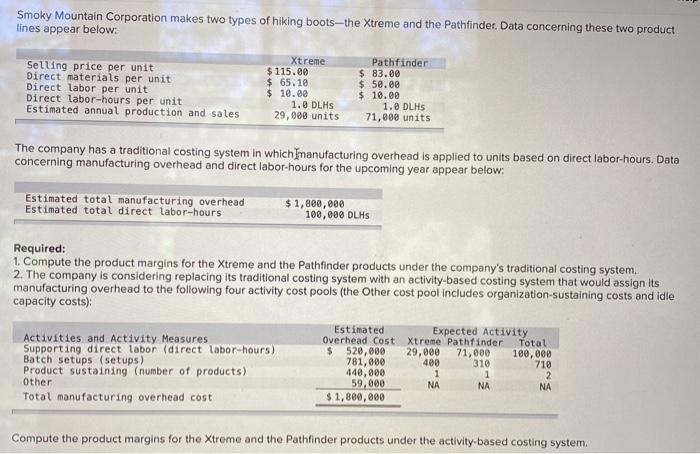

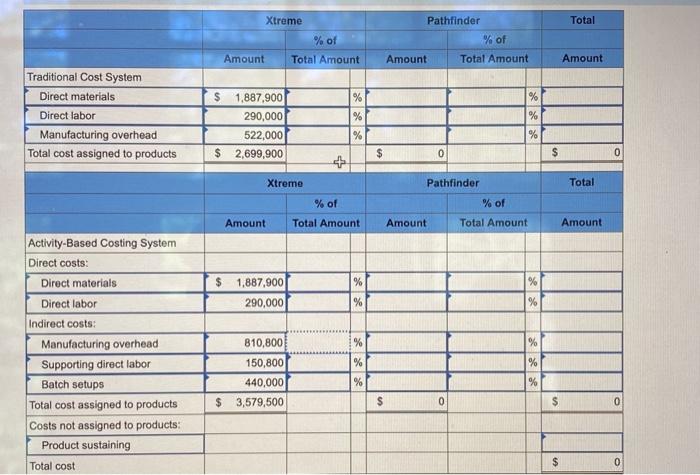

Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Selling price per unit Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production and sales Xtreme $115.00 $ 65.10 $ 10.00 1.0 DLHS 29,000 units Pathfinder $ 83.00 $ 50.00 $10.00 1.0 DLHS 71,000 units The company has a traditional costing system in which Inanufacturing overhead is applied to unlts based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $1,800,000 100,000 DLHS Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the other cost pool Includes organization-sustaining costs and idle capacity costs) Total Activities and Activity Measures Supporting direct labor (direct labor-hours) Product sustaining (number of products) Other Total manufacturing overhead cost Estimated Expected Activity Overhead Cost Xtreme Pathfinder $ 520,000 29,000 71,000 100,000 781,000 400 310 710 440,000 1 1 2 59,000 NA NA NA $ 1,800,000 Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system. Xtreme Pathfinder Total % of % of Total Amount Amount Total Amount Amount Amount % % Traditional Cost System Direct materials Direct labor Manufacturing overhead Total cost assigned to products $ 1,887,900 290,000 522,000 $ 2,699,900 % % % % $ 0 $ 0 Xtreme Pathfinder Total % of Total Amount % of Total Amount Amount Amount Amount % % 1,887,900 290,000 % % % % Activity-Based Costing System Direct costs: Direct materials Direct labor Indirect costs: Manufacturing overhead Supporting direct labor Batch setups Total cost assigned to products Costs not assigned to products: Product sustaining Total cost 810,800 150,800 440,000 $ 3,579,500 % % % % $ 0 $ 0 $ 0