Question

Sofie's Socks had the following transactions in May. May 2 Purchased merchandise on account at a cost of $40,400; terms 2/10,n/30, FOB destination, freight

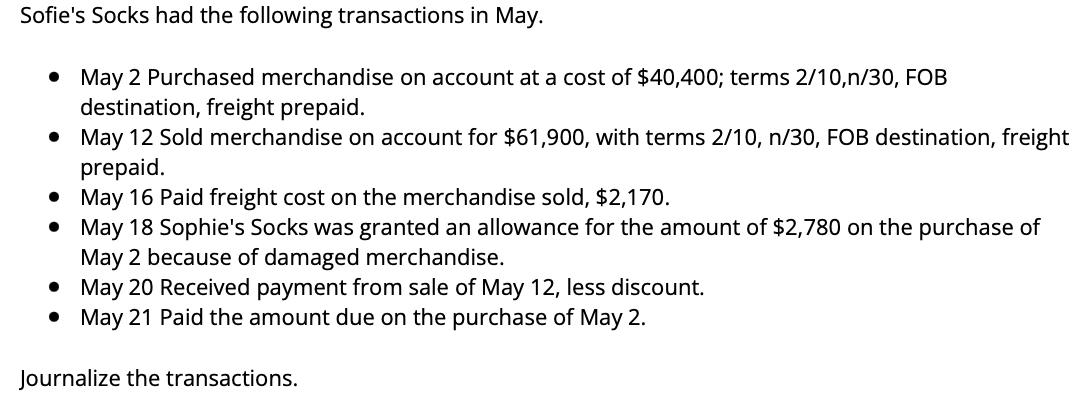

Sofie's Socks had the following transactions in May. May 2 Purchased merchandise on account at a cost of $40,400; terms 2/10,n/30, FOB destination, freight prepaid. May 12 Sold merchandise on account for $61,900, with terms 2/10, n/30, FOB destination, freight prepaid. May 16 Paid freight cost on the merchandise sold, $2,170. May 18 Sophie's Socks was granted an allowance for the amount of $2,780 on the purchase of May 2 because of damaged merchandise. May 20 Received payment from sale of May 12, less discount. May 21 Paid the amount due on the purchase of May 2. Journalize the transactions.

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions of Soph...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Financial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

12th edition

1305041399, 1285078586, 978-1-133-9524, 9781133952428, 978-1305041394, 9781285078588, 1-133-95241-0, 978-1133952411

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App