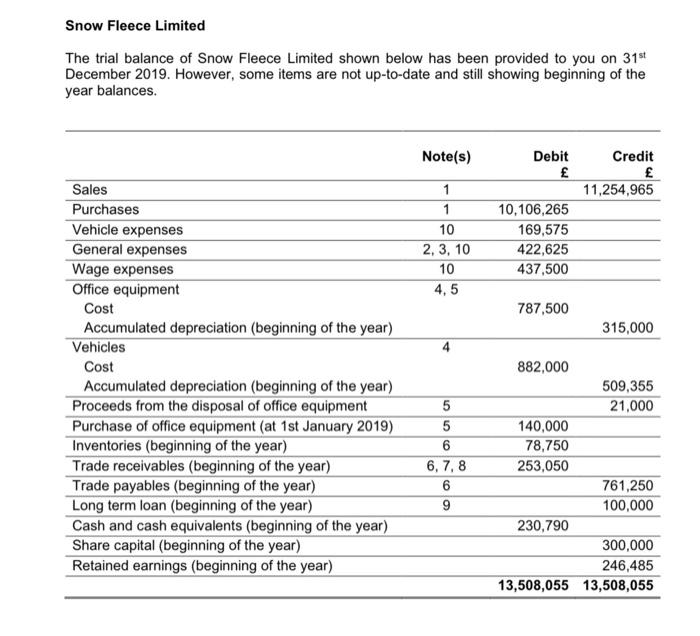

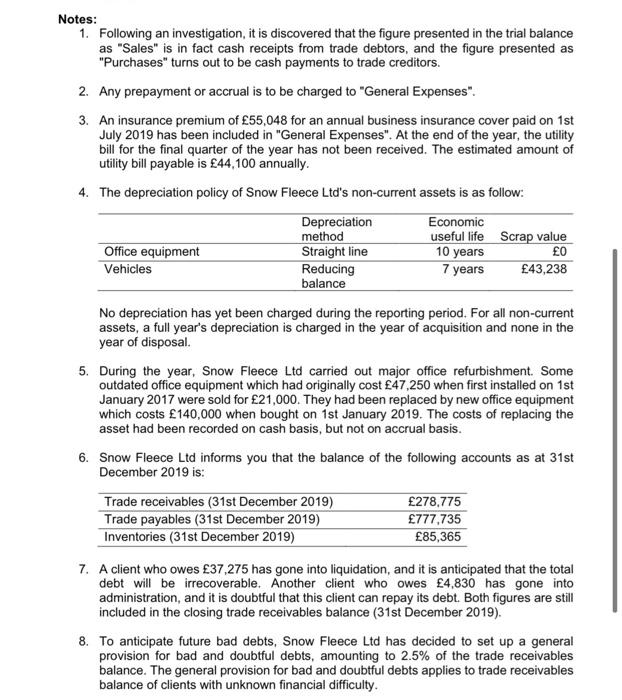

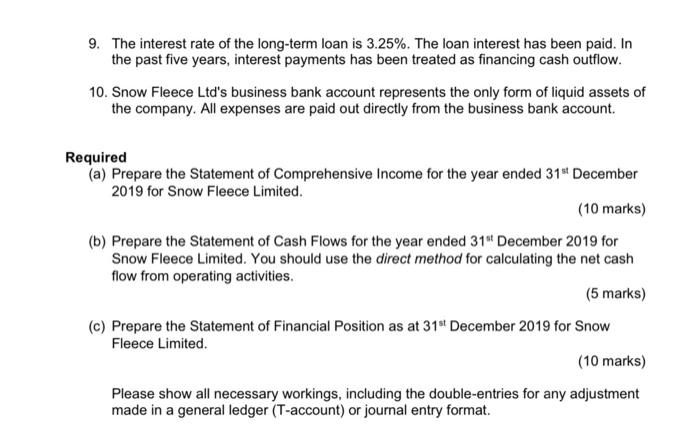

Snow Fleece Limited The trial balance of Snow Fleece Limited shown below has been provided to you on 31st December 2019. However, some items are not up-to-date and still showing beginning of the year balances. Note(s) Debit Credit 11.254.965 1 1 10 2, 3, 10 10 4,5 10,106,265 169,575 422,625 437,500 787,500 315,000 Sales Purchases Vehicle expenses General expenses Wage expenses Office equipment Cost Accumulated depreciation (beginning of the year) Vehicles Cost Accumulated depreciation (beginning of the year) Proceeds from the disposal of office equipment Purchase of office equipment (at 1st January 2019) Inventories (beginning of the year) Trade receivables (beginning of the year) Trade payables (beginning of the year) Long term loan (beginning of the year) Cash and cash equivalents (beginning of the year) Share capital (beginning of the year) Retained earnings (beginning of the year) 6, 7, 8 6 9 882,000 509,355 21,000 140,000 78,750 253,050 761,250 100,000 230,790 300,000 246,485 13,508,055 13,508,055 Notes: 1. Following an investigation, it is discovered that the figure presented in the trial balance as "Sales" is in fact cash receipts from trade debtors, and the figure presented as "Purchases" turns out to be cash payments to trade creditors. 2. Any prepayment or accrual is to be charged to "General Expenses". 3. An insurance premium of 55,048 for an annual business insurance cover paid on 1st July 2019 has been included in "General Expenses". At the end of the year, the utility bill for the final quarter of the year has not been received. The estimated amount of utility bill payable is 44,100 annually. 4. The depreciation policy of Snow Fleece Ltd's non-current assets is as follow: Depreciation Economic method useful life Scrap value Office equipment Straight line 10 years 0 Vehicles Reducing 7 years 43,238 balance No depreciation has yet been charged during the reporting period. For all non-current assets, a full year's depreciation is charged in the year of acquisition and none in the year of disposal. 5. During the year, Snow Fleece Ltd carried out major office refurbishment. Some outdated office equipment which had originally cost 47,250 when first installed on 1st January 2017 were sold for 21,000. They had been replaced by new office equipment which costs 140,000 when bought on 1st January 2019. The costs of replacing the asset had been recorded on cash basis, but not on accrual basis. 6. Snow Fleece Ltd informs you that the balance of the following accounts as at 31st December 2019 is: Trade receivables (31st December 2019) 278,775 Trade payables (31st December 2019) 777.735 Inventories (31st December 2019) 85,365 7. A client who owes 37,275 has gone into liquidation, and it is anticipated that the total debt will be irrecoverable. Another client who owes 4,830 has gone into administration, and it is doubtful that this client can repay its debt. Both figures are still included in the closing trade receivables balance (31st December 2019). 8. To anticipate future bad debts, Snow Fleece Ltd has decided to set up a general provision for bad and doubtful debts, amounting to 2.5% of the trade receivables balance. The general provision for bad and doubtful debts applies to trade receivables balance of clients with unknown financial difficulty. 9. The interest rate of the long-term loan is 3.25%. The loan interest has been paid. In the past five years, interest payments has been treated as financing cash outflow. 10. Snow Fleece Ltd's business bank account represents the only form of liquid assets of the company. All expenses are paid out directly from the business bank account. Required (a) Prepare the Statement of Comprehensive Income for the year ended 31" December 2019 for Snow Fleece Limited. (10 marks) (b) Prepare the Statement of Cash Flows for the year ended 31" December 2019 for Snow Fleece Limited. You should use the direct method for calculating the net cash flow from operating activities. (5 marks) (c) Prepare the Statement of Financial Position as at 31" December 2019 for Snow Fleece Limited. (10 marks) Please show all necessary workings, including the double-entries for any adjustment