Answered step by step

Verified Expert Solution

Question

1 Approved Answer

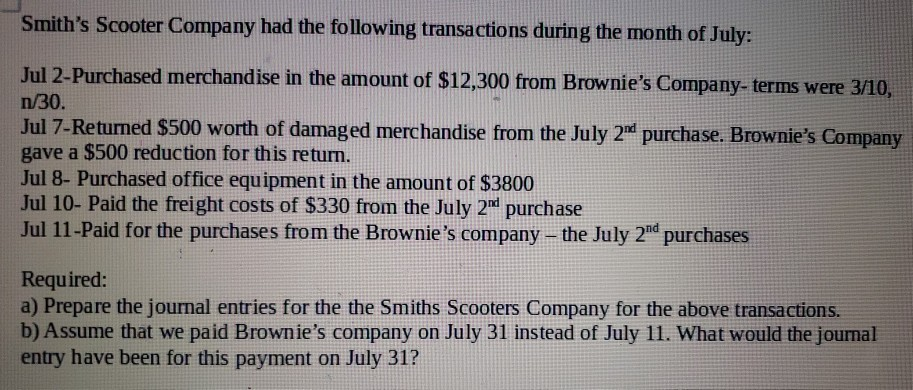

Smith's Scooter Company had the following transactions during the month of July: Jul 2-Purchased merchandise in the amount of $12,300 from Brownie's Company-terms were 3/10,

Smith's Scooter Company had the following transactions during the month of July: Jul 2-Purchased merchandise in the amount of $12,300 from Brownie's Company-terms were 3/10, n/30. Jul 7-Returmed $500 worth of damaged merchandise from the July 2d purchase. Brownie's Company gave a $500 reduction for this return. Jul 8- Purchased office equipment in the amount of $3800 Jul 10- Paid the freight costs of $330 from the July 2" purchase Jul 11-Paid for the purchases from the Brownie's company- the July 2"d purchases Required: a) Prepare the journal entries for the the Smiths Scooters Company for the above transactions. b) Assume that we paid Brownie's company on July 31 instead of July 11. What would the jourmal entry have been for this payment on July 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started