Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soalan 5 Question 5 Sebuah mesin pemasangan berkelajuan tinggi telah dibeli dua tahun yang lepas dengan harga RM500,000. Pada masa sekarang, ianya boleh dijual dengan

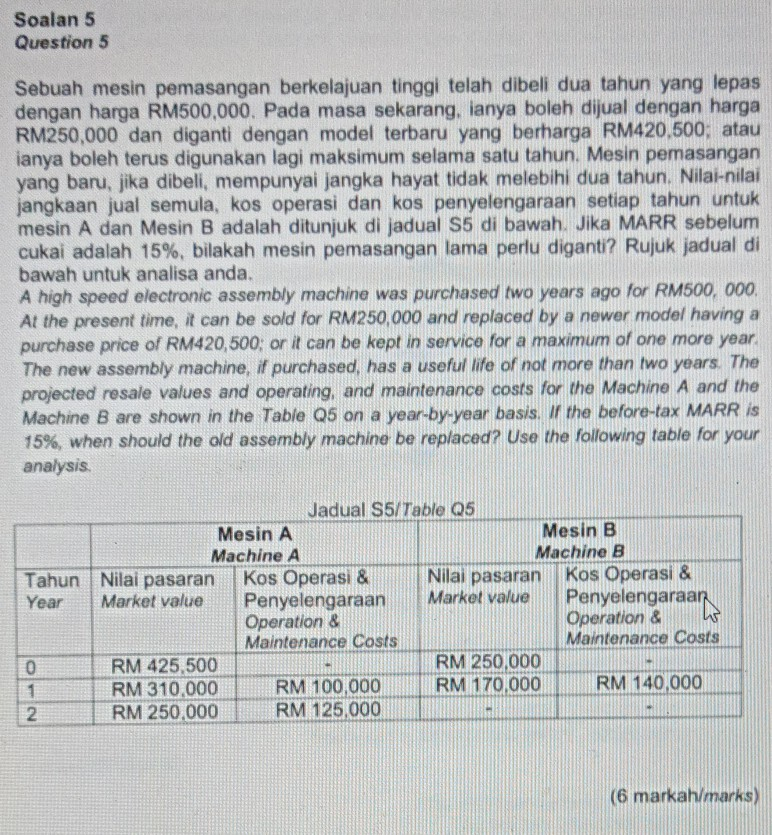

Soalan 5 Question 5 Sebuah mesin pemasangan berkelajuan tinggi telah dibeli dua tahun yang lepas dengan harga RM500,000. Pada masa sekarang, ianya boleh dijual dengan harga RM250,000 dan diganti dengan model terbaru yang berharga RM420,500; atau ianya boleh terus digunakan lagi maksimum selama satu tahun. Mesin pemasangan yang baru, jika dibeli, mempunyai jangka hayat tidak melebihi dua tahun. Nilai-nilai jangkaan jual semula, kos operasi dan kos penyelengaraan setiap tahun untuk mesin A dan Mesin B adalah ditunjuk di jadual $5 di bawah. Jika MARR sebelum cukai adalah 15%, bilakah mesin pemasangan lama perlu diganti? Rujuk jadual di bawah untuk analisa anda. A high speed electronic assembly machine was purchased two years ago for RM500, 000. At the present time, it can be sold for RM250,000 and replaced by a newer model having a purchase price of RM420,500; or it can be kept in service for a maximum of one more year The new assembly machine, if purchased, has a useful life of not more than two years. The projected resale values and operating, and maintenance costs for the Machine A and the Machine B are shown in the Table Q5 on a year-by-year basis. If the before-tax MARR is 15%, when should the old assembly machine be replaced? Use the following table for your analysis. Jadual $5/Table Q5 Mesin B Machine B Mesin A Machine A Kos Operasi & Penyelengaraan Operation & Maintenance Costs Kos Operasi & Penyelengaraar Operation & Maintenance Costs Nilai pasaran Market value Nilai pasaran Market value Tahun Year RM 250,000 RM 170,000 RM 425,500 RM 310,000 RM 250.000 RM 140,000 RM 100,000 RM 125,000 (6 markah/marks) O12 Soalan 5 Question 5 Sebuah mesin pemasangan berkelajuan tinggi telah dibeli dua tahun yang lepas dengan harga RM500,000. Pada masa sekarang, ianya boleh dijual dengan harga RM250,000 dan diganti dengan model terbaru yang berharga RM420,500; atau ianya boleh terus digunakan lagi maksimum selama satu tahun. Mesin pemasangan yang baru, jika dibeli, mempunyai jangka hayat tidak melebihi dua tahun. Nilai-nilai jangkaan jual semula, kos operasi dan kos penyelengaraan setiap tahun untuk mesin A dan Mesin B adalah ditunjuk di jadual $5 di bawah. Jika MARR sebelum cukai adalah 15%, bilakah mesin pemasangan lama perlu diganti? Rujuk jadual di bawah untuk analisa anda. A high speed electronic assembly machine was purchased two years ago for RM500, 000. At the present time, it can be sold for RM250,000 and replaced by a newer model having a purchase price of RM420,500; or it can be kept in service for a maximum of one more year The new assembly machine, if purchased, has a useful life of not more than two years. The projected resale values and operating, and maintenance costs for the Machine A and the Machine B are shown in the Table Q5 on a year-by-year basis. If the before-tax MARR is 15%, when should the old assembly machine be replaced? Use the following table for your analysis. Jadual $5/Table Q5 Mesin B Machine B Mesin A Machine A Kos Operasi & Penyelengaraan Operation & Maintenance Costs Kos Operasi & Penyelengaraar Operation & Maintenance Costs Nilai pasaran Market value Nilai pasaran Market value Tahun Year RM 250,000 RM 170,000 RM 425,500 RM 310,000 RM 250.000 RM 140,000 RM 100,000 RM 125,000 (6 markah/marks) O12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started