Answered step by step

Verified Expert Solution

Question

1 Approved Answer

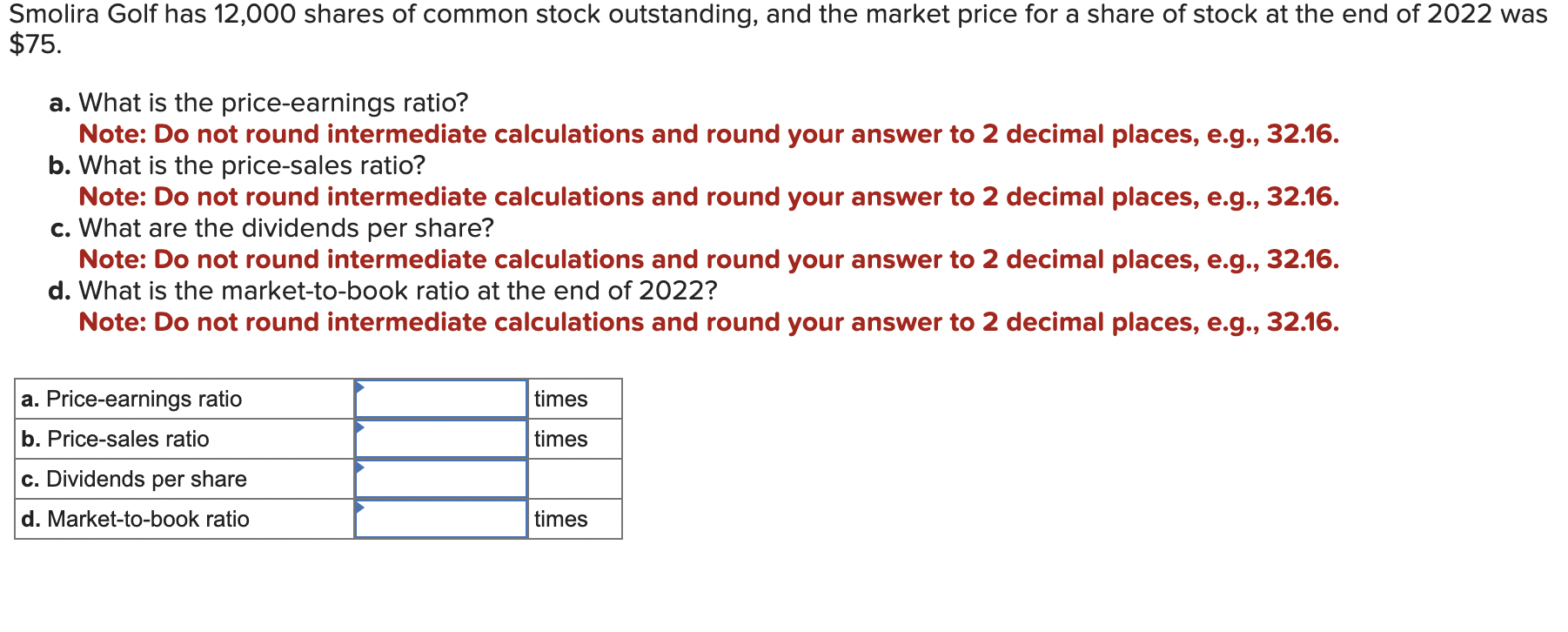

SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 Assets 2021 2022 Liabilities and Owners Equity 2021 2022 Current assets Current liabilities

| SMOLIRA GOLF, INCORPORATED | |||||

|---|---|---|---|---|---|

| Balance Sheets as of December 31, 2021 and 2022 | |||||

| Assets | 2021 | 2022 | Liabilities and Owners Equity | 2021 | 2022 |

| Current assets | Current liabilities | ||||

| Cash | $ 3,251 | $ 3,407 | Accounts payable | $2,143 | $ 2,580 |

| Accounts receivable | 4,777 | 5,801 | Notes payable | 1,740 | 2,096 |

| Inventory | 12,438 | 13,802 | Other | 88 | 105 |

| Total | $ 20,466 | $ 23,010 | Total | $ 3,971 | $ 4,781 |

| Long-term debt | $ 13,600 | $ 16,360 | |||

| Owners equity | |||||

| Common stock and paid-in surplus | $ 37,000 | $ 37,000 | |||

| Fixed assets | Accumulated retained earnings | 15,644 | 38,966 | ||

| Net plant and equipment | $ 49,749 | $ 74,097 | Total | $ 52,644 | $ 75,966 |

| Total assets | $ 70,215 | $ 97,107 | Total liabilities and owners equity | $ 70,215 | $ 97,107 |

| SMOLIRA GOLF, INCORPORATED | |

|---|---|

| 2022 Income Statement | |

| Sales | $ 186,970 |

| Cost of goods sold | 126,003 |

| Depreciation | 5,353 |

| EBIT | $ 55,614 |

| Interest paid | 1,450 |

| Taxable income | $ 54,164 |

| Taxes | 18,957 |

| Net income | $ 35,207 |

| Dividends | $ 11,885 |

| Retained earnings | 23,322 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started