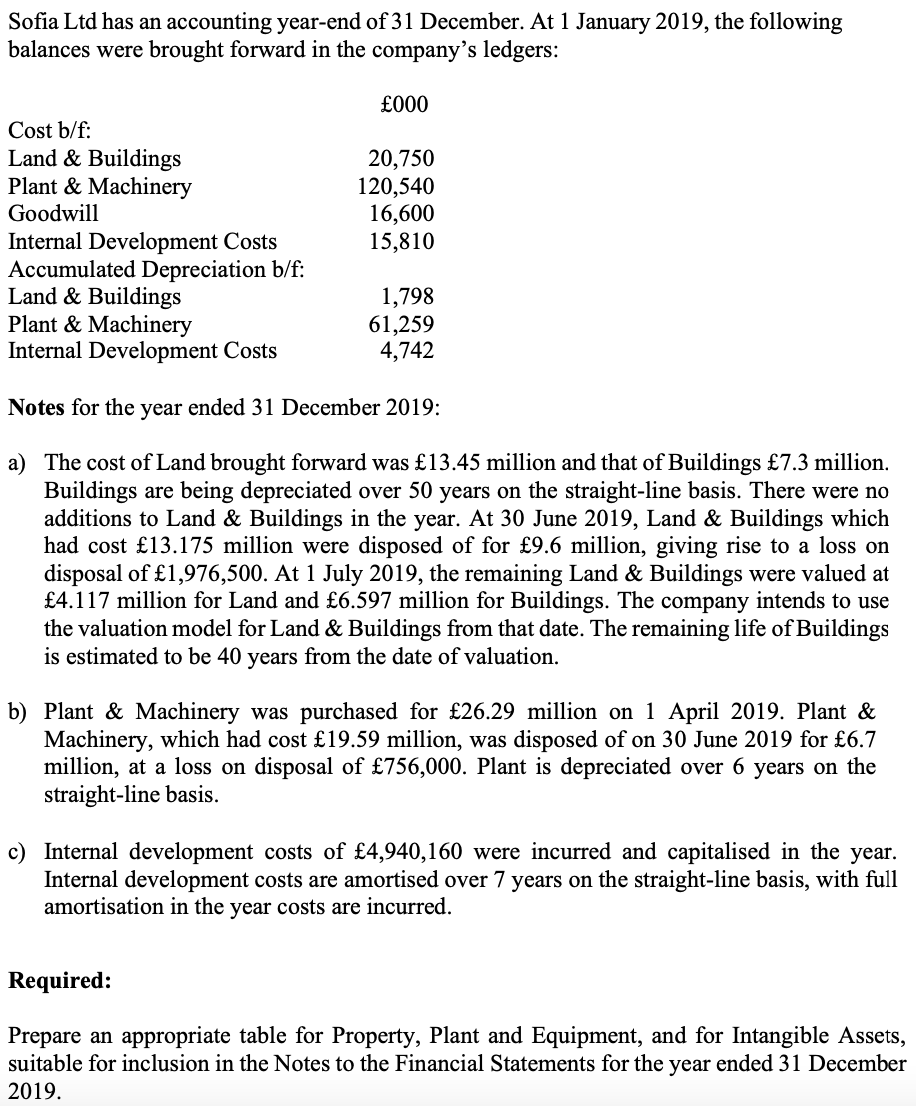

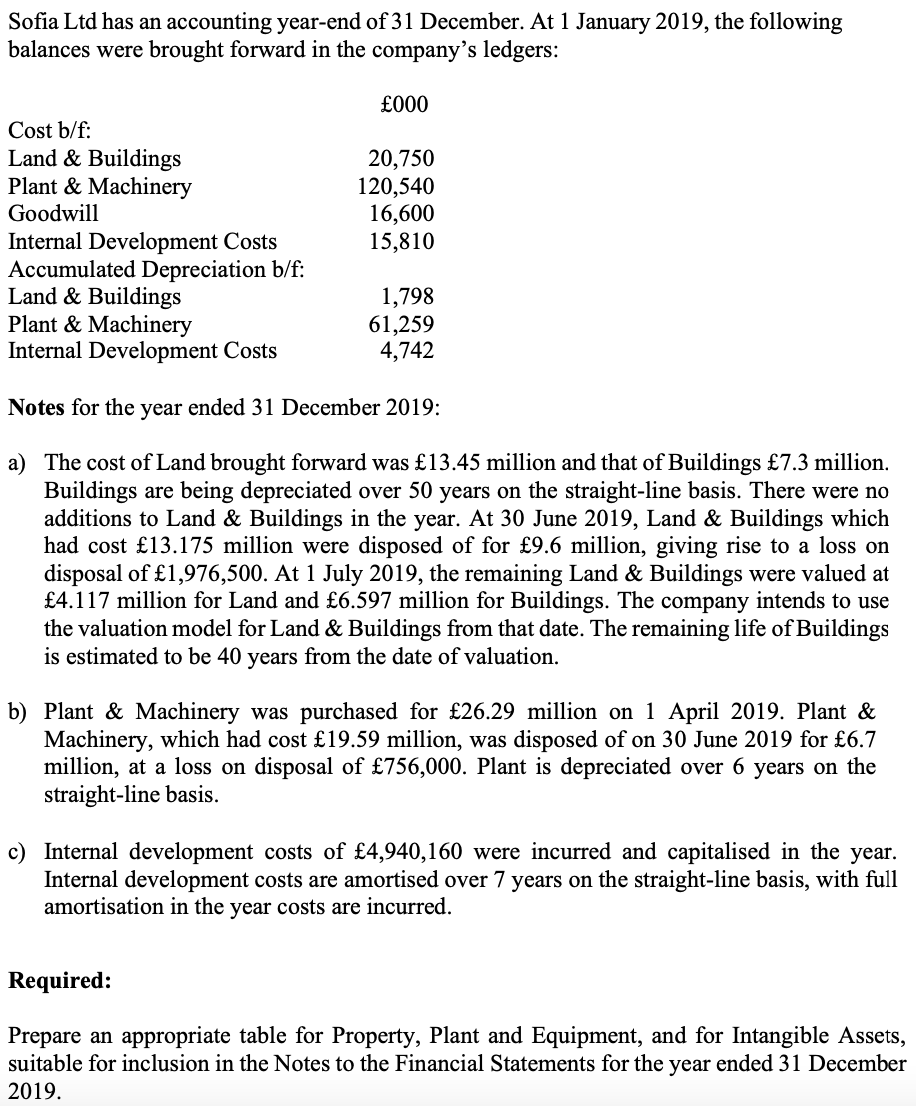

Sofia Ltd has an accounting year-end of 31 December. At 1 January 2019, the following balances were brought forward in the company's ledgers: 000 Cost b/f: Land & Buildings Plant & Machinery Goodwill Internal Development Costs Accumulated Depreciation b/f: Land & Buildings Plant & Machinery Internal Development Costs 20,750 120,540 16,600 15,810 1,798 61,259 4,742 Notes for the year ended 31 December 2019: a) The cost of Land brought forward was 13.45 million and that of Buildings 7.3 million. Buildings are being depreciated over 50 years on the straight-line basis. There were no additions to Land & Buildings in the year. At 30 June 2019, Land & Buildings which had cost 13.175 million were disposed of for 9.6 million, giving rise to a loss on disposal of 1,976,500. At 1 July 2019, the remaining Land & Buildings were valued at 4.117 million for Land and 6.597 million for Buildings. The company intends to use the valuation model for Land & Buildings from that date. The remaining life of Buildings is estimated to be 40 years from the date of valuation. b) Plant & Machinery was purchased for 26.29 million on 1 April 2019. Plant & Machinery, which had cost 19.59 million, was disposed of on 30 June 2019 for 6.7 million, at a loss on disposal of 756,000. Plant is depreciated over 6 years on the straight-line basis. c) Internal development costs of 4,940,160 were incurred and capitalised in the year. Internal development costs are amortised over 7 years on the straight-line basis, with full amortisation in the year costs are incurred. Required: Prepare an appropriate table for Property, Plant and Equipment, and for Intangible Assets, suitable for inclusion in the Notes to the Financial