Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sofia Palermo Company (SPC) is considering the purchase of a new equipment to replace the existing one to increase the company's productivity and save the

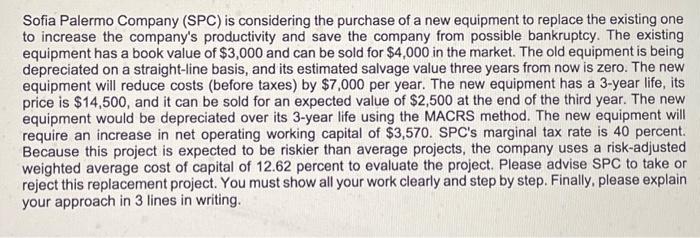

Sofia Palermo Company (SPC) is considering the purchase of a new equipment to replace the existing one to increase the company's productivity and save the company from possible bankruptcy. The existing equipment has a book value of $3,000 and can be sold for $4,000 in the market. The old equipment is being depreciated on a straight-line basis, and its estimated salvage value three years from now is zero. The new equipment will reduce costs (before taxes) by $7,000 per year. The new equipment has a 3-year life, its price is $14,500, and it can be sold for an expected value of $2,500 at the end of the third year. The new equipment would be depreciated over its 3-year life using the MACRS method. The new equipment will require an increase in net operating working capital of $3,570. SPC's marginal tax rate is 40 percent. Because this project is expected to be riskier than average projects, the company uses a risk-adjusted weighted average cost of capital of 12.62 percent to evaluate the project. Please advise SPC to take or reject this replacement project. You must show all your work clearly and step by step. Finally, please explain your approach in 3 lines in writing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started