Answered step by step

Verified Expert Solution

Question

1 Approved Answer

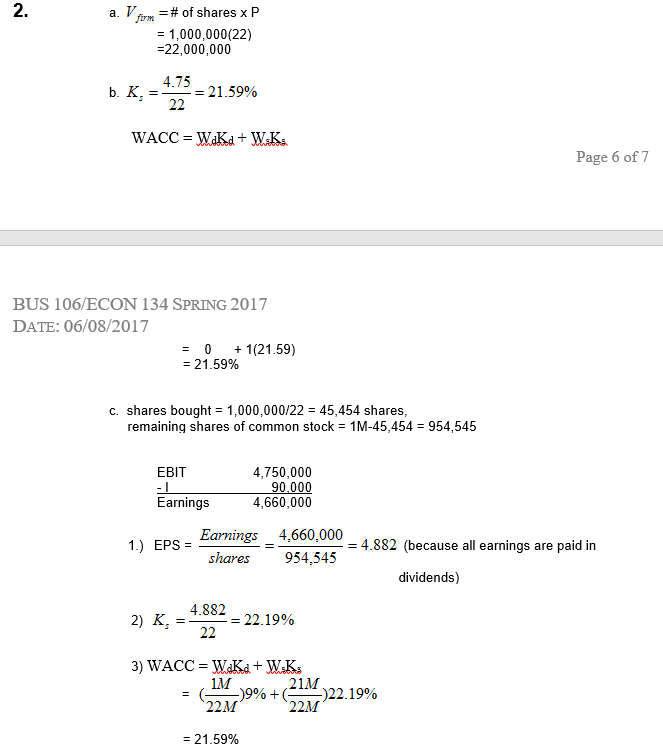

So here is the problem followed by the solution. The thing i'm struggling with here how they found the Ks, it looks like they are

So here is the problem followed by the solution.

The thing i'm struggling with here how they found the Ks, it looks like they are doing EPS/common stock price, but honesatly for both parts I don't know why they chose those numbers nor what it actually represents in these circumstances. So I was hoping someone would be kind enough to explain in detail whats going on here. Thanks!

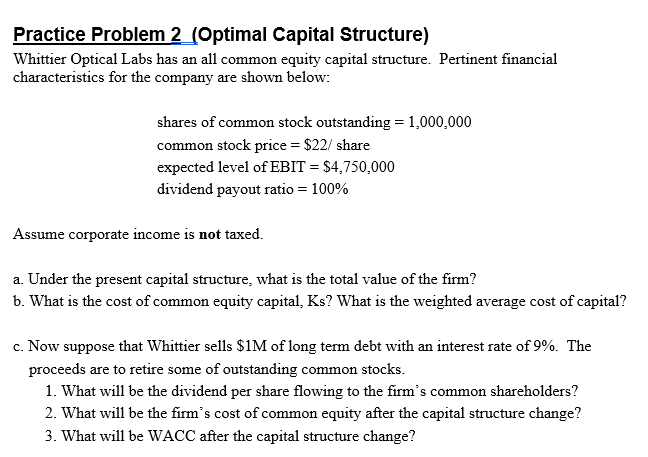

Practice Problem 2 (optimal Capital structure) Whittier optical Labs has an all common equity capital structure. Pertinent financial characteristics for the company are shown below shares of common stock outstanding -1,000,000 common stock price $22/ share expected level of EBIT E$4,750,000 dividend payout ratio 100% Assume corporate income is not taxed a. Under the present capital structure, what is the total value of the firm? b. What is the cost of common equity capital, Ks? What is the weighted average cost of capital? c. Now suppose that Whittier sells $1M of long term debt with an interest rate of 9%. The proceeds are to retire some of outstanding common stocks 1. What will be the dividend per share flowing to the firm's common shareholders 2. What will be the firm's cost of common equity after the capital structure change? 3. What will be WACC after the capital structure changeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started