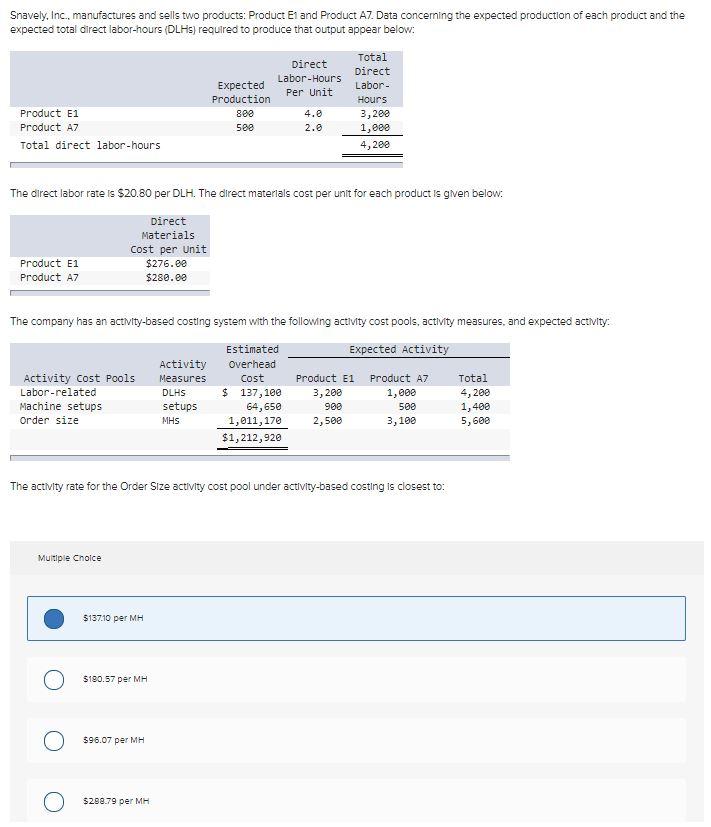

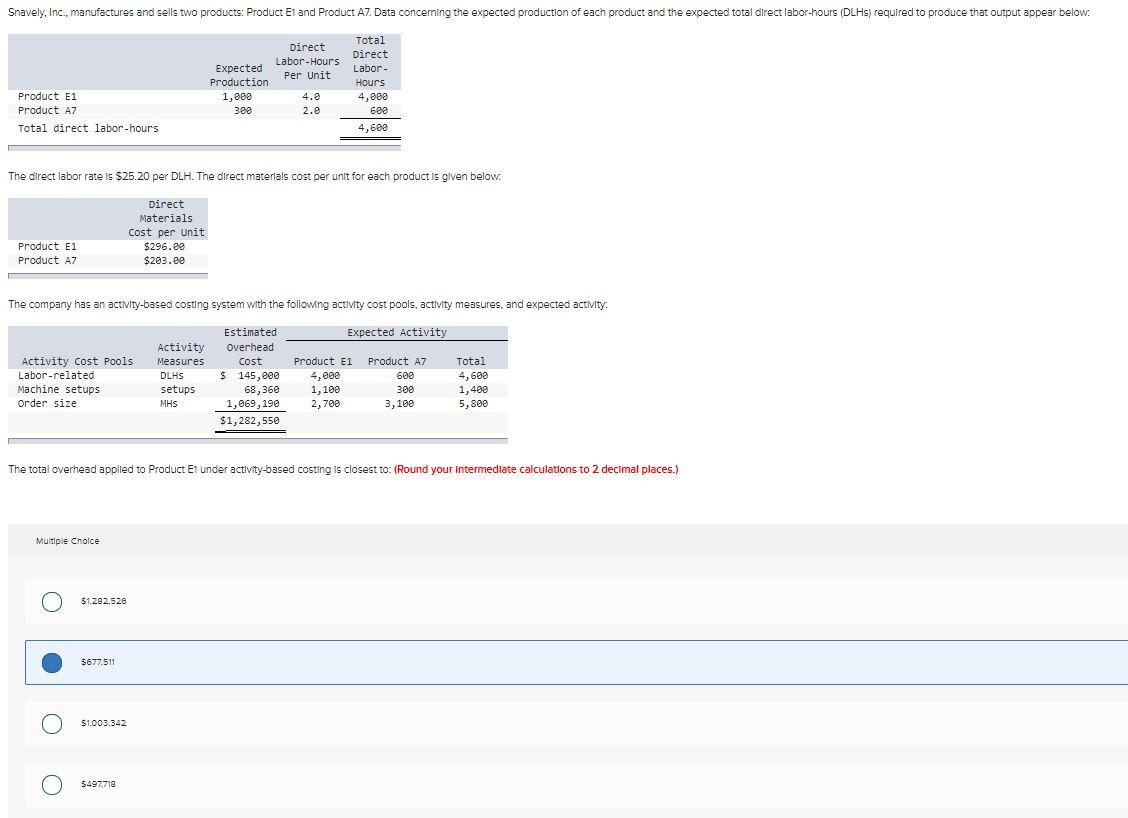

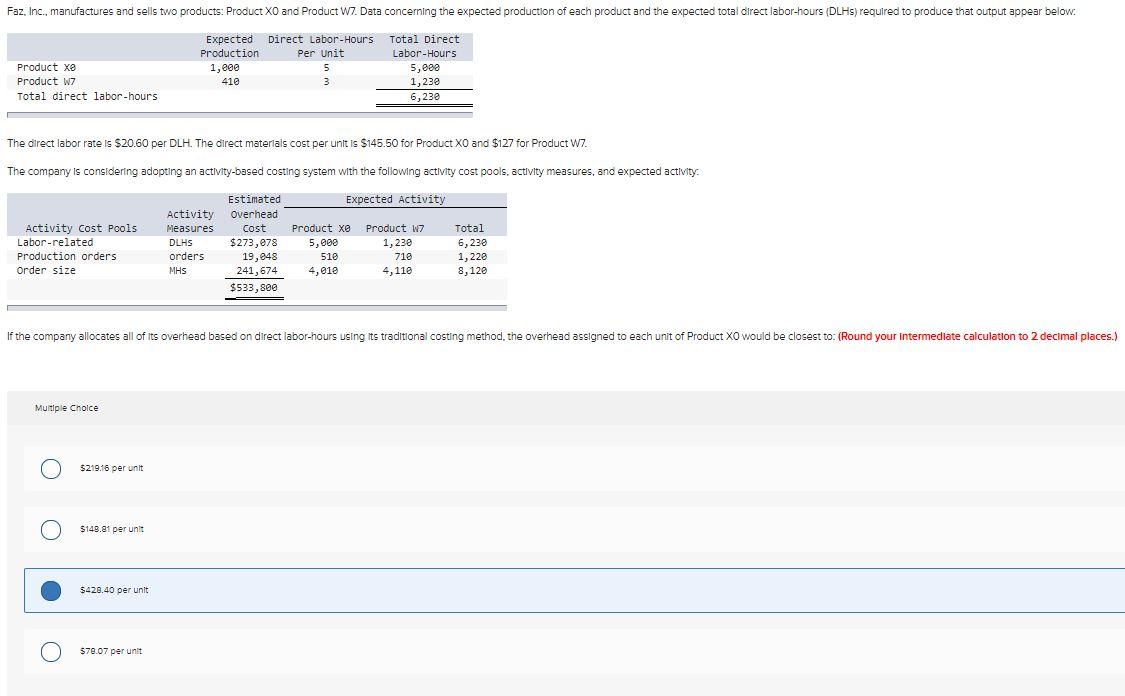

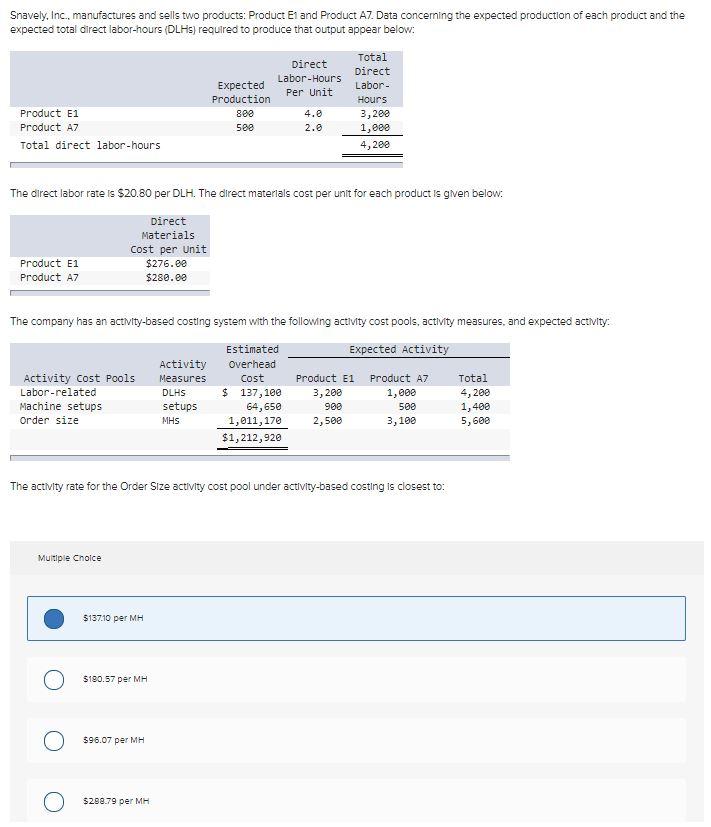

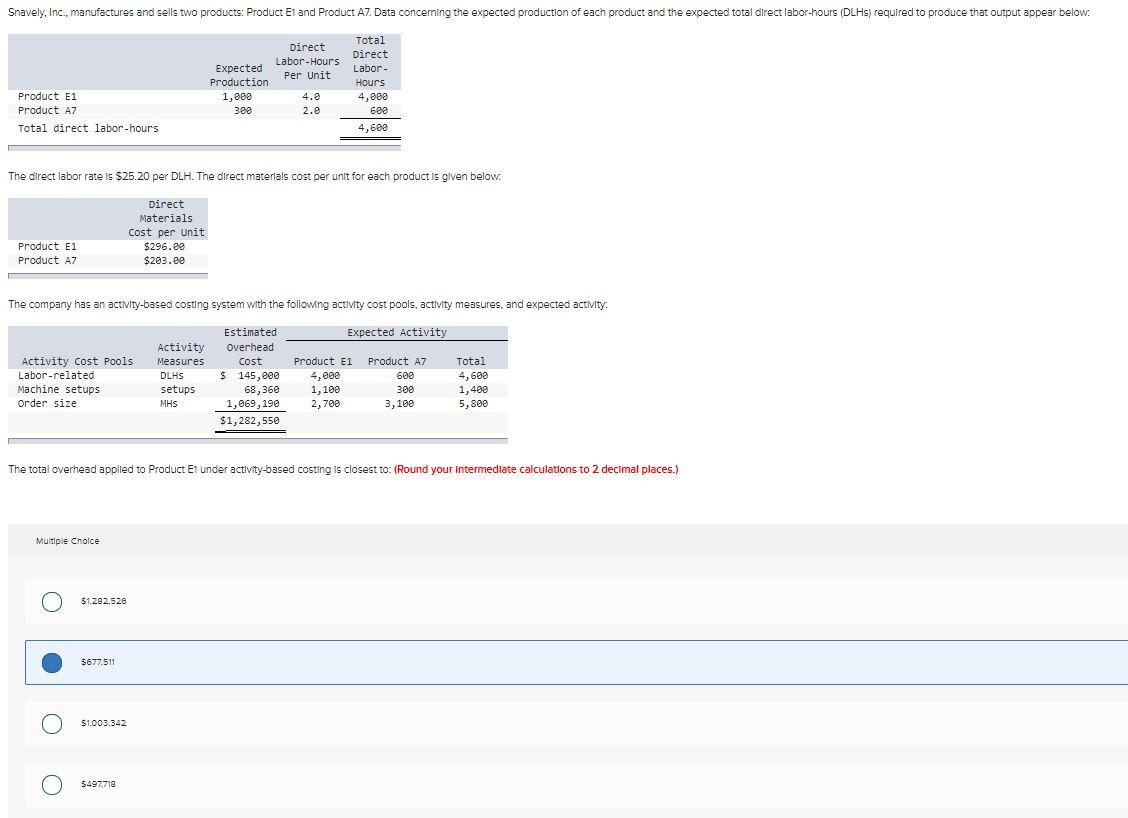

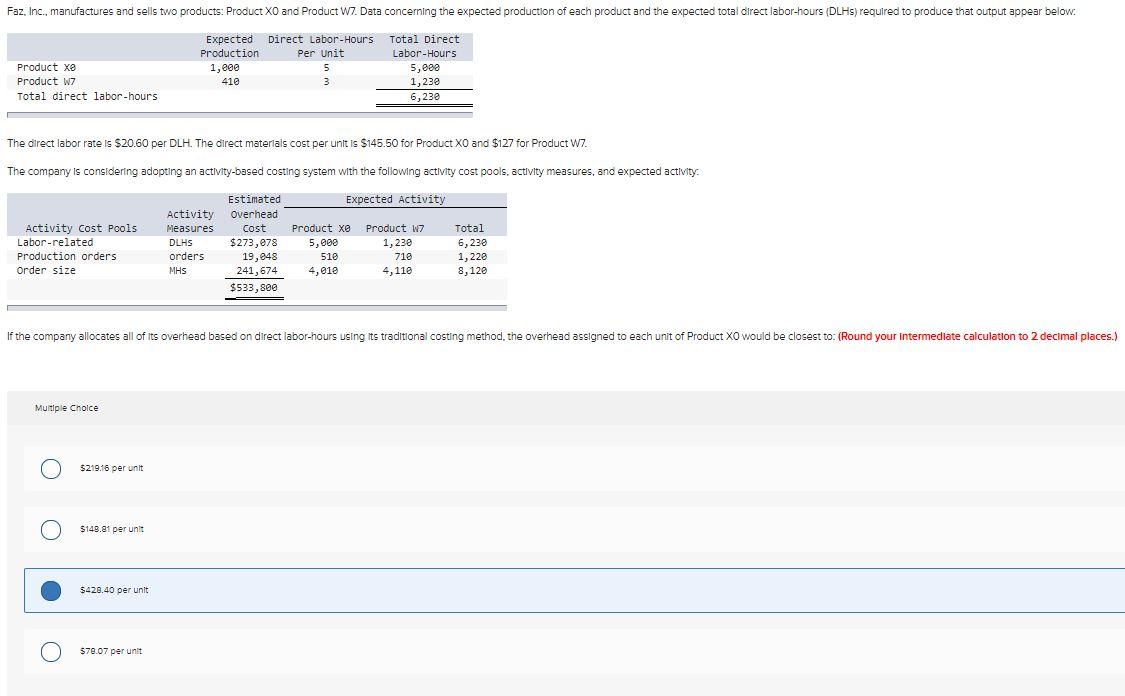

Snavely, Inc., manufactures and sells two products: Product Ei and Product A7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Direct Labor-Hours Per Unit Expected Production 882 580 Total Direct Labor- Hours 3,200 1,082 4,200 Product E1 Product A7 Total direct labor-hours 4.0 2.0 The direct labor rate is $20.80 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $276.00 $280.00 Product E1 Product A7 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Overhead Activity Cost