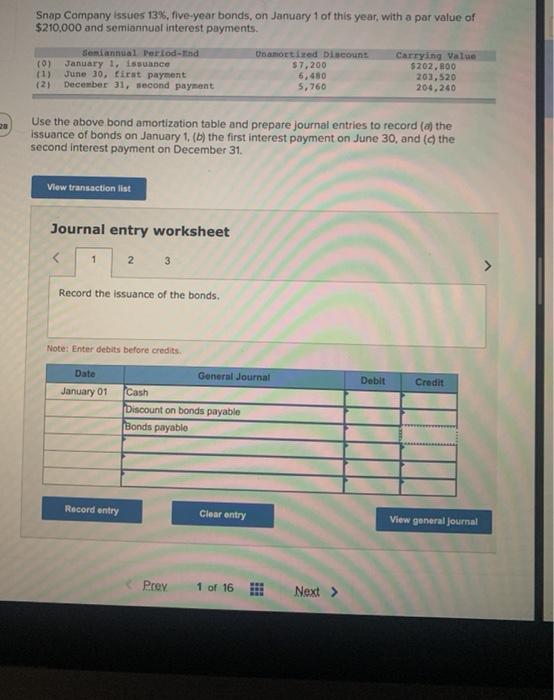

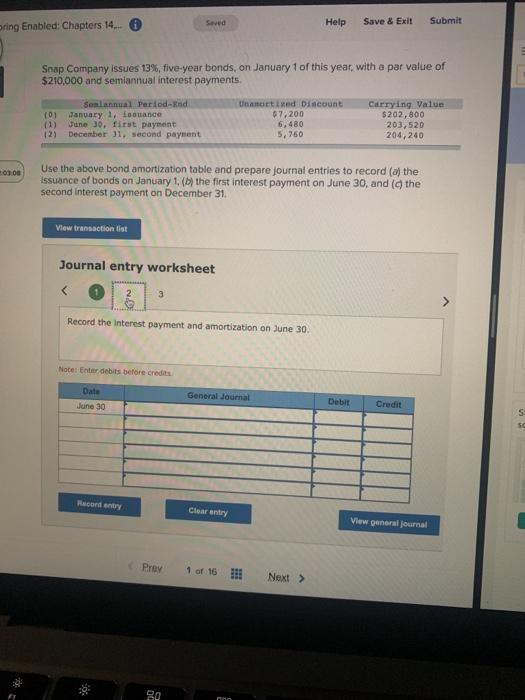

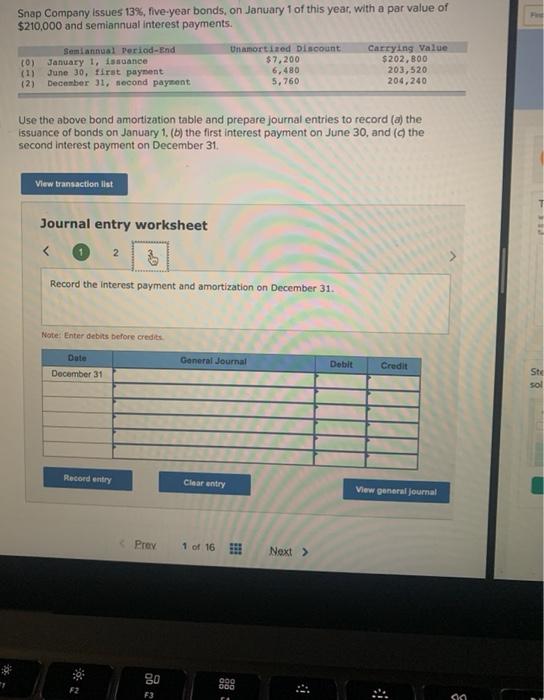

Snap Company issues 13%, five-year bonds, on January 1 of this year, with a par value of $210,000 and semiannual interest payments. Sentiannual Period-ind (0) January 1, Issuance June 30, first payment (2) December 31, second payment Un amortized Discount $7.200 6,480 5,760 Carrying Valu $202.800 203,520 204,240 28 Use the above bond amortization table and prepare journal entries to record (c) the issuance of bonds on January 1, (b) the first interest payment on June 30, and (the second interest payment on December 31. View transaction list Journal entry worksheet 1 2 3 Record the issuance of the bonds. Note: Enter debits before credits Date General Journal Debit Credit January 01 Cash Discount on bonds payable Bonds payable Record entry Clear entry View general journal Prey 1 of 16 !!! Next Help Save & Exit Submit ring Enabled: Chapters 14... Snap Company issues 13%, five-year bonds, on January 1 of this year, with a par value of $210,000 and semiannual interest payments. Semlangal Period-End 10 January 1, Louance (1) June 30, first payment 12) December 31, second payment tinantised Discount 07,200 6,480 5,760 Carrying Value $202,800 203,520 204,240 Use the above bond amortization table and prepare journal entries to record (a) the issuance of bonds on January 1, () the first interest payment on June 30, and (the second interest payment on December 31 View transaction tist Journal entry worksheet 3 Record the interest payment and amortization on June 30, Note: Enter debits before credits Date June 30 General Journal Debit Credit S Racord entry Clear entry View general journal Prey 1 of 16 i Next > 80 Snap Company issues 13%, five-year bonds, on January 1 of this year, with a par value of $210,000 and semiannual interest payments. Semiannual Period-End (0) January 1, Issuance (1) June 30, first payment 12) December 31, second payment Un amortized Discount $7,200 6.480 5,760 Carrying Value $ 202,800 203, 520 204,240 Use the above bond amortization table and prepare journal entries to record (a) the issuance of bonds on January 1. (b) the first interest payment on June 30, and (the second interest payment on December 31. View transaction list Journal entry worksheet 2 Record the interest payment and amortization on December 31. Note: Enter debits before credits General Journal Date December 31 Debit Credit St sol Record entry Clear entry View general Journal Prev 1 of 16 Next > 80 000 F3 so