Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soaring Pieces Inc. creates aluminum alloy parts for commercial aircraft. In a recent transaction Soaring leased a high precision lathe machine from Rapid Revolving

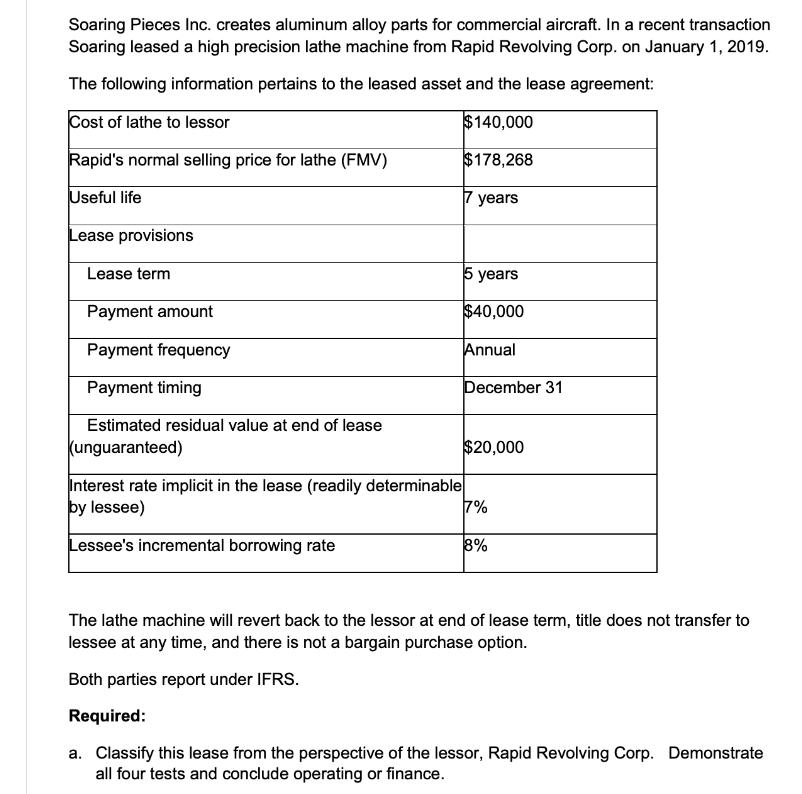

Soaring Pieces Inc. creates aluminum alloy parts for commercial aircraft. In a recent transaction Soaring leased a high precision lathe machine from Rapid Revolving Corp. on January 1, 2019. The following information pertains to the leased asset and the lease agreement: Cost of lathe to lessor $140,000 Rapid's normal selling price for lathe (FMV) $178,268 Useful life Lease provisions 7 years Lease term Payment amount Payment frequency Payment timing Estimated residual value at end of lease (unguaranteed) Interest rate implicit in the lease (readily determinable by lessee) Lessee's incremental borrowing rate 5 years $40,000 Annual December 31 $20,000 7% 8% The lathe machine will revert back to the lessor at end of lease term, title does not transfer to lessee at any time, and there is not a bargain purchase option. Both parties report under IFRS. Required: a. Classify this lease from the perspective of the lessor, Rapid Revolving Corp. Demonstrate all four tests and conclude operating or finance. b. Prepare the journal entries on January 1, 2019 and December 31, 2019 for the lessor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To classify the lease from the perspective of the lessor Rapid Revolving Corp we need to perform the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started