Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Snow White Sdn Bhd (SWSB) manufactures and sells the product XYZ. Budgeted units to be sold for each quarter of the year 2021 are

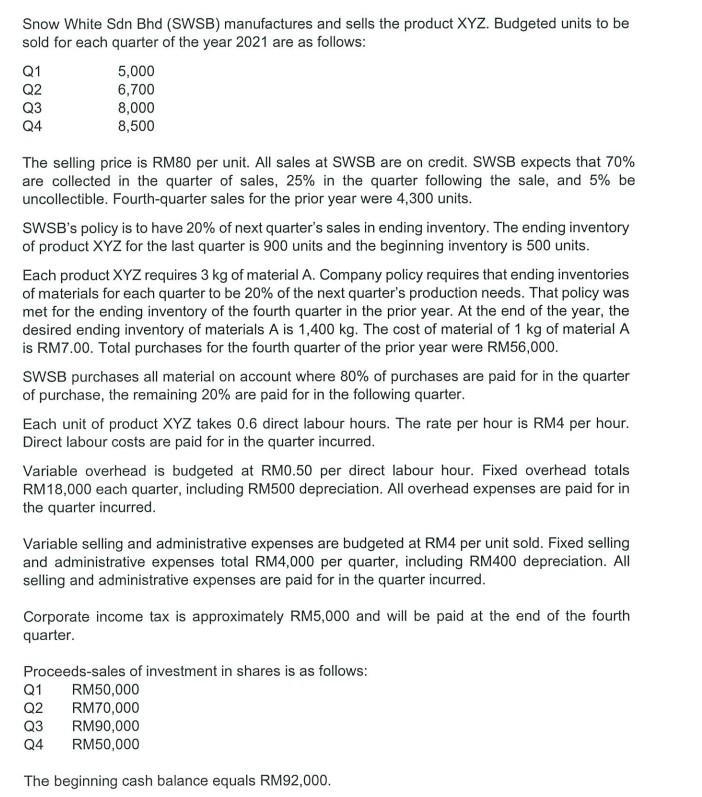

Snow White Sdn Bhd (SWSB) manufactures and sells the product XYZ. Budgeted units to be sold for each quarter of the year 2021 are as follows: Q1 Q2 5,000 6,700 8,000 8,500 Q4 The selling price is RM80 per unit. All sales at SWSB are on credit. SWSB expects that 70% are collected in the quarter of sales, 25% in the quarter following the sale, and 5% be uncollectible. Fourth-quarter sales for the prior year were 4,300 units. SWSB's policy is to have 20% of next quarter's sales in ending inventory. The ending inventory of product XYZ for the last quarter is 900 units and the beginning inventory is 500 units. Each product XYZ requires 3 kg of material A. Company policy requires that ending inventories of materials for each quarter to be 20% of the next quarter's production needs. That policy was met for the ending inventory of the fourth quarter in the prior year. At the end of the year, the desired ending inventory of materials A is 1,400 kg. The cost of material of 1 kg of material A is RM7.00. Total purchases for the fourth quarter of the prior year were RM56,000. SWSB purchases all material on account where 80% of purchases are paid for in the quarter of purchase, the remaining 20% are paid for in the following quarter. Each unit of product XYZ takes 0.6 direct labour hours. The rate per hour is RM4 per hour. Direct labour costs are paid for in the quarter incurred. Variable overhead is budgeted at RM0.50 per direct labour hour. Fixed overhead totals RM18,000 each quarter, including RM500 depreciation. All overhead expenses are paid for in the quarter incurred. Variable selling and administrative expenses are budgeted at RM4 per unit sold. Fixed selling and administrative expenses total RM4,000 per quarter, including RM400 depreciation. All selling and administrative expenses are paid for in the quarter incurred. Corporate income tax is approximately RM5,000 and will be paid at the end of the fourth quarter. Proceeds-sales of investment in shares is as follows: Q1 RM50,000 Q2 RM70,000 Q3 RM90,000 Q4 RM50,000 The beginning cash balance equals RM92,000. Required: Prepare the following budget: a) Sales budget b) Production budget c) Direct materials purchase budget d) Direct labour budget e) Manufacturing overhead f) Selling and administrative g) Schedule of cash collection h) Schedule of payment i) Cash budget

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Lets start with the requested budgets and schedules a Sales budget Quarter Units Sold Selling Price Sales Revenue Q1 8888 RM80 RM711040 Q2 5000 RM80 R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started