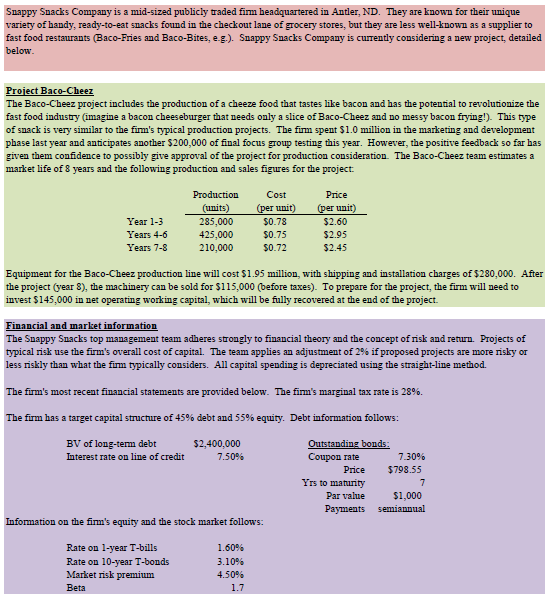

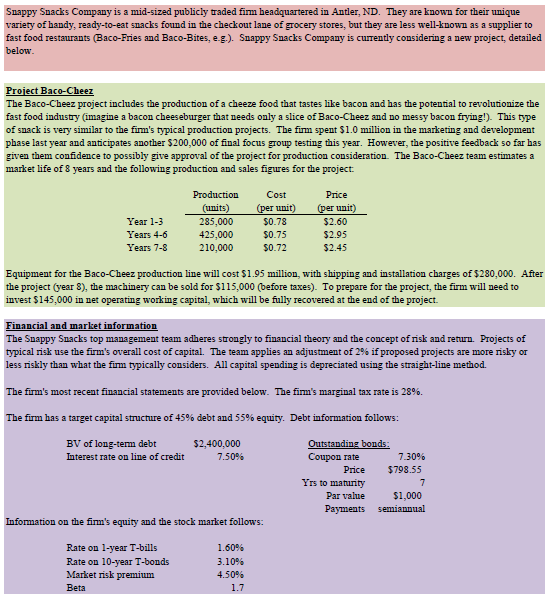

Snappy Snacks Company is a mid-sized publicly traded fimn headquartered in Antler, ND. They are known for their unique variety of handy, ready-to-eat snacks found in the checkout lane of grocery stores, but they are less well-known as a supplier to fast food restaurants (Baco-Fries and Baco-Bites, e.g.). Snappy Snacks Company is currently considering a new project, detailed below. Project Baco-Cheez The Baco-Cheez project includes the production of a cheeze food that tastes like bacon and has the potential to revolutionize the fast food industry (imagine a bacon cheeseburger that needs only a slice of Baco-Cheez and no messy bacon frying!). This type of snack is very similar to the firn's typical production projects. The firm spent $1.0 million in the marketing and development phase last year and anticipates another $200,000 of final focus group testing this year. However, the positive feedback so far has given them confidence to possibly give approval of the project for production consideration. The Baco-Cheez team estimates a market life of 8 years and the following production and sales figures for the project: Equipment for the Baco-Cheez production line will cost $1.95 million, with shipping and installation charges of $280,000. After the project (year 8), the machinery can be sold for $115,000 (before taxes). To prepare for the project, the firm will need to invest $145,000 in net operating working capital, which will be fully recovered at the end of the project. Financial and market information The Snappy Snacks top management team adheres strongly to financial theory and the concept of risk and return. Projects of typical risk use the firm's overall cost of capital. The team applies an adjustment of 2% if proposed projects are more risky or less riskly than what the firm typically considers. All capital spending is depreciated using the straight-line method. The firm's most recent financial statements are provided below. The fimn's marginal tax rate is 28%. The firm has a target capital structure of 45% debt and 55% equity. Debt information follows: Submit a HAND-WRITTEN solution for this problem. Be sure to provide ALL work or no partical credit will be awarded. Answer the following questions: 1) Estimate the company's cost of capital. 2) Find the project's net present value. 3) Find the project's internal rate of return. 4) State whether the project is financially feasible and your reason(5) why. You will work on this problem on your own, without help from colleagues, real or digital. Be sure that your name is on your paper submission The solution to this problem must be submitted by 2:00 pm, Friday, May 5. All late submissions will be ignored (i.e., not reviewed). This is an OPTIONAL assigument that may provide additional points to be used when determining your final grade for the course. The professor will only answer questions that clarify the assignment and its information. Snappy Snacks Company is a mid-sized publicly traded fimn headquartered in Antler, ND. They are known for their unique variety of handy, ready-to-eat snacks found in the checkout lane of grocery stores, but they are less well-known as a supplier to fast food restaurants (Baco-Fries and Baco-Bites, e.g.). Snappy Snacks Company is currently considering a new project, detailed below. Project Baco-Cheez The Baco-Cheez project includes the production of a cheeze food that tastes like bacon and has the potential to revolutionize the fast food industry (imagine a bacon cheeseburger that needs only a slice of Baco-Cheez and no messy bacon frying!). This type of snack is very similar to the firn's typical production projects. The firm spent $1.0 million in the marketing and development phase last year and anticipates another $200,000 of final focus group testing this year. However, the positive feedback so far has given them confidence to possibly give approval of the project for production consideration. The Baco-Cheez team estimates a market life of 8 years and the following production and sales figures for the project: Equipment for the Baco-Cheez production line will cost $1.95 million, with shipping and installation charges of $280,000. After the project (year 8), the machinery can be sold for $115,000 (before taxes). To prepare for the project, the firm will need to invest $145,000 in net operating working capital, which will be fully recovered at the end of the project. Financial and market information The Snappy Snacks top management team adheres strongly to financial theory and the concept of risk and return. Projects of typical risk use the firm's overall cost of capital. The team applies an adjustment of 2% if proposed projects are more risky or less riskly than what the firm typically considers. All capital spending is depreciated using the straight-line method. The firm's most recent financial statements are provided below. The fimn's marginal tax rate is 28%. The firm has a target capital structure of 45% debt and 55% equity. Debt information follows: Submit a HAND-WRITTEN solution for this problem. Be sure to provide ALL work or no partical credit will be awarded. Answer the following questions: 1) Estimate the company's cost of capital. 2) Find the project's net present value. 3) Find the project's internal rate of return. 4) State whether the project is financially feasible and your reason(5) why. You will work on this problem on your own, without help from colleagues, real or digital. Be sure that your name is on your paper submission The solution to this problem must be submitted by 2:00 pm, Friday, May 5. All late submissions will be ignored (i.e., not reviewed). This is an OPTIONAL assigument that may provide additional points to be used when determining your final grade for the course. The professor will only answer questions that clarify the assignment and its information