Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Smitty's Home Repair Company, a regional hardware chain that specializes in do-ityourself materials and equipment rentals, is cash rich because of several consecutive good years.

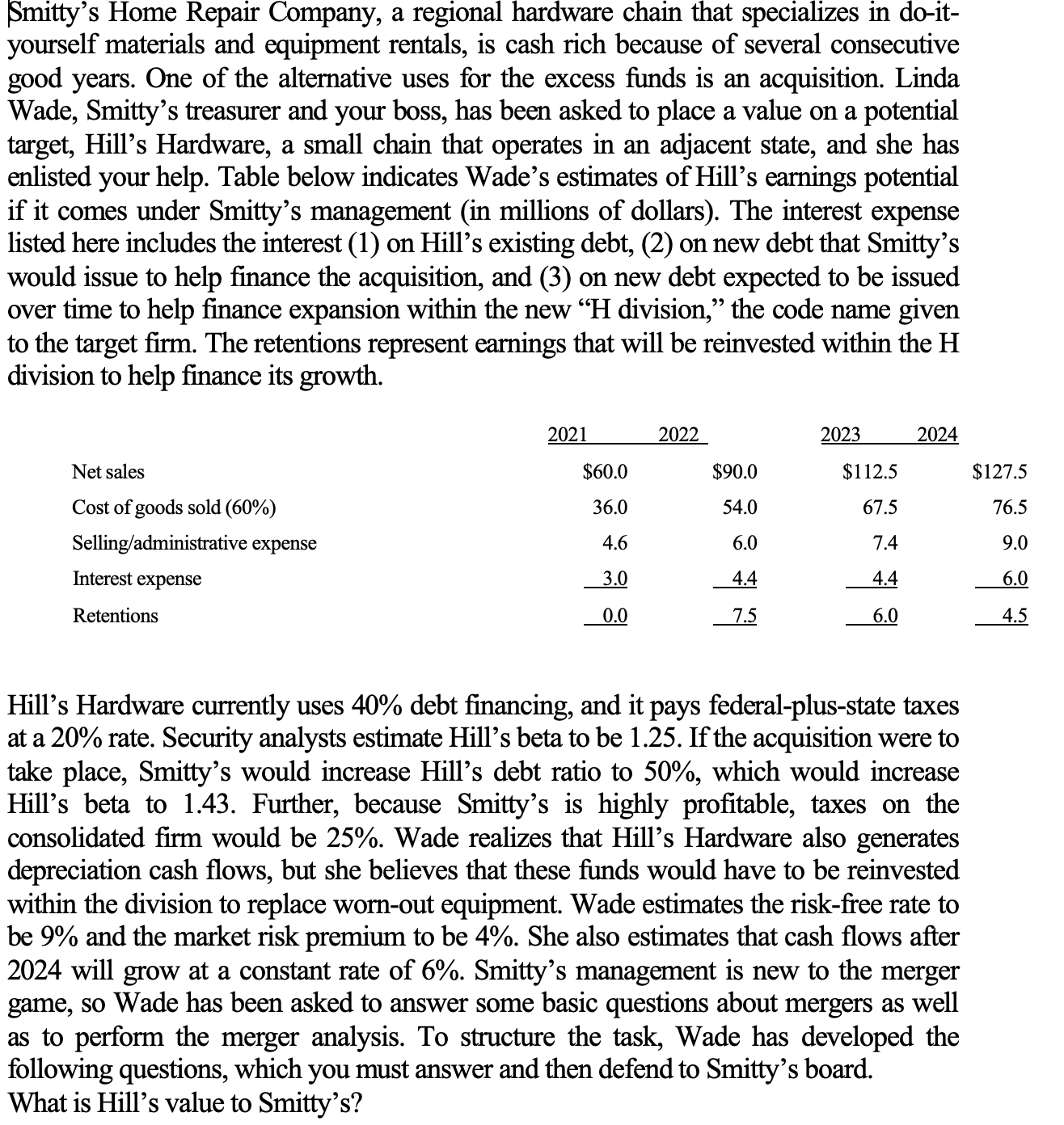

Smitty's Home Repair Company, a regional hardware chain that specializes in do-ityourself materials and equipment rentals, is cash rich because of several consecutive good years. One of the alternative uses for the excess funds is an acquisition. Linda Wade, Smitty's treasurer and your boss, has been asked to place a value on a potential target, Hill's Hardware, a small chain that operates in an adjacent state, and she has enlisted your help. Table below indicates Wade's estimates of Hill's earnings potential if it comes under Smitty's management (in millions of dollars). The interest expense listed here includes the interest (1) on Hill's existing debt, (2) on new debt that Smitty's would issue to help finance the acquisition, and (3) on new debt expected to be issued over time to help finance expansion within the new "H division," the code name given to the target firm. The retentions represent earnings that will be reinvested within the H division to help finance its growth. Net sales Cost of goods sold (60\%) Selling/administrative expense Interest expense Retentions Hill's Hardware currently uses 40% debt financing, and it pays federal-plus-state taxes at a 20% rate. Security analysts estimate Hill's beta to be 1.25 . If the acquisition were to take place, Smitty's would increase Hill's debt ratio to 50%, which would increase Hill's beta to 1.43. Further, because Smitty's is highly profitable, taxes on the consolidated firm would be 25%. Wade realizes that Hill's Hardware also generates depreciation cash flows, but she believes that these funds would have to be reinvested within the division to replace worn-out equipment. Wade estimates the risk-free rate to be 9% and the market risk premium to be 4%. She also estimates that cash flows after 2024 will grow at a constant rate of 6%. Smitty's management is new to the merger game, so Wade has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Wade has developed the following questions, which you must answer and then defend to Smitty's board. What is Hill's value to Smitty's

Smitty's Home Repair Company, a regional hardware chain that specializes in do-ityourself materials and equipment rentals, is cash rich because of several consecutive good years. One of the alternative uses for the excess funds is an acquisition. Linda Wade, Smitty's treasurer and your boss, has been asked to place a value on a potential target, Hill's Hardware, a small chain that operates in an adjacent state, and she has enlisted your help. Table below indicates Wade's estimates of Hill's earnings potential if it comes under Smitty's management (in millions of dollars). The interest expense listed here includes the interest (1) on Hill's existing debt, (2) on new debt that Smitty's would issue to help finance the acquisition, and (3) on new debt expected to be issued over time to help finance expansion within the new "H division," the code name given to the target firm. The retentions represent earnings that will be reinvested within the H division to help finance its growth. Net sales Cost of goods sold (60\%) Selling/administrative expense Interest expense Retentions Hill's Hardware currently uses 40% debt financing, and it pays federal-plus-state taxes at a 20% rate. Security analysts estimate Hill's beta to be 1.25 . If the acquisition were to take place, Smitty's would increase Hill's debt ratio to 50%, which would increase Hill's beta to 1.43. Further, because Smitty's is highly profitable, taxes on the consolidated firm would be 25%. Wade realizes that Hill's Hardware also generates depreciation cash flows, but she believes that these funds would have to be reinvested within the division to replace worn-out equipment. Wade estimates the risk-free rate to be 9% and the market risk premium to be 4%. She also estimates that cash flows after 2024 will grow at a constant rate of 6%. Smitty's management is new to the merger game, so Wade has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Wade has developed the following questions, which you must answer and then defend to Smitty's board. What is Hill's value to Smitty's Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started