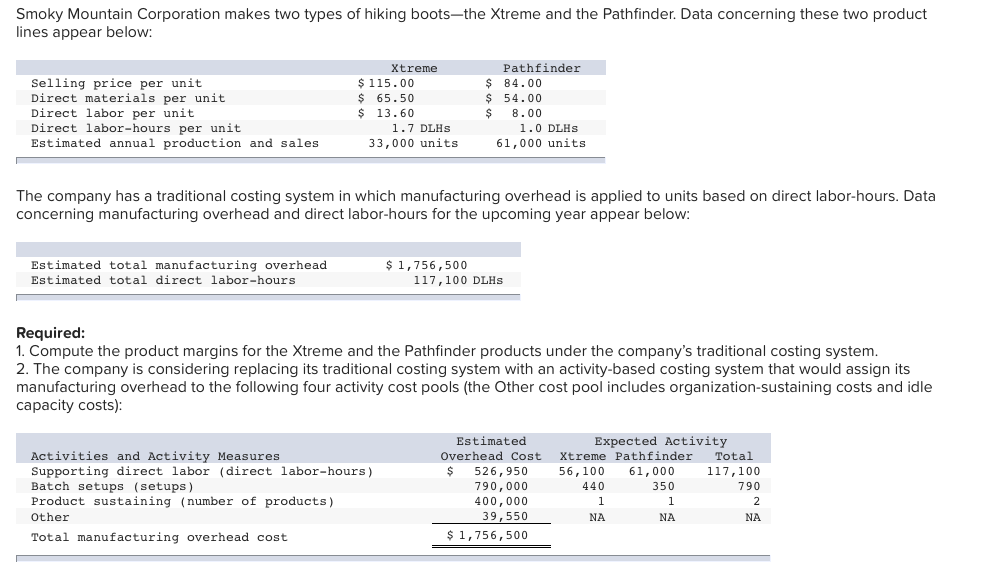

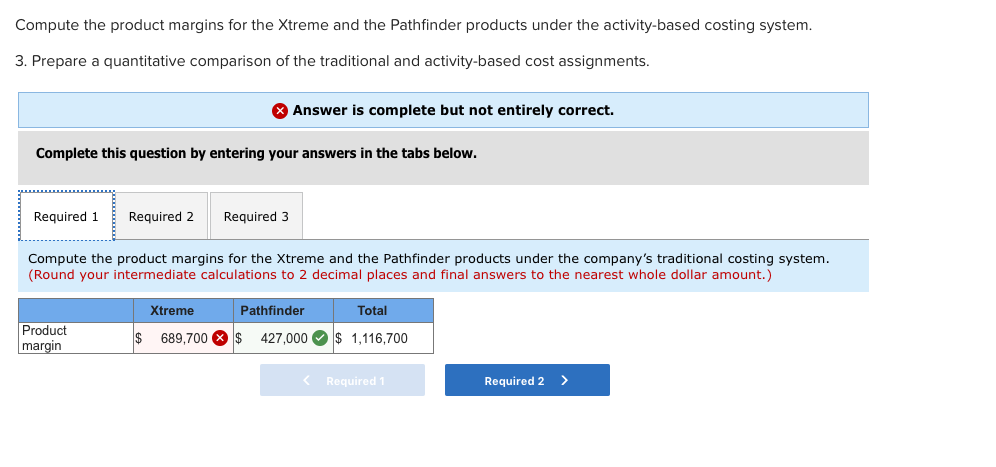

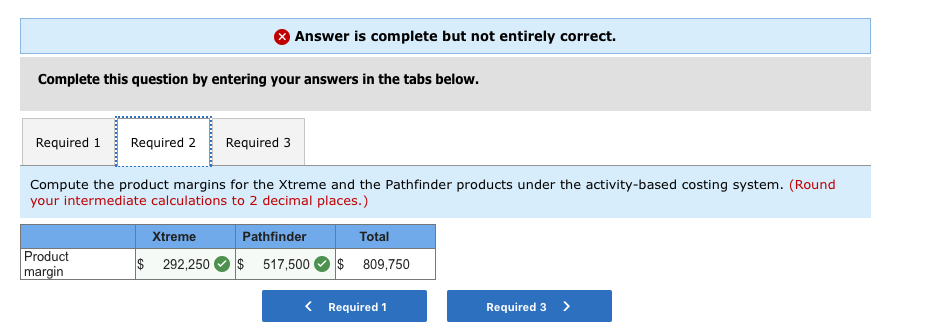

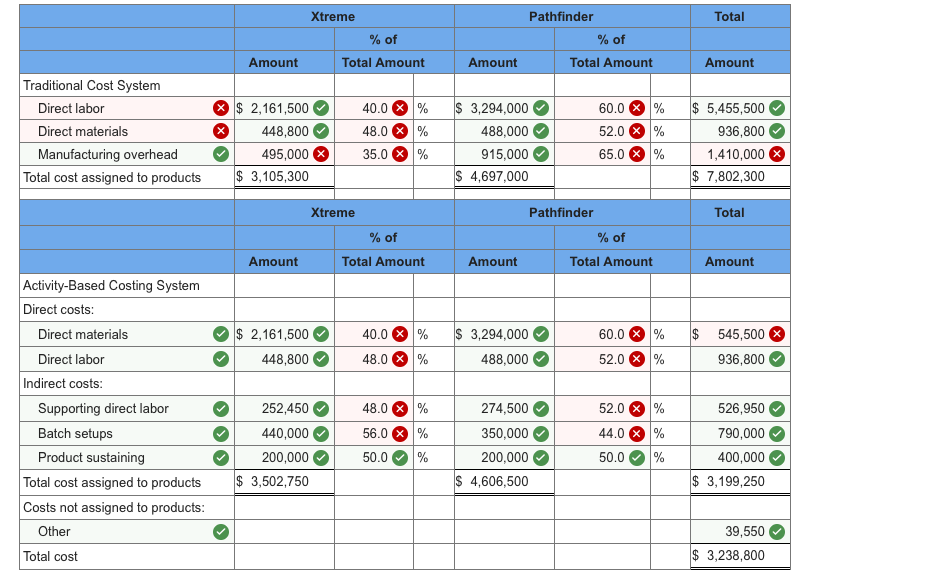

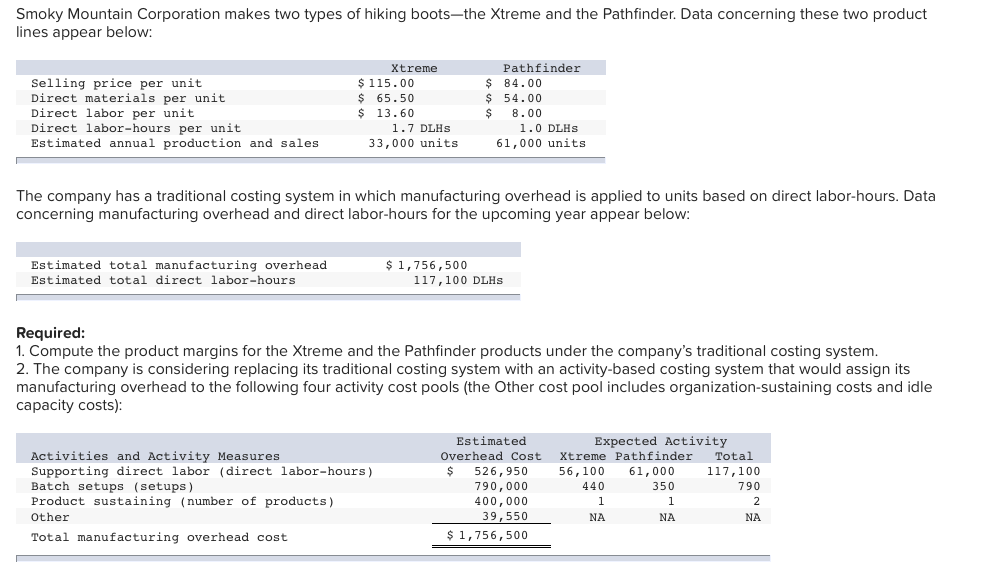

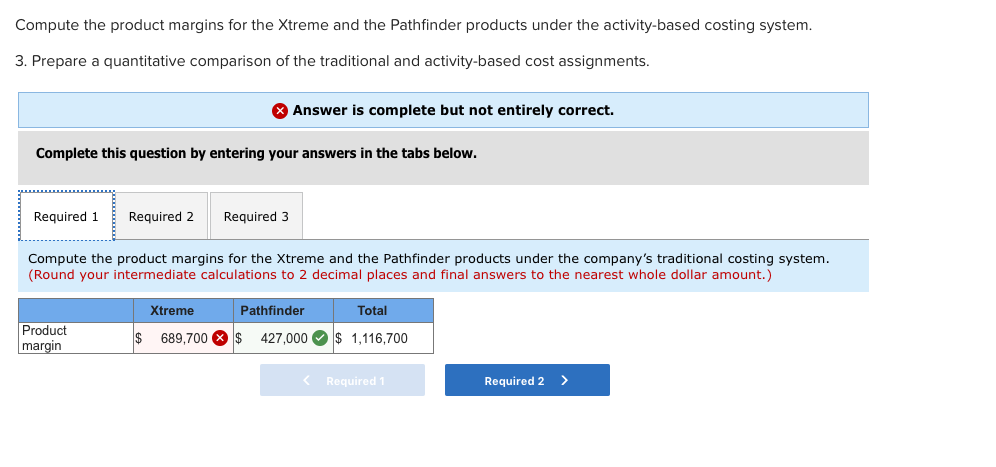

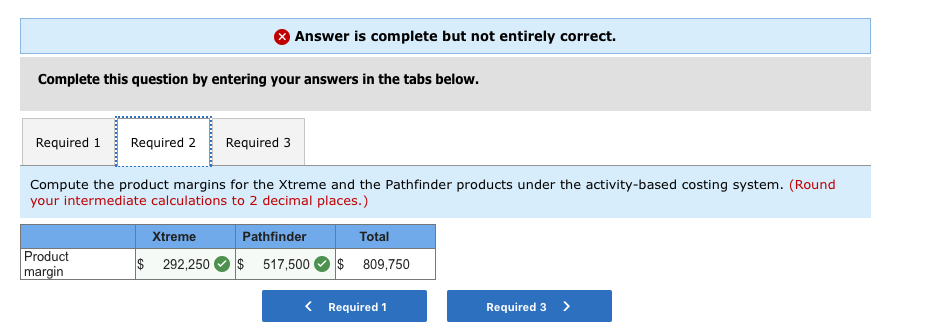

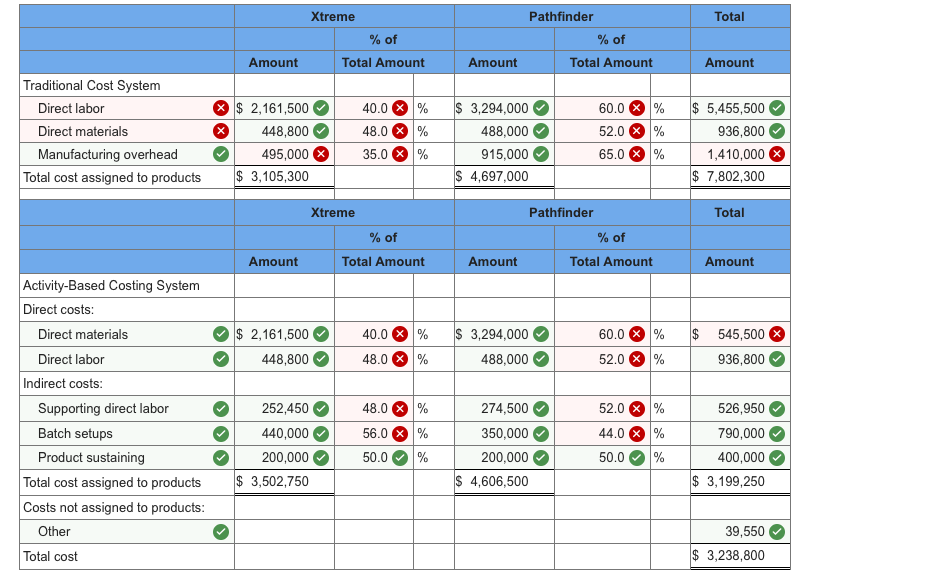

Smoky Mountain Corporation makes two types of hiking bootsthe Xtreme and the Pathfinder. Data concerning these two product lines appear below: Selling price per unit Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production and sales Xtreme $ 115.00 $ 65.50 $ 13.60 1.7 DLHS 33,000 units Pathfinder $ 84.00 $ 54.00 $ 8.00 1.0 DLHS 61,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $1,756,500 117,100 