| Smith's Sports Incorporated |

| Balance Sheet |

| As at December 31, 2022 |

| ASSETS | | | | |

| Current assets: | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total current assets | | | | |

| | | | | |

| Long-term Investments: | | | | |

| | | | | |

| | | | | |

| Total long-term investments | | | | |

| | | | | |

| Capital Assets: | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total capital assets | | | | |

| | | | | |

| Intangibles: | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total intangibles | | | | |

| | | | | |

| Total Assets | | | | |

| | | | | |

| LIABILITIES | | | | |

| Current liabilities | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total current liabilities | | | | |

| | | | | |

| Non-current liabilities: | | | | |

| | | | | |

| Total non-current liabilities | | | | |

| Total liabilities | | | | |

| | | | | |

| SHAREHOLDERS EQUITY | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total shareholders equity | | | | |

| | | | | |

| Total Liabilities & Equity | | | | |

| | | |

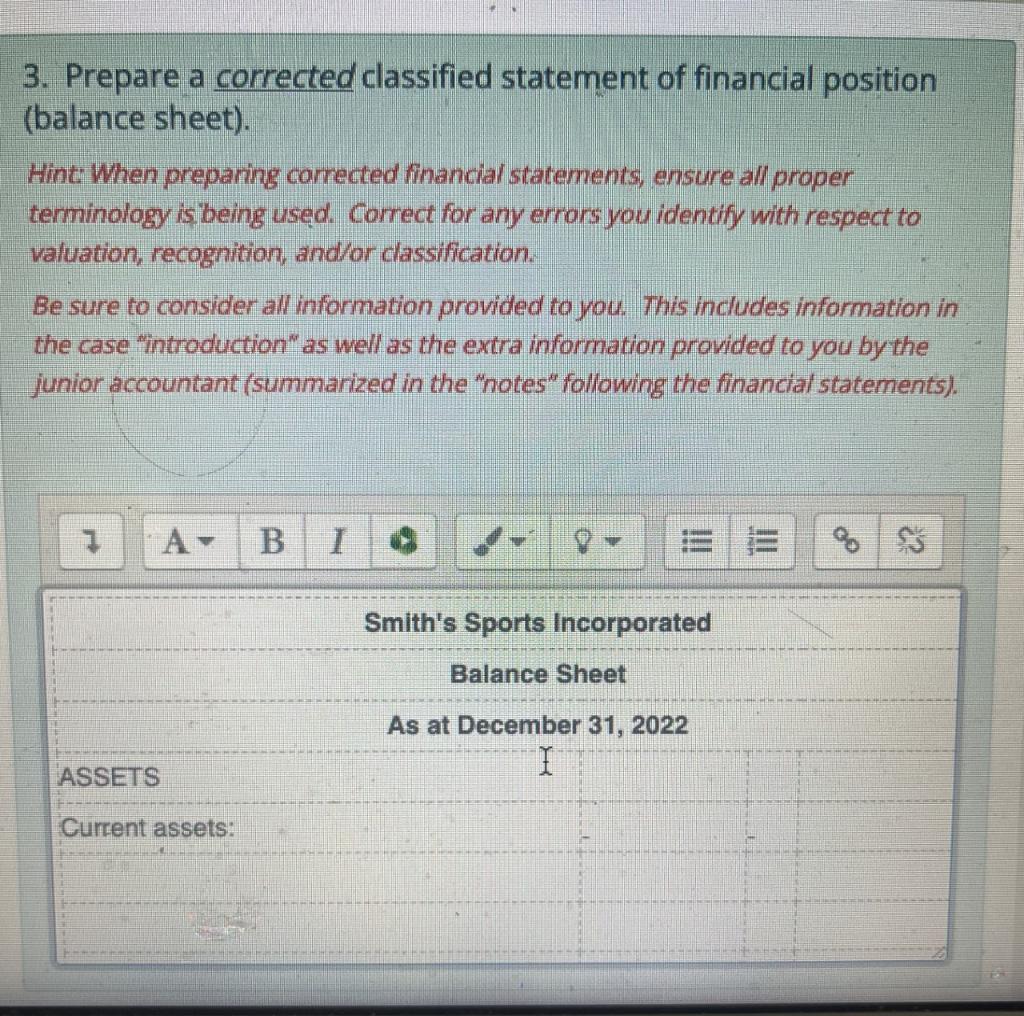

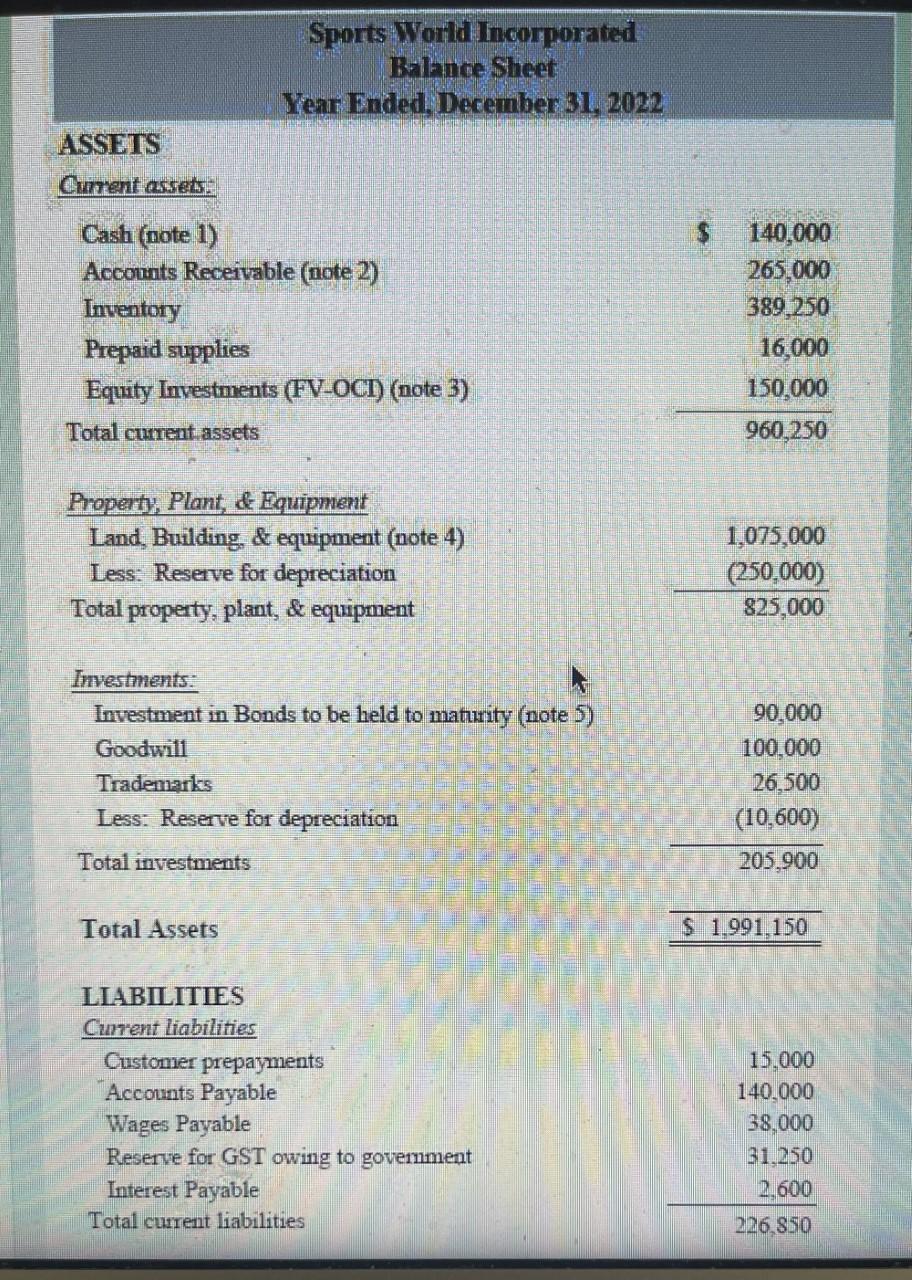

