Answered step by step

Verified Expert Solution

Question

1 Approved Answer

So, how to do If the Contract which is expiring in Sep is a 180 day Futures. QUESTION 5 [7 marks] It is 1 April

So, how to do If the Contract which is expiring in Sep is a 180 day Futures.

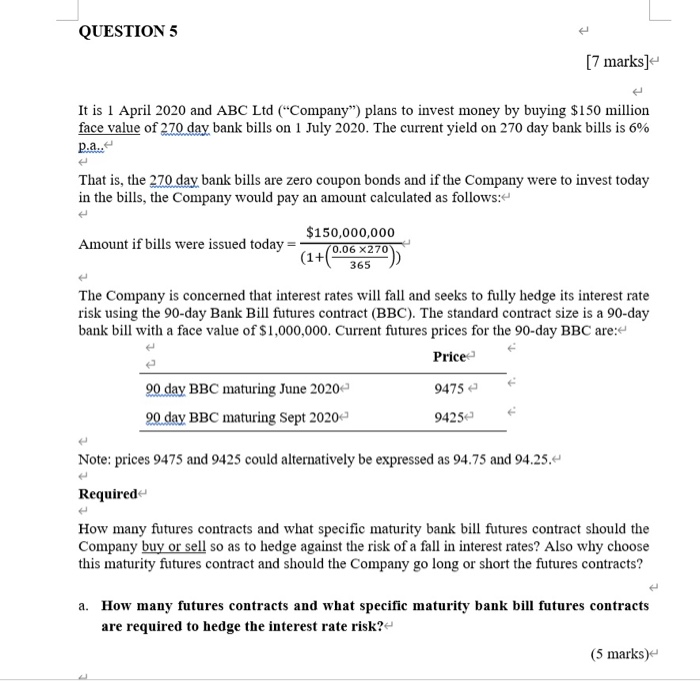

QUESTION 5 [7 marks] It is 1 April 2020 and ABC Ltd ("Company") plans to invest money by buying $150 million face value of 270 day bank bills on 1 July 2020. The current yield on 270 day bank bills is 6% p.a.. That is, the 270 day bank bills are zero coupon bonds and if the Company were to invest today in the bills, the Company would pay an amount calculated as follows: Amount if bills were issued today = ( 1 (1+0.06 X270) 365) The Company is concerned that interest rates will fall and seeks to fully hedge its interest rate risk using the 90-day Bank Bill futures contract (BBC). The standard contract size is a 90-day bank bill with a face value of $1,000,000. Current futures prices for the 90-day BBC are: Price 4 9475 90 day BBC maturing June 2020 90 day BBC maturing Sept 2020 94252 Note: prices 9475 and 9425 could alternatively be expressed as 94.75 and 94.25.4 Required How many futures contracts and what specific maturity bank bill futures contract should the Company buy or sell so as to hedge against the risk of a fall in interest rates? Also why choose this maturity futures contract and should the Company go long or short the futures contracts? a. How many futures contracts and what specific maturity bank bill futures contracts are required to hedge the interest rate risk? (5 marks) b. Should position be long or short and what maturity? Please clearly state below." (1 mark) c. Why choose the specific maturity Bank Bill futures contract? (1 mark) QUESTION 5 [7 marks] It is 1 April 2020 and ABC Ltd ("Company") plans to invest money by buying $150 million face value of 270 day bank bills on 1 July 2020. The current yield on 270 day bank bills is 6% p.a.. That is, the 270 day bank bills are zero coupon bonds and if the Company were to invest today in the bills, the Company would pay an amount calculated as follows: Amount if bills were issued today = ( 1 (1+0.06 X270) 365) The Company is concerned that interest rates will fall and seeks to fully hedge its interest rate risk using the 90-day Bank Bill futures contract (BBC). The standard contract size is a 90-day bank bill with a face value of $1,000,000. Current futures prices for the 90-day BBC are: Price 4 9475 90 day BBC maturing June 2020 90 day BBC maturing Sept 2020 94252 Note: prices 9475 and 9425 could alternatively be expressed as 94.75 and 94.25.4 Required How many futures contracts and what specific maturity bank bill futures contract should the Company buy or sell so as to hedge against the risk of a fall in interest rates? Also why choose this maturity futures contract and should the Company go long or short the futures contracts? a. How many futures contracts and what specific maturity bank bill futures contracts are required to hedge the interest rate risk? (5 marks) b. Should position be long or short and what maturity? Please clearly state below." (1 mark) c. Why choose the specific maturity Bank Bill futures contract? (1 mark) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started