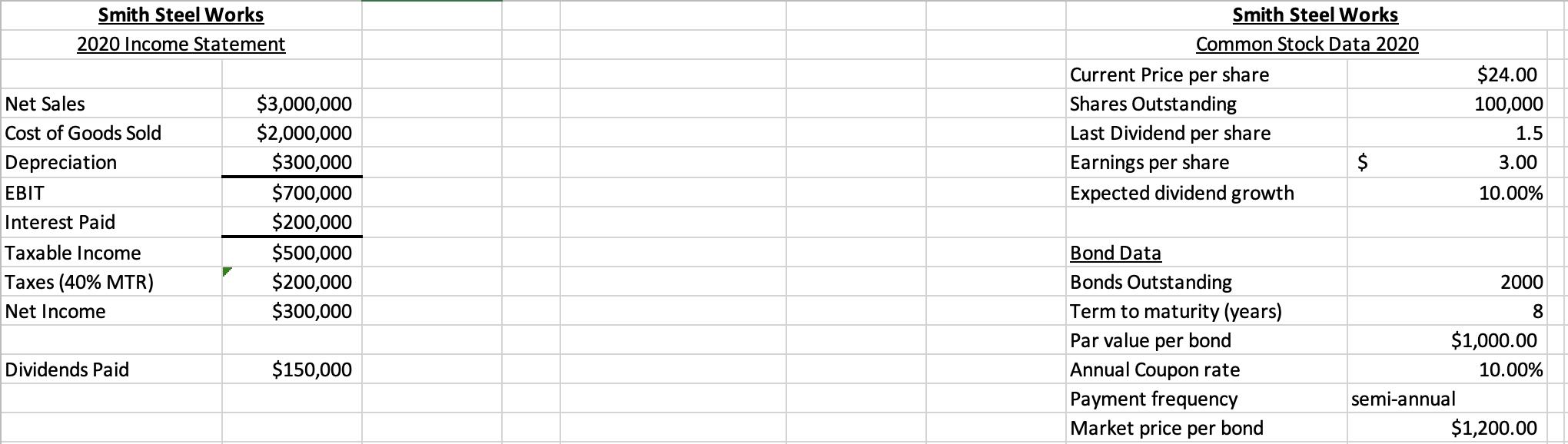

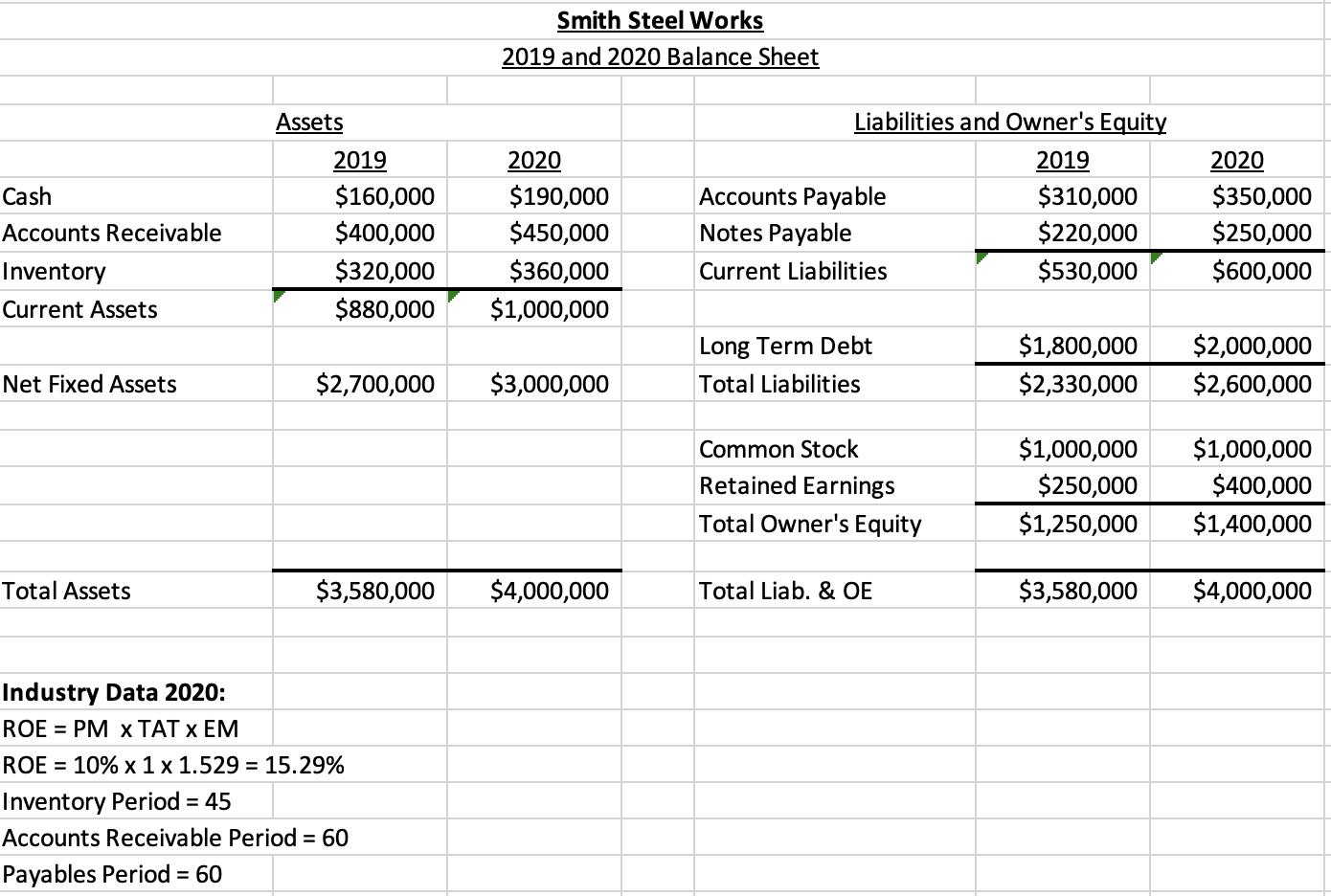

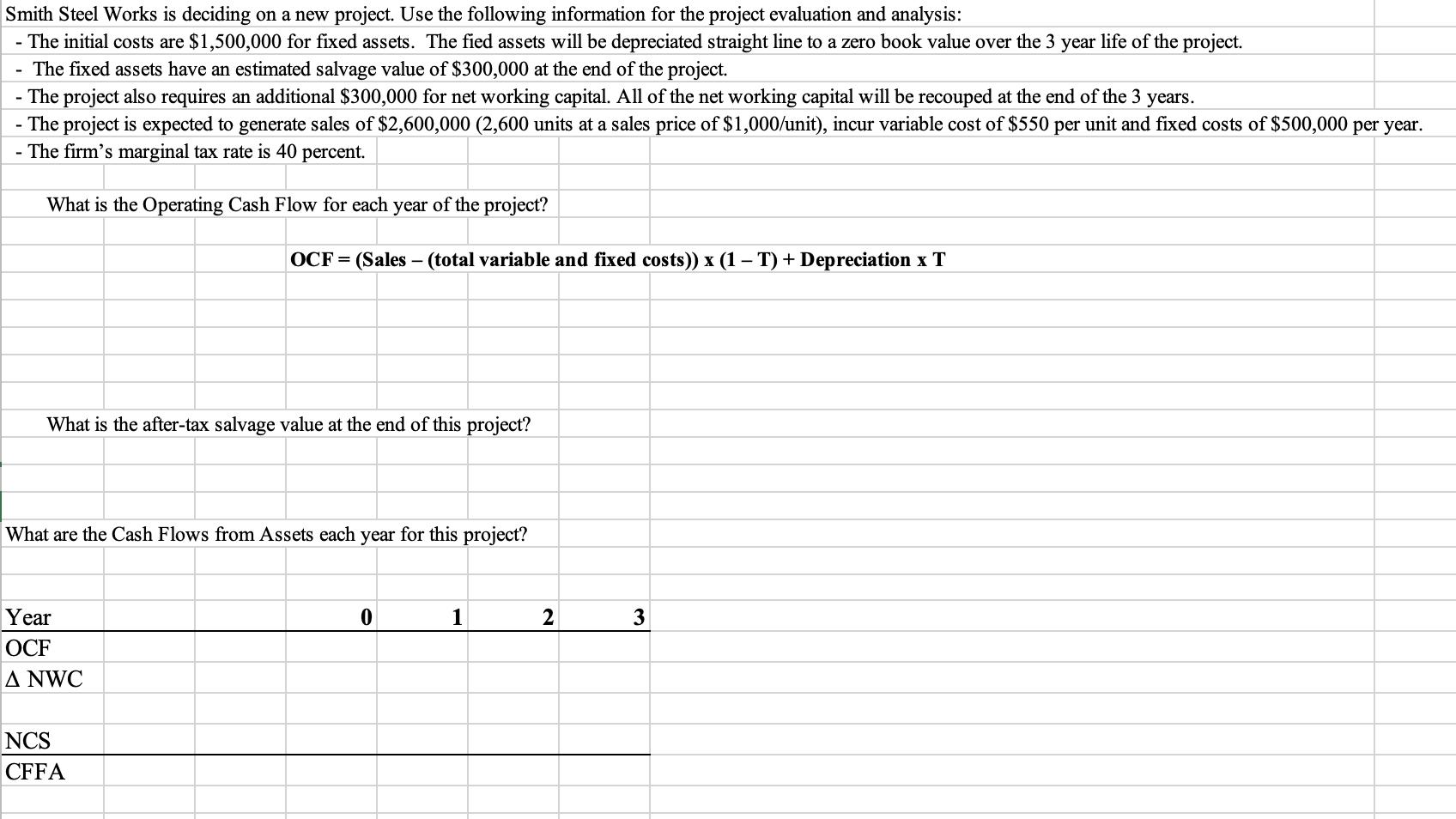

Smith Steel Works is deciding on a new project. Use the following information for the project evaluation and analysis: Smith Steel WWorks Smith Steel Works

Smith Steel Works is deciding on a new project. Use the following information for the project evaluation and analysis:

Smith Steel WWorks Smith Steel Works 2020 Income Statement Common Stock Data 2020 Current Price per share $24.00 Shares Outstanding $3,000,000 $2,000,000 Net Sales 100,000 Cost of Goods Sold Last Dividend per share 1.5 $300,000 $700,000 $200,000 Depreciation Earnings per share $ 3.00 BIT Expected dividend growth 10.00% Interest Paid Bond Data Bonds Outstanding Taxable Income $500,000 Taxes (40% MTR) $200,000 2000 Net Income $300,000 Term to maturity (years) 8 $1,000.00 Par value per bond Annual Coupon rate Dividends Paid $150,000 10.00% Payment frequency semi-annual Market price per bond $1,200.00

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

New Microsoft Excel Worksheet Excel File Home Insert Page Layout Formulas Data Review View O Tell m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started