made in a general ledger (T-account) or journal entry format. Snow Fleece Limited The trial balance of Snow Fleece Limited shown below has been provided to you on 31st December 2019. However, some items are not up-to-date and still showing beginning of the year balances. Note(s) Debit Credit 11.254.965 1 1 10 2, 3, 10 10 4,5 10,106,265 169,575 422,625 437,500 787,500 315,000 Sales Purchases Vehicle expenses General expenses Wage expenses Office equipment Cost Accumulated depreciation (beginning of the year) Vehicles Cost Accumulated depreciation (beginning of the year) Proceeds from the disposal of office equipment Purchase of office equipment (at 1st January 2019) Inventories (beginning of the year) Trade receivables (beginning of the year) Trade payables (beginning of the year) Long term loan (beginning of the year) Cash and cash equivalents (beginning of the year) Share capital (beginning of the year) Retained earnings (beginning of the year) 6, 7, 8 6 9 882,000 509,355 21,000 140,000 78,750 253,050 761,250 100,000 230,790 300,000 246,485 13,508,055 13,508,055 Notes: 1. Following an investigation, it is discovered that the figure presented in the trial balance as "Sales" is in fact cash receipts from trade debtors, and the figure presented as "Purchases" turns out to be cash payments to trade creditors. 2. Any prepayment or accrual is to be charged to "General Expenses". 3. An insurance premium of 55,048 for an annual business insurance cover paid on 1st July 2019 has been included in "General Expenses". At the end of the year, the utility bill for the final quarter of the year has not been received. The estimated amount of utility bill payable is 44,100 annually. 4. The depreciation policy of Snow Fleece Ltd's non-current assets is as follow: Depreciation Economic method useful life Scrap value Office equipment Straight line 10 years 0 Vehicles Reducing 7 years 43,238 balance No depreciation has yet been charged during the reporting period. For all non-current assets, a full year's depreciation is charged in the year of acquisition and none in the year of disposal. 5. During the year, Snow Fleece Ltd carried out major office refurbishment. Some outdated office equipment which had originally cost 47,250 when first installed on 1st January 2017 were sold for 21,000. They had been replaced by new office equipment which costs 140,000 when bought on 1st January 2019. The costs of replacing the asset had been recorded on cash basis, but not on accrual basis. 6. Snow Fleece Ltd informs you that the balance of the following accounts as at 31st December 2019 is: Trade receivables (31st December 2019) 278,775 Trade payables (31st December 2019) 777.735 Inventories (31st December 2019) 85,365 7. A client who owes 37,275 has gone into liquidation, and it is anticipated that the total debt will be irrecoverable. Another client who owes 4,830 has gone into administration, and it is doubtful that this client can repay its debt. Both figures are still included in the closing trade receivables balance (31st December 2019). 8. To anticipate future bad debts, Snow Fleece Ltd has decided to set up a general provision for bad and doubtful debts, amounting to 2.5% of the trade receivables balance. The general provision for bad and doubtful debts applies to trade receivables balance of clients with unknown financial difficulty. 9. The interest rate of the long-term loan is 3.25%. The loan interest has been paid. In the past five years, interest payments has been treated as financing cash outflow. 10. Snow Fleece Ltd's business bank account represents the only form of liquid assets of the company. All expenses are paid out directly from the business bank account. Required (a) Prepare the Statement of Comprehensive Income for the year ended 31" December 2019 for Snow Fleece Limited. (10 marks) (b) Prepare the Statement of Cash Flows for the year ended 31" December 2019 for Snow Fleece Limited. You should use the direct method for calculating the net cash flow from operating activities. (5 marks) (c) Prepare the Statement of Financial Position as at 31" December 2019 for Snow Fleece Limited. (10 marks) Please show all necessary workings, including the double-entries for any adjustment made in a general ledger (T-account) or journal entry format