DLHS Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Activities and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) Other Total manufacturing overhead cost Estimated Expected Activity Overhead Cost Xtreme Pathfinder Total $ 526,95056,100 61,000 117,100 790,000 440 350 790 400,000 1 1 2 39,550 NA NA NA $1,756,500 Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Product margin Xtreme Pathfinder $ 689,700 $ 427,000 Total $ 1,116,700 Required 1 Required 2 > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system. (Round your intermediate calculations to 2 decimal places.) Product margin Xtreme $ 292,250 Pathfinder $ 517,500 Total $ 809,750 Total Xtreme % of Total Amount Pathfinder % of Total Amount Amount Amount Amount Traditional Cost System Direct labor Direct materials Manufacturing overhead Total cost assigned to products $ 2,161,500 X 448,800 495,000 $ 3,105,300 40.0 48.0 % 35.0 % % % $ 3,294,000 488,000 915,000 $ 4,697,000 60.0 52.0 % 65.0 % % % % $ 5,455,500 936,800 1,410,000 X $ 7,802,300 Xtreme Total % of Total Amount Pathfinder % of Total Amount Amount Amount Amount Activity-Based Costing System Direct costs: Direct materials $ $ 2,161,500 448,800 40.0 % 48.0 % % % 3,294,000 488,000 60.0 52.0 % % 545,500 936,800 Direct labor Indirect costs: Supporting direct labor Batch setups Product sustaining Total cost assigned to products Costs not assigned to products: Other Total cost 252,450 440,000 200,000 $ 3,502,750 48.0 56.0 50.0 % % % 274,500 350,000 200,000 $ 4,606,500 52.0 % 44.0 50.0 % % % 526,950 790,000 400,000 $ 3,199,250 39,550 $ 3,238,800