Answered step by step

Verified Expert Solution

Question

1 Approved Answer

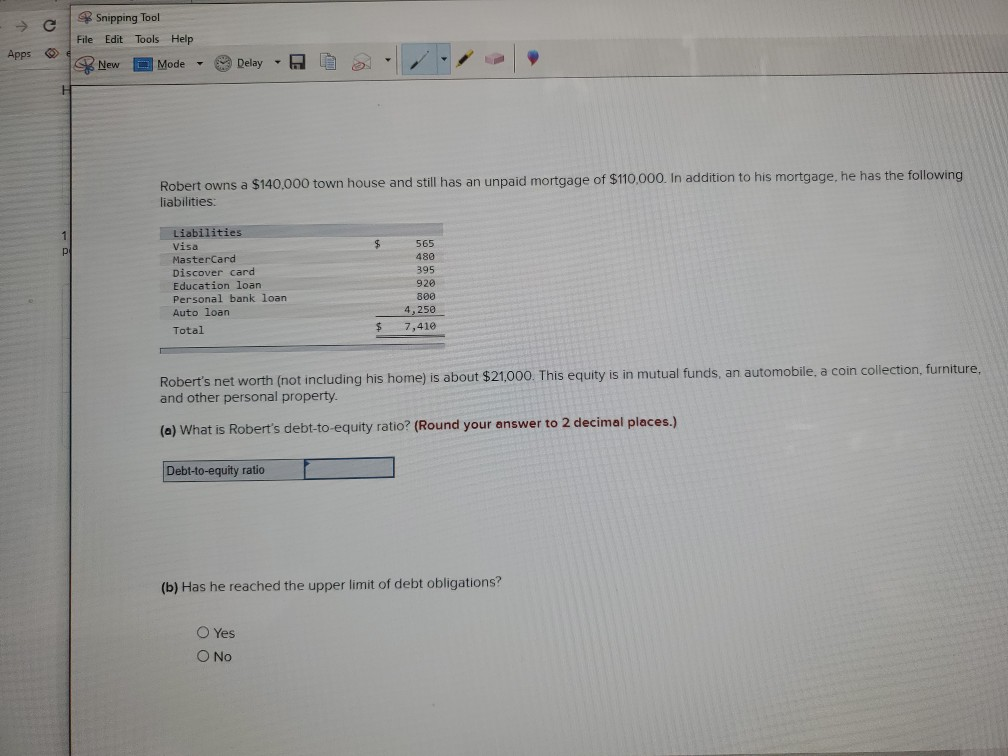

Snipping Tool File Edit Tools Help Apps New - Mode Delay Robert owns a $140,000 town house and still has an unpaid mortgage of $110,000.

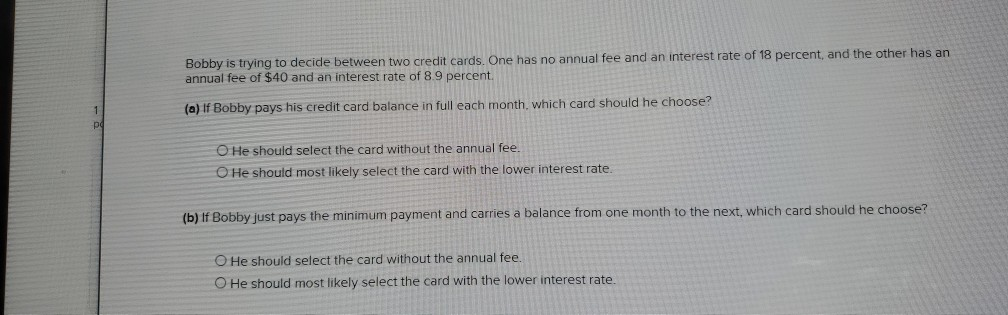

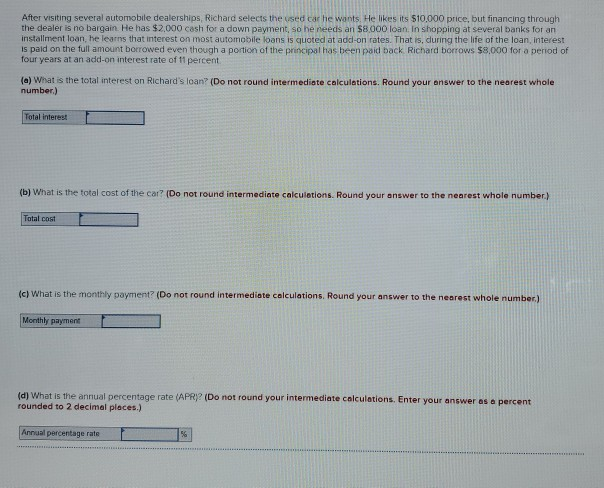

Snipping Tool File Edit Tools Help Apps New - Mode Delay Robert owns a $140,000 town house and still has an unpaid mortgage of $110,000. In addition to his mortgage, he has the following liabilities: Liabilities Visa MasterCard Discover card Education loan Personal bank loan Auto loan Total 565 480 395 920 800 4,250 7,410 $ Robert's net worth (not including his home) is about $21,000. This equity is in mutual funds, an automobile, a coin collection, furniture, and other personal property. (a) What is Robert's debt-to-equity ratio? (Round your answer to 2 decimal places.) Debt-to-equity ratio (b) Has he reached the upper limit of debt obligations? O Yes O No Bobby is trying to decide between two credit cards. One has no annual fee and an interest rate of 18 percent, and the other has an annual fee of $40 and an interest rate of 8.9 percent. (a) If Bobby pays his credit card balance in full each month, which card should he choose? O He should select the card without the annual fee. O He should most likely select the card with the lower interest rate. (b) If Bobby just pays the minimum payment and carries a balance from one month to the next, which card should he choose? O He should select the card without the annual fee. O He should most likely select the card with the lower interest rate. After visiting several automobile dealerships, Richard selects the used car he wants. He likes its $10,000 price, but financing through the dealer is no bargain. He has $2.000 cash for a down payment, so he needs an $8.000 loan. In shopping at several banks for an installment loan, he learns that interest on most automobile loans is quoted at add-on rates. That is, during the life of the loan interest is paid on the full amount borrowed even though a portion of the principal has been paid back Richard borrows $8,000 for a period of four years at an add-on interest rate of 11 percent (a) What is the total interest on Richard's loan? (Do not round intermediate calculations. Round your answer to the nearest whole number) Total Interest (b) What is the total cost of the car? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Total cost (c) What is the monthly payment? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Monthly payment (d) What is the annual percentage rate (APR)? (Do not round your intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Annual percentage rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started