Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soapbox Ltd is seeking to restructure and expand its capital base by making a bonus issue and a rights issue during the financial year. On

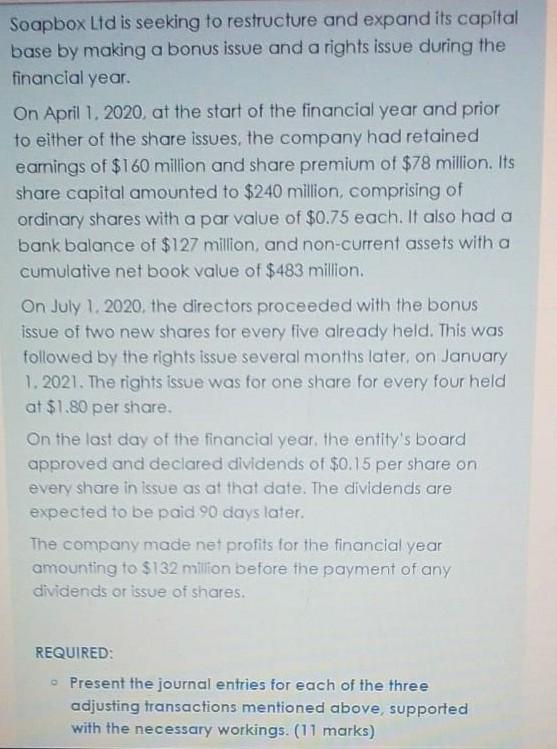

Soapbox Ltd is seeking to restructure and expand its capital base by making a bonus issue and a rights issue during the financial year. On April 1, 2020, at the start of the financial year and prior to either of the share issues, the company had retained earnings of $160 million and share premium of $78 million. Its share capital amounted to $240 million, comprising of ordinary shares with a par value of $0.75 each. It also had a bank balance of $127 million, and non-current assets with a cumulative net book value of $483 million. On July 1, 2020, the directors proceeded with the bonus issue of two new shares for every five already held. This was followed by the rights issue several months later, on January 1. 2021. The rights Issue was for one share for every four held at $1.80 per share. On the last day of the financial year the entity's board approved and declared dividends of $0.15 per share on every share in issue as at that date. The dividends are expected to be paid 90 days later. The company made net profits for the financial year amounting to $132 million before the payment of any dividends or issue of shares. REQUIRED: Present the journal entries for each of the three adjusting transactions mentioned above, supported with the necessary workings. (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started