Pools Measures Cost Product E1 Product A7 Total Labor-related DLHS $ 137,100 3,200 1,000 4,200 Machine setups setups 64,650 900 500 1,400 Order size MHS 1,011,170 2,588 3,100 5,600 $1,212,920 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: Multiple Choice S137.10 per MH $190.57 per MH O $96.07 per MH $298.79 per MH Snavely, Inc., manufactures and sells two products: Product Ei and Product A7. Data conceming the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Direct Labor-Hours Per Unit Total Direct Labor Hours 4, eee 6ee 4,688 Expected Production 1,000 300 Product E1 Product A7 Total direct labor-hours 4.2 2.0 The alrect labor rate is $25.20 per DLH. The direct materials cost per unit for each product is given below. Direct Materials Cost per Unit $296.ee $203.00 Product E1 Product A7 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Expected Activity Activity cost Pools Labor-related Machine setups Order size Activity Measures DLHS setups MHS Estimated Overhead Cost $ 145,000 68,360 1,069, 190 $1,282,550 Product E1 Product A7 4,000 600 1,100 300 2,700 3,100 Total 4,600 1,488 5,800 The total overhead appiled to Product Ei under activity-based costing is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $1.292,526 O $677.511 O $1.003,342 O S497.718 Faz, Inc., manufactures and sells two products: Product XO and Product W7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Direct Labor-Hours Production Per Unit 1, eee 5 410 3 Product xa Product W7 Total direct labor-hours Total Direct Labor-Hours 5, eee 1,230 6,230 The direct labor rate is $20.60 per DLH. The direct materials cost per unit is $145.50 for Product XO and $127 for Product W7. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity Expected Activity Activity Cost Pools Labor-related Production orders Order size Activity Measures DLHS orders MHS Estimated Overhead Cost $273, 278 19,848 241,674 Product xo 5,000 510 4,010 Product W7 1,230 710 4,110 Total 6,230 1,220 8,120 $533,800 If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product XO would be closest to: (Round your intermediate calculation to 2 decimal places.) Multiple Choice $219.16 per unit O $149.81 per unit $420.40 per unit $78.07 per unit