Question

Snowden Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because

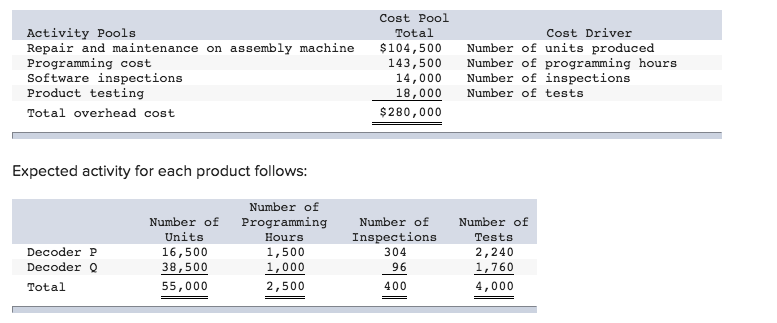

Snowden Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows:

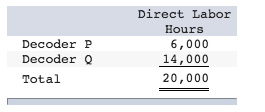

Assume that before shifting to activity-based costing, Snowden Industries allocated all overhead costs based on direct labor hours. Direct labor data pertaining to the two decoders follow:

Required

-

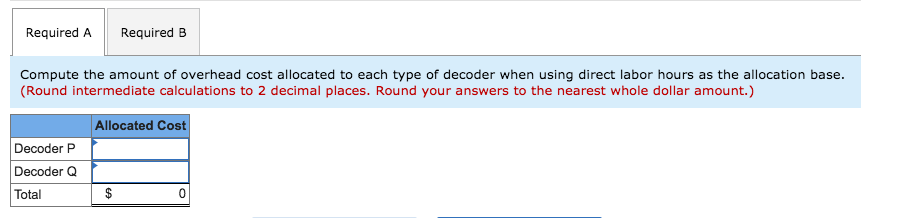

Compute the amount of overhead cost allocated to each type of decoder when using direct labor hours as the allocation base.

-

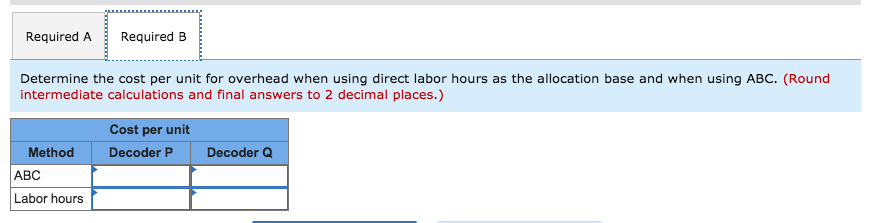

Determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started