Question

Sol and Moira own a second home in Colorado. They have always used it personally for their family, but are considering renting it out to

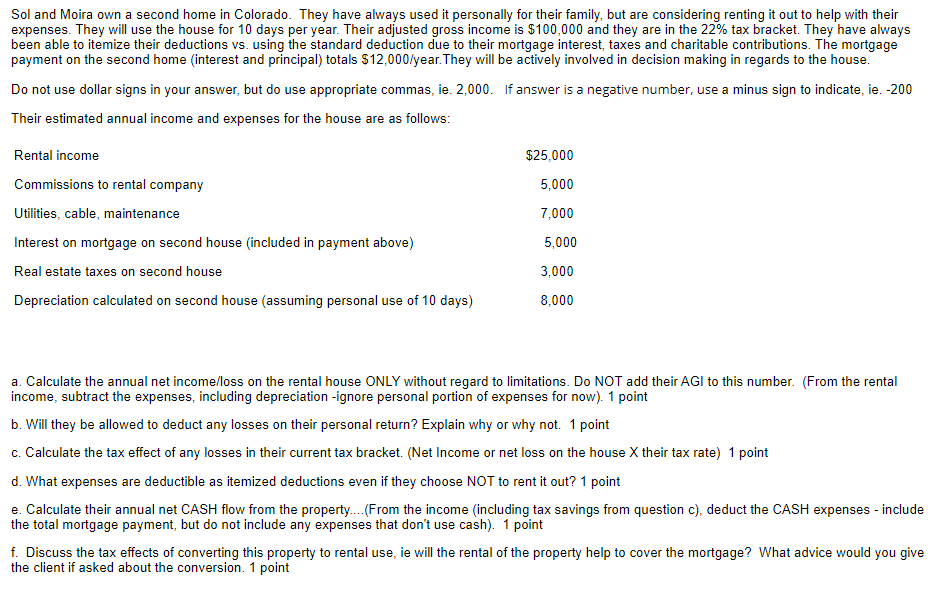

Sol and Moira own a second home in Colorado. They have always used it personally for their family, but are considering renting it out to help with their expenses. They will use the house for 10 days per year. Their adjusted gross income is $100,000 and they are in the 22% tax bracket. They have always been able to itemize their deductions vs. using the standard deduction due to their mortgage interest, taxes and charitable contributions. The mortgage payment on the second home (interest and principal) totals $12,000/year.They will be actively involved in decision making in regards to the house.

Please don't repost answers. This question has different criteria.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started