Question

So , you are in the Finance Department of True Blood Soda Pop (TBSP) Inc. You have two projects on your desk and the boss

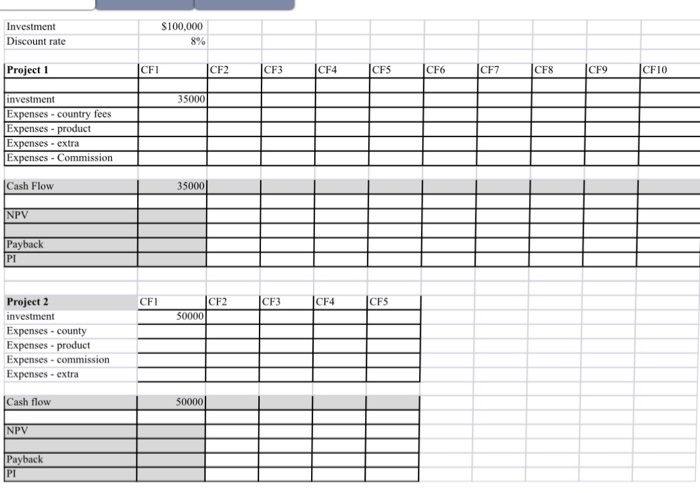

So, you are in the Finance Department of True Blood Soda Pop (TBSP) Inc. You have two projects on your desk and the boss (CEO) wants to know which one is better from a Financial perspective. For each option, there is an immediate upfront cost of $100,000. Then for each, there are revenues and expenses for each year. You will need to calculate the cash-flow for each year, and then come up with a Net Present value for the project. The Discount rate is 8%.

Option #1

For option 1, TBSP is expanding into California, and it is a ten-year project. For Revenue, years 1 - 3 have $35,000; years 4-6 have $40,000; and years 7-10 have $75,000. For Expenses, there are fees to operate in various counties and they are $1,000 per year. Product costs are $4,000 per year for the first 5 years and $8,000 per year after that. Sales commission expenses are 50% of sales. Finally, there are some extra costs of $5,000 per year for years 1 3.

Option #2

For option 2, TBSP is expanding into Arizona, and it is a five-year project. For Revenue, year 1 has $50,000, years 2-3 have $105,000, and years 4-5 have $25,000. For expenses, Arizona also has fees to operate in various counties and they are $1,000 per year in total. Product costs are $4,000 per year. Sales commission expenses are 50% of sales. Also, there are extra costs of $5,000 per year for the first three years.

Make sure to show net cash flow each year and also the NPV, IRR, PI and Payback.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started