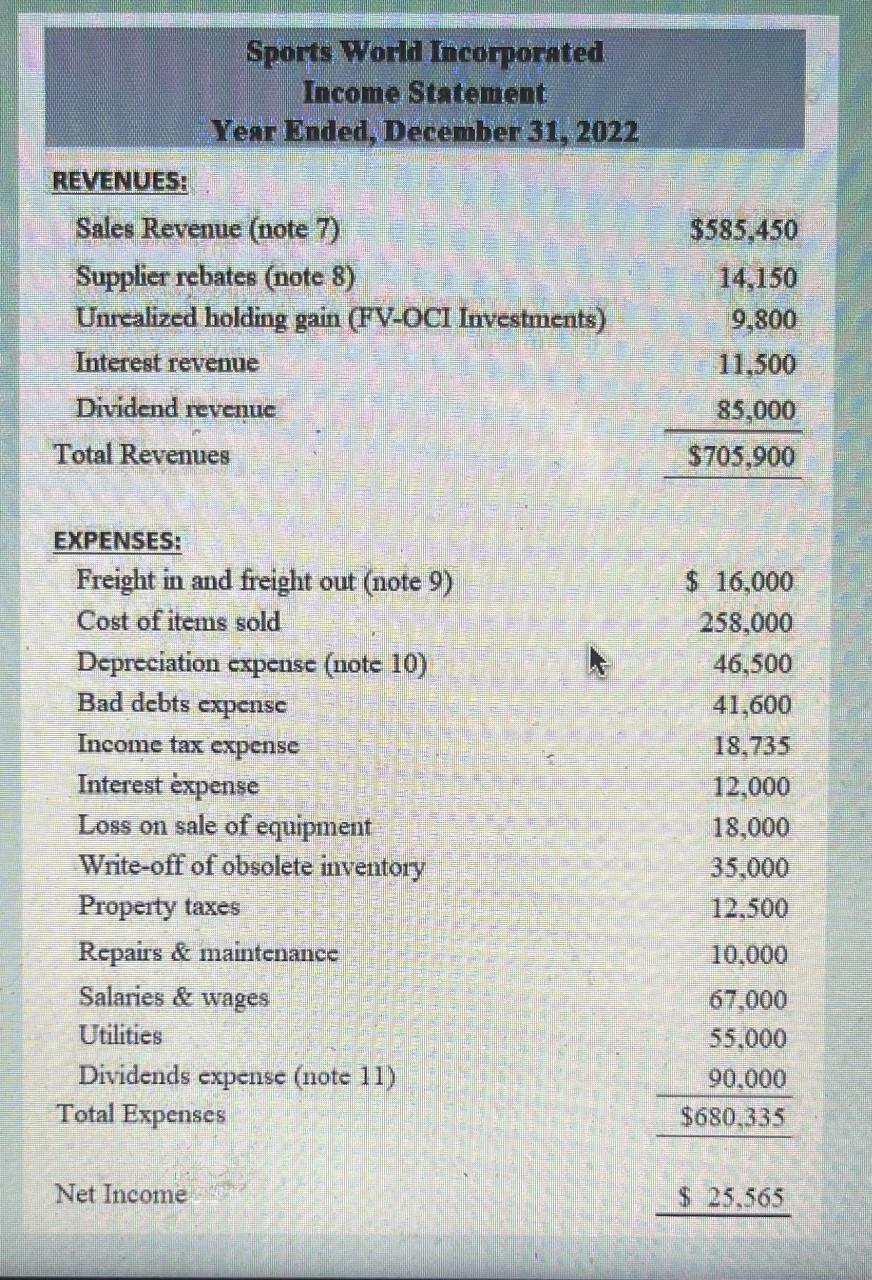

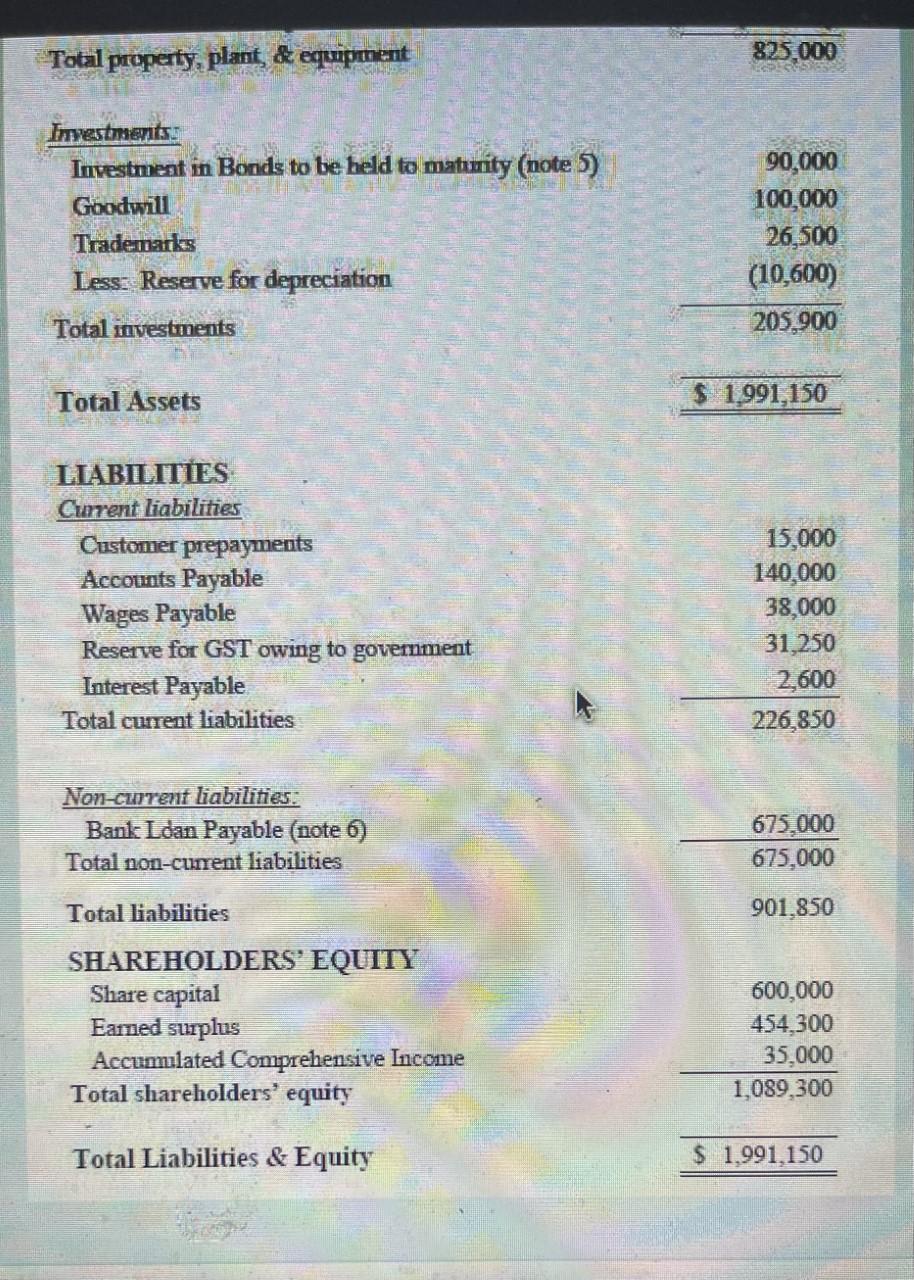

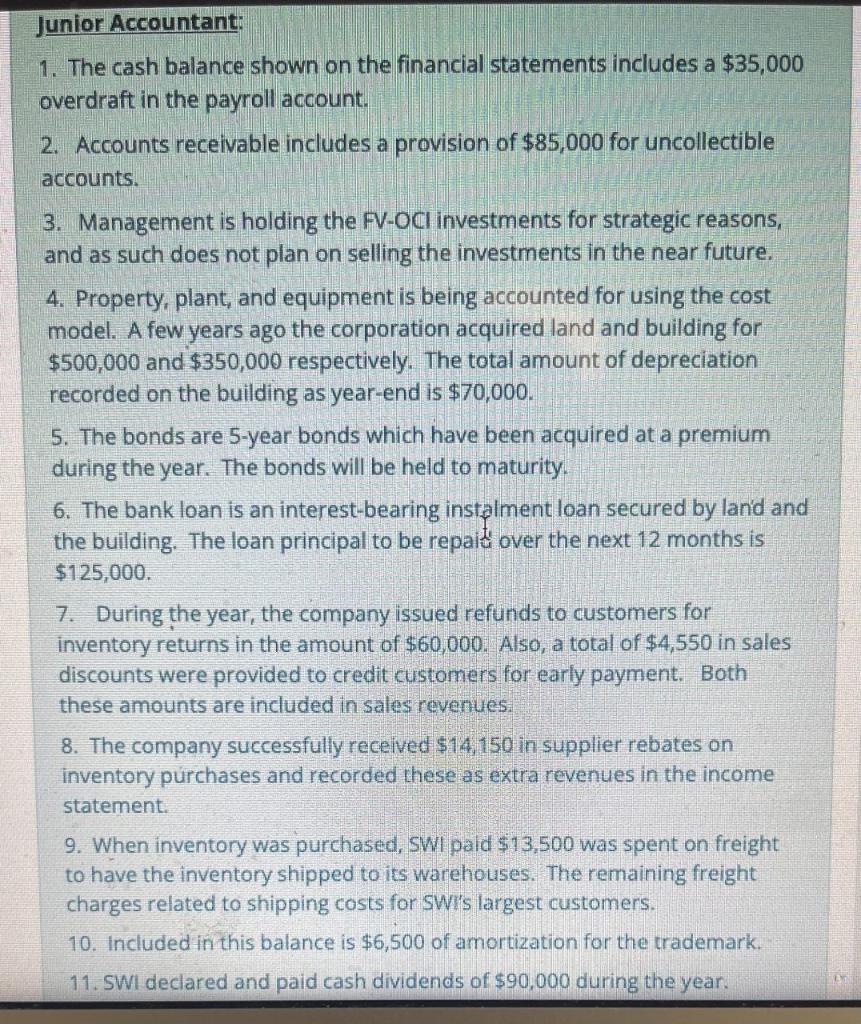

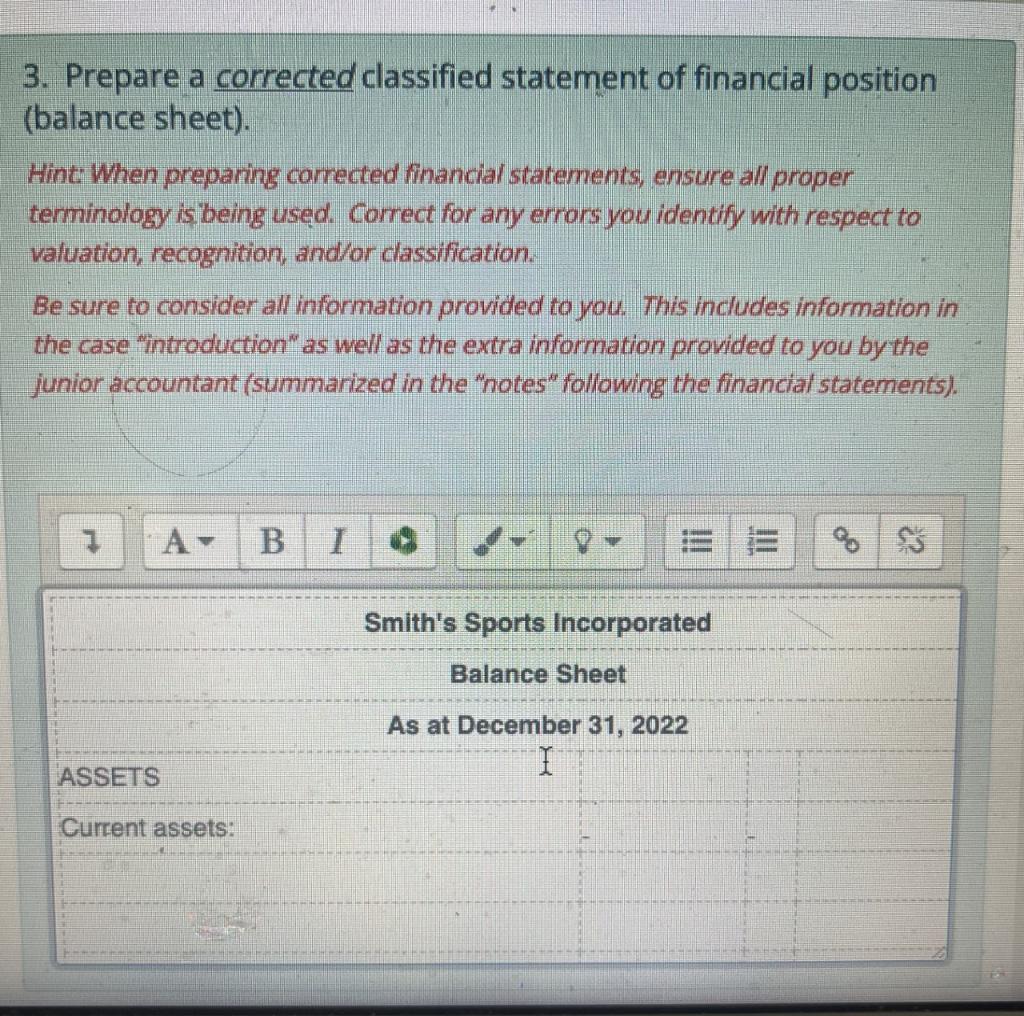

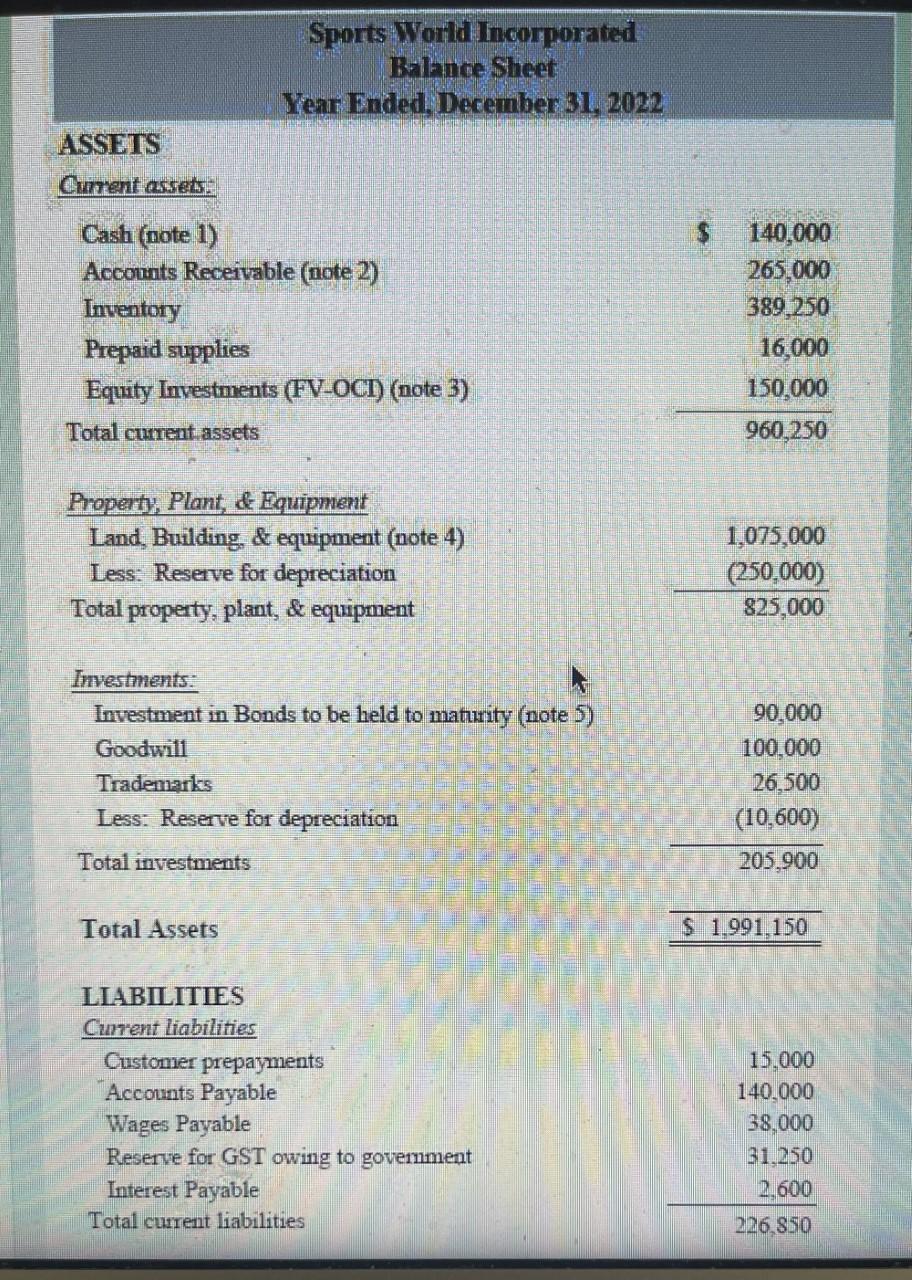

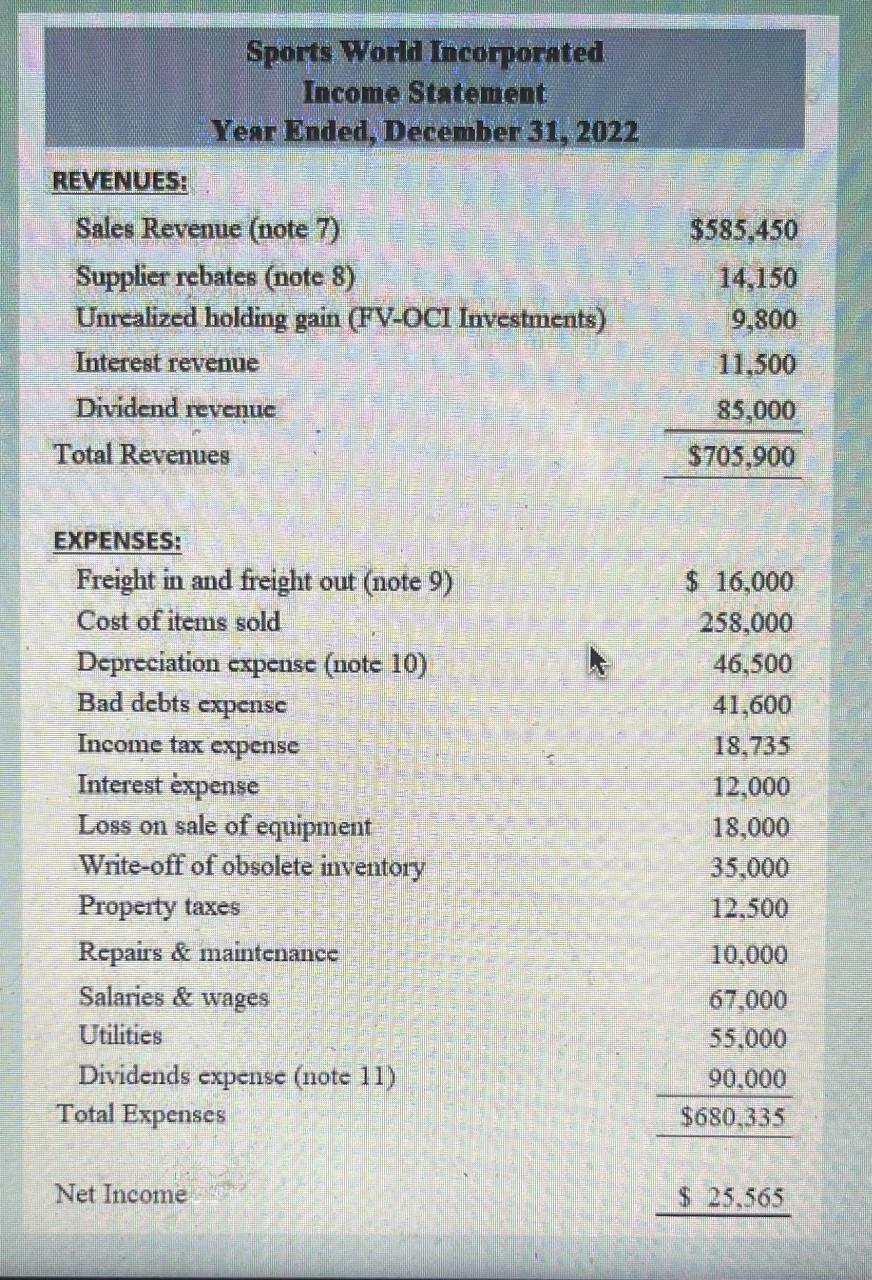

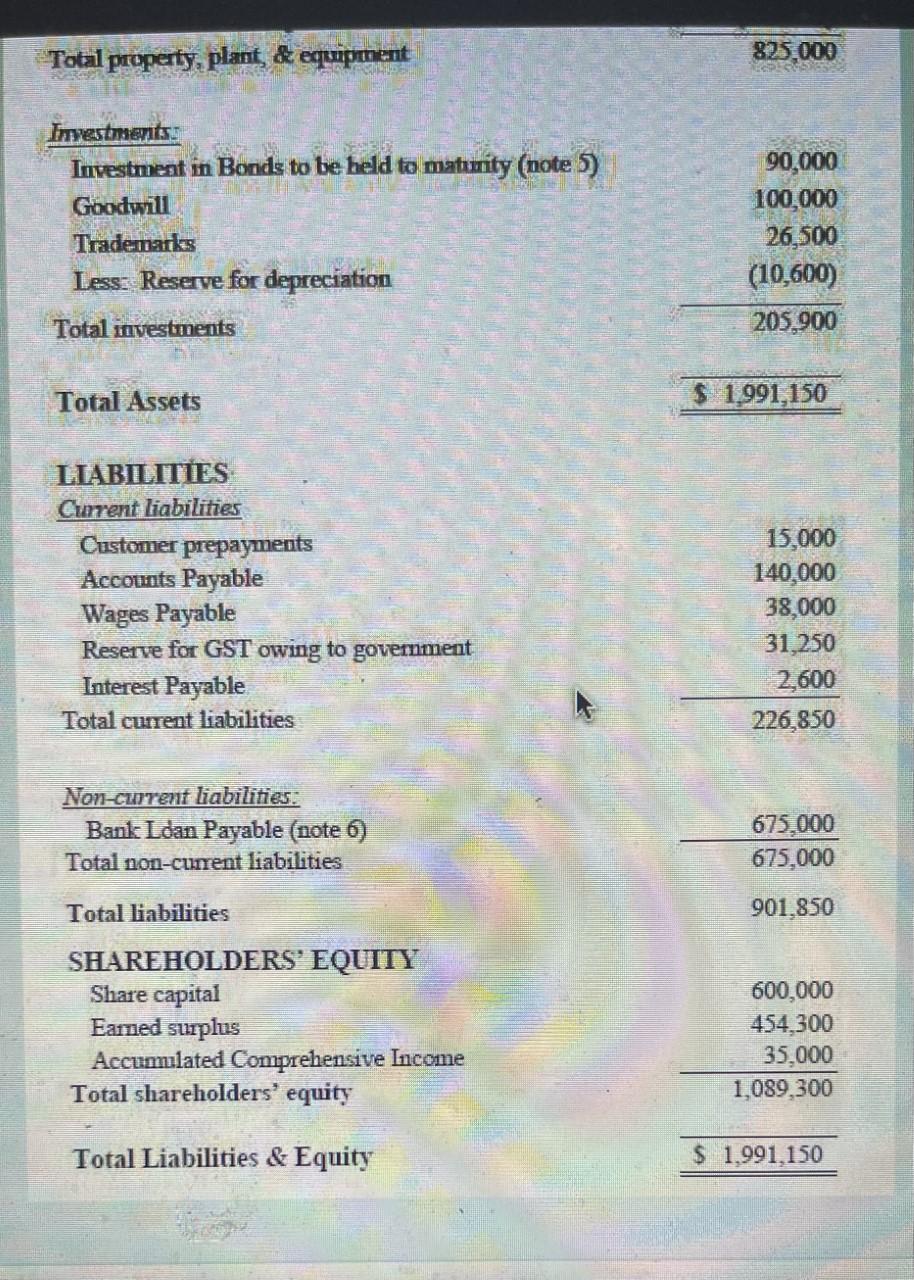

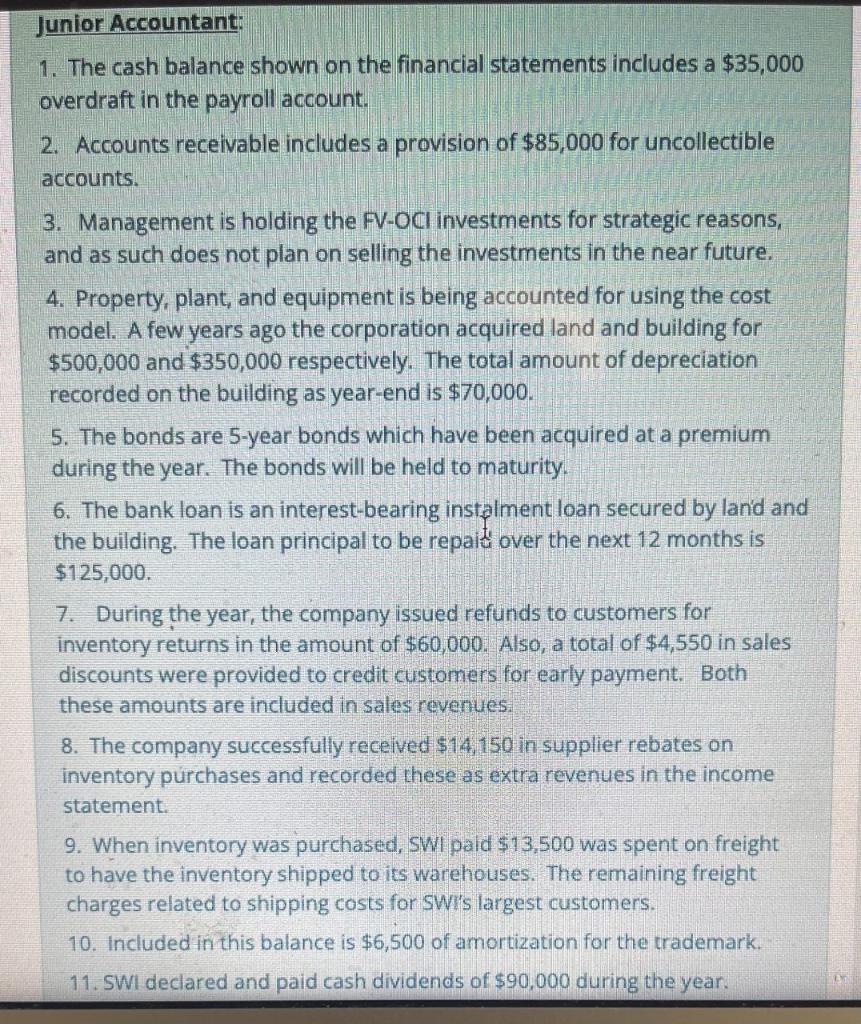

3. Prepare a corrected classified statement of financial position (balance sheet). Hint: When preparing corrected financial statements, ensure all proper terminology is being used. Correct for any errors you identify with