Answered step by step

Verified Expert Solution

Question

1 Approved Answer

So I missed class last week. HELP! No earthly clue! Instructions: 1. Journalize the entries to record the operations, identifying each entry by letter 2.

So I missed class last week. HELP! No earthly clue!

Instructions:

1. Journalize the entries to record the operations, identifying each entry by letter

2. Compute the December 31 balances of the inventory accounts.

3. Compute the December 31 balances of the factory overhead accounts.

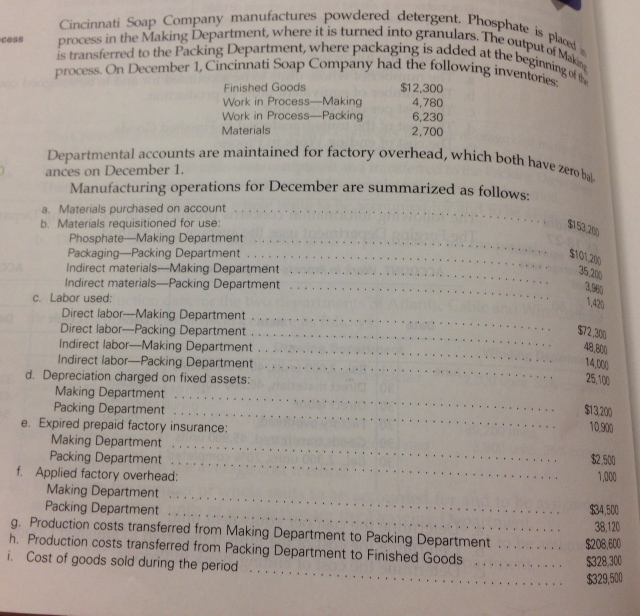

Cincinnati Soap Company manufactures powdered detergent. Phosphate is process in the Making Departmeny, where it is turned into granulars. The output of Making is transffered to the Packing Department, where packaging is added at the beginning of the process. On December 1, Cincinnati Soap Company had the following inventories: Departmental accounts are maintained for factory overhead, which both have ? ances on December 1. Manufacturing operations for December are summarized as follows: Materials purchased on account......................$153,200 Materials requisitioned for use Phosphate-Making Department....................$101,200 Packaging-Packing Department....................................35,200 Indirect materials-Making Department ..................................3,960 Indirect materials-Packing Department ...........................1,420 Labor used. Direct labor-Making Department.................................$72,300 Direct labor-Packing Department..................................................................48,800 Indirect labor-Making Department..................................................................14,000 Indirect labor-Packing Department ..................................25,100 Depreciation charged on fixed assets: Making Department ...........................................$13,200 Packing Department ....................................................................................10,900 Expired prepaid factory insurance: Making Department ...................................................................$13,200 Packing Department ..............................10,900 Applied factory overhead: Making Department ............................................$34,500 Packing Department ...............38,120 Production costs transferred from Making Department to Packing Department......................$208,600 Production costs transferred from Packing Department to Finished Goods...............$328,300 Cost of goods sold during the period ............................................................$329,500 Cincinnati Soap Company manufactures powdered detergent. Phosphate is process in the Making Departmeny, where it is turned into granulars. The output of Making is transffered to the Packing Department, where packaging is added at the beginning of the process. On December 1, Cincinnati Soap Company had the following inventories: Departmental accounts are maintained for factory overhead, which both have ? ances on December 1. Manufacturing operations for December are summarized as follows: Materials purchased on account......................$153,200 Materials requisitioned for use Phosphate-Making Department....................$101,200 Packaging-Packing Department....................................35,200 Indirect materials-Making Department ..................................3,960 Indirect materials-Packing Department ...........................1,420 Labor used. Direct labor-Making Department.................................$72,300 Direct labor-Packing Department..................................................................48,800 Indirect labor-Making Department..................................................................14,000 Indirect labor-Packing Department ..................................25,100 Depreciation charged on fixed assets: Making Department ...........................................$13,200 Packing Department ....................................................................................10,900 Expired prepaid factory insurance: Making Department ...................................................................$13,200 Packing Department ..............................10,900 Applied factory overhead: Making Department ............................................$34,500 Packing Department ...............38,120 Production costs transferred from Making Department to Packing Department......................$208,600 Production costs transferred from Packing Department to Finished Goods...............$328,300 Cost of goods sold during the period ............................................................$329,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started