Statements for the year ended 31 December 2019. Sofia Ltd has an accounting year-end of 31 December. At 1 January 2019, the following balances were brought forward in the company's ledgers: 000 Cost b/f: Land & Buildings Plant & Machinery Goodwill Internal Development Costs Accumulated Depreciation b/f: Land & Buildings Plant & Machinery Internal Development Costs 20,750 120,540 16,600 15,810 1,798 61,259 4,742 Notes for the year ended 31 December 2019: a) The cost of Land brought forward was 13.45 million and that of Buildings 7.3 million. Buildings are being depreciated over 50 years on the straight-line basis. There were no additions to Land & Buildings in the year. At 30 June 2019, Land & Buildings which had cost 13.175 million were disposed of for 9.6 million, giving rise to a loss on disposal of 1,976,500. At 1 July 2019, the remaining Land & Buildings were valued at 4.117 million for Land and 6.597 million for Buildings. The company intends to use the valuation model for Land & Buildings from that date. The remaining life of Buildings is estimated to be 40 years from the date of valuation. b) Plant & Machinery was purchased for 26.29 million on 1 April 2019. Plant & Machinery, which had cost 19.59 million, was disposed of on 30 June 2019 for 6.7 million, at a loss on disposal of 756,000. Plant is depreciated over 6 years on the straight-line basis. c) Internal development costs of 4,940,160 were incurred and capitalised in the year. Internal development costs are amortised over 7 years on the straight-line basis, with full amortisation in the year costs are incurred. Required: Prepare an appropriate table for Property, Plant and Equipment, and for Intangible Assets, suitable for inclusion in the Notes to the Financial Statements for the year ended 31 December 2019