respect to valuation, recognition, and/or classification. Be sure to consider all information provided to you. This includes information in the case "introduction" as well as the extra information provided to you by the junior accountant (summarized in the "notes" following the financial statements). Sports World Incorporated Balhne Sheet Year Ended, December 31,2022 ASSETS Current assets: Cash(note1)AccountsReceivable(note2)InventoryPrepaidsuppliesEquityInvestments(FV-OCI)(note3)Totalcurrent.assets140,000265,000389,25016,000150,000960,250 Property, Plant, \& Equipment Land, Building, \& equipment (note 4) Less: Reserve for depreciation Total property, plant, \& equipment 825,000(250,000) Investments: \begin{tabular}{lr} Investment in Bonds to be held to maturity (note 5) & 90,000 \\ Goodwill & 100,000 \\ Trademarks & 26,500 \\ Less: Reserve for depreciation & (10,600) \\ \hline Total investments & 205,900 \\ Total Assets & \\ \hline 1,991,150 \\ \hline \end{tabular} LIABILITIES Current liabilities CustomerprepaymentsAccountsPayableWagesPayableReserveforGSTowingtogovernmentInterestPayableTotalcurrentliabilities15,000140,00038,00031,2502,600 Sports World Incomporated Income Statement Year Ended, December 31, 2022 REVENUES: \begin{tabular}{lr} Sales Revenue (note 7) & $585,450 \\ Supplier rebates (note 8) & 14,150 \\ Unrealized holding gain (FV-OCI Investments) & 9,800 \\ Interest revenue & 11,500 \\ Dividend revenue & 85,000 \\ Total Revenues & $705,900 \\ \hline \end{tabular} EXPENSES: \begin{tabular}{lr} Freight in and freight out (note 9) & $16,000 \\ Cost of items sold & 258,000 \\ Depreciation expense (note 10) & 46,500 \\ Bad debts expense & 41,600 \\ Income tax expense & 18,735 \\ Interest expense & 12,000 \\ Loss on sale of equipment & 18,000 \\ Write-off of obsolete inventory & 35,000 \\ Property taxes & 12,500 \\ Repairs \& maintenance & 10,000 \\ Salaries \& wages & 67,000 \\ Utilities & 55,000 \\ Dividends expense (note 11) & 90,000 \\ Total Expenses & $680,335 \\ \hline Net Income & $25,565 \\ \hline \end{tabular} Total properf, plant, of equipment Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. Property, plant, and equipment is being accounted for using the cost model. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000. 5. The bonds are 5 -year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaiu over the next 12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues: 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. 9. When inventory was purchased, SWI paid $13,500 was spent on freight to have the inventory shipped to its warehouses. The remaining freight charges related to shipping costs for SWi's largest customers. 10. Included in this balance is $6,500 of amortization for the trademark. 11. SWI declared and paid cash dividends of $90,000 during the year