Question

SMU Corp recently became public. Since SMU has only been a public company for a short while, you do not have an accurate assessment

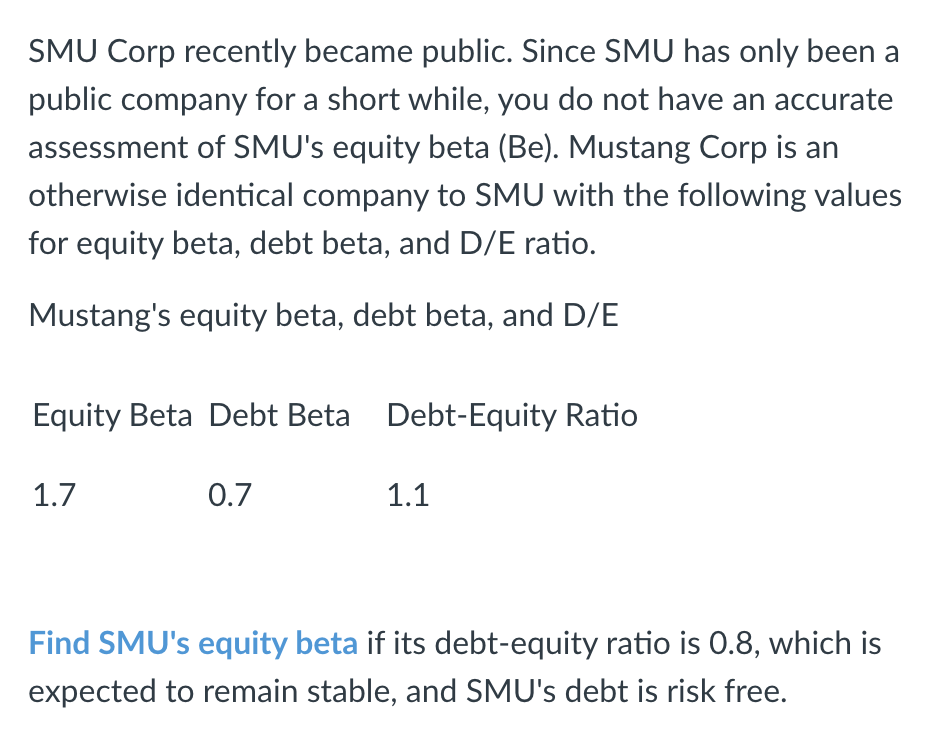

SMU Corp recently became public. Since SMU has only been a public company for a short while, you do not have an accurate assessment of SMU's equity beta (Be). Mustang Corp is an otherwise identical company to SMU with the following values for equity beta, debt beta, and D/E ratio. Mustang's equity beta, debt beta, and D/E Equity Beta Debt Beta Debt-Equity Ratio 1.7 0.7 1.1 Find SMU's equity beta if its debt-equity ratio is 0.8, which is expected to remain stable, and SMU's debt is risk free.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Finding SMUs Equity Beta Be We can estimate SMUs equity beta Be using the inf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Jonathan Berk and Peter DeMarzo

3rd edition

978-0132992473, 132992477, 978-0